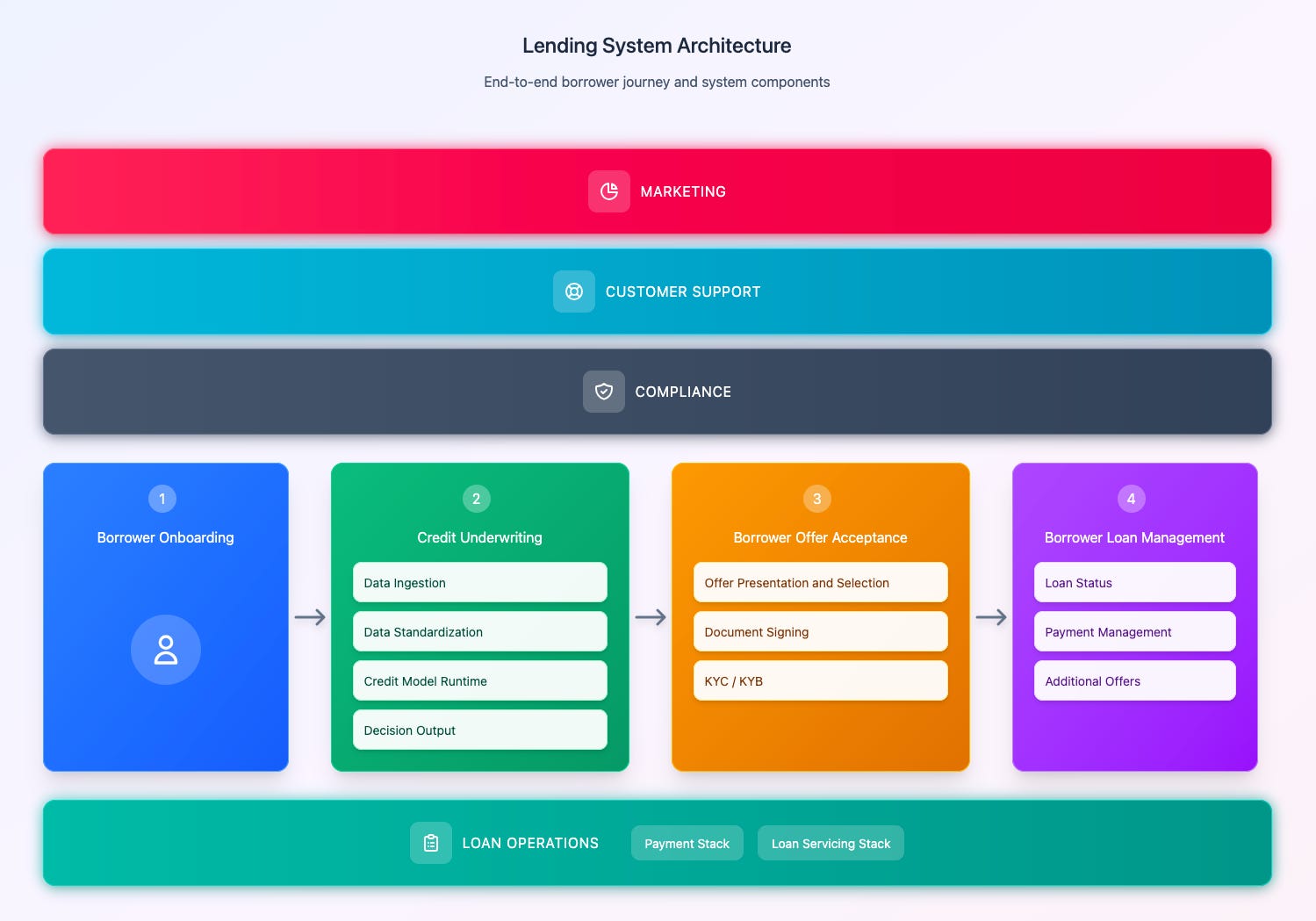

Before we dive into what’s broken with loan portals, let’s take a step back and look at the full lending system architecture (Lending System Architecture). Modern lending isn’t just one system—it’s an intricate dance of multiple components working together.

At the top, you’ve got Marketing drawing in potential borrowers and Customer Support fielding their questions. Compliance runs across everything (because, well, it’s financial services). But the real action happens in four critical stages:

- Borrower Onboarding – Where the journey begins, collecting basic information and setting expectations

- Credit Underwriting – The brain of the operation, ingesting data, standardizing it, running credit models, and making that crucial yes/no decision

- Borrower Offer Acceptance – The handshake moment, presenting loan offers, getting documents signed, and verifying identities (KYC/KYB)

- Borrower Loan Management – The long-term relationship, handling loan status, payments, and additional offers

All of this sits on top of Loan Operations—the payment and servicing stacks that keep money flowing and accounts balanced.

Here’s the thing: Most of the innovation in lending has focused on those first three boxes. Companies have poured millions into instant onboarding, AI-powered underwriting, and seamless offer acceptance. The loan application process that once took weeks now takes minutes.

But then what?

The forgotten fourth box

Today, I want to focus on that purple box in section 4: Borrower Loan Management. This is where borrowers spend 99% of their time after getting a loan—months or years of monthly payments, balance checks, and financial planning. Yet somehow, this critical piece of the lending journey feels stuck in 2010.

While the industry revolutionized how we get loans, we forgot about the experience of actually having one.

Let me show you what I mean by comparing two versions of the same loan portal—one traditional, one AI-powered—and why this matters for the future of lending.

The problem: information overload in action

Look at the Traditional Loan Servicing portal. This borrower has a $42,500 balance remaining on a $50,000 loan. Simple enough, right? But instead of just telling them that, the interface bombards them with:

- Current Balance ($42,500)

- Next Payment ($944 on December 1, 2025)

- Interest Rate (5.2% APR)

- Original Amount ($50,000)

- Monthly Payment (again, $944)

- Term Remaining (45 months)

- Total Paid ($7,500)

- A full payment schedule showing Dec 1, Jan 1, Feb 1, Mar 1…

- A payment progress bar showing 15%

- Amount paid vs remaining visualizations

I counted—that’s over 20 different data points on a single screen. And this is supposedly the “simple” view! No wonder borrowers feel overwhelmed.

The solution: less is more (until you need more)

Now check out the AI-enabled Loan Servicing version.

Same loan, completely different experience:

- Status: Current ?

- Remaining Balance: $42,500

- Monthly Payment: $944

- Next Payment Due: December 1, 2025

- Progress: 15% paid

That’s it. Five key pieces of information. Clean, digestible, calming.

But here’s the magic—see that AI assistant named Sarah on the right? She’s not just decoration. Those suggested prompts (”When is my next payment due?” “Can I pay extra this month?”) show that all that detailed information from the traditional portal isn’t gone—it’s just waiting in the wings, ready when the borrower actually wants it.

Why this design philosophy works

The architecture tells the story

Looking back at that Lending System Architecture diagram, the Borrower Loan Management section needs to handle three key functions: Loan Status, Payment Management, and Additional Offers. The traditional approach tries to surface all of this at once, creating that overwhelming dashboard. The AI approach keeps all these capabilities but fundamentally changes how they’re delivered.

Instead of showing everything the Payment Management system knows, Sarah might simply say: “Your next payment of $944 is due December 1st. Would you like to schedule it now?”

Real questions vs. assumed needs

The Traditional Loan Servicing portal assumes you want to see your entire payment schedule. But in reality, most borrowers logging into that Loan Management section just want to know:

- Am I current?

- What do I owe this month?

- How much longer until I’m done?

The AI interface nails these basics, then lets curious borrowers dig deeper through conversation.

The hidden power of conversational coverage

Here’s something that took me a while to fully appreciate: Conversational AI isn’t just simplifying the interface—it’s actually expanding what we can offer users without cluttering the screen.

Let me explain. That Traditional Loan Servicing portal with its 20+ data points? That’s not the product team being sadistic. It’s the result of years of different customer segments asking for different things. First-time homebuyers wanted to see progress bars. Small business owners needed quick access to payment schedules. Someone preparing taxes requested year-to-date interest statements. Over time, every edge case got permanently bolted onto the main screen because we had no better way to ensure every user could find what they needed. It’s the classic kitchen sink problem—we kept adding faucets but never removed any.

AI fundamentally changes this equation. Now we can cover 10x the use cases while showing 5x less information upfront. Need to dispute a payment? Update your bank account? Calculate early payoff amounts? Get a payoff letter for refinancing? These aren’t buttons cluttering the interface—they’re just conversations waiting to happen.

But here’s where it gets really interesting. Look at the “Smart Suggestions” section in the enhanced AI interface.

The system noticed it’s tax season and proactively surfaces “Your tax documents are ready for download” with a simple button for the 1098 form. No permanent “Tax Documents” section taking up screen real estate year-round. Just the right information at the right time.

Even better, based on this borrower’s past interactions (maybe they asked about extra payments before), the system suggests: “Pay $100 extra/month to save $1,200 in interest.” This isn’t a generic calculator buried in a menu—it’s personalized, contextual advice appearing exactly when the borrower might be thinking about their financial goals.

This is the future we’re heading toward. The AI doesn’t just respond to questions; it anticipates needs based on timing, user patterns, and lifecycle events. Come February, tax documents appear. Approaching loan maturity? Payoff options surface. Been consistently paying extra? It might suggest optimizing that strategy. The interface becomes a living, breathing assistant that adapts to each borrower’s journey, not a static dashboard that treats everyone the same.

The subtle genius I almost missed

Looking closer at the AI-enabled Loan Servicing version, there’s a brilliant touch—the timestamp “03:22 PM” under Sarah’s response. This isn’t just a chat log; it’s creating a sense of ongoing dialogue. Your loan isn’t a static spreadsheet; it’s an ongoing conversation about your financial journey.

Compare that to the Traditional Loan Servicing portal’s “Download Full Schedule” button. One invites engagement; the other feels like homework.

What the traditional portal gets wrong

That Traditional Loan Servicing interface is actually well-designed by conventional standards. It’s organized, comprehensive, uses clear labels, and even has some nice visual touches like the purple progress bar. But it’s solving the wrong problem.

It’s designed for that one power user who wants everything at once, not for the 95% of borrowers who just want to check if they’re on track and maybe understand one specific thing about their loan.

The proof is in the simplicity

Here’s what convinced me this approach works: In the AI-enabled version, when Sarah asks “What would you like to know?”—she really means it. She’s not pushing information at you; she’s waiting for you to define what matters right now.

Need your full payment history for taxes? She’s got it. Want to understand how extra payments affect your timeline? She’ll walk you through it. Just checking you’re current? Done in two seconds.

The Traditional Loan Servicing portal makes you hunt through tabs and sections. The AI assistant brings the information to you.

Connecting back to the bigger picture

Remember that Lending System Architecture we started with? Every one of those components—from Credit Underwriting to Loan Operations—generates data that eventually needs to surface in the Borrower Loan Management interface. The traditional approach tries to display it all. The AI approach understands that data availability and data presentation are two very different things.

When borrowers can actually understand and engage with their loans through that AI interface (rather than just tolerate a monthly payment), the entire lending ecosystem works better. Lenders see better repayment rates, Customer Support fields fewer confused calls, and that Payment Stack processes more on-time payments.

The road ahead

We’ve revolutionized how people apply for loans. The Borrower Onboarding through Offer Acceptance pipeline is smoother than ever. Now it’s time to bring that same innovation to where borrowers actually spend their time—in the Loan Management portal.

Because getting a loan might take minutes, but paying it back takes years. Shouldn’t that experience be just as thoughtfully designed?

The screenshots tell the story better than any words could. One interface throws everything at you and hopes something sticks. The other starts simple and goes deep when you’re ready. In a world where everyone’s overwhelmed, sometimes the most sophisticated solution is just having someone to talk to—even if that someone is an AI named Sarah.