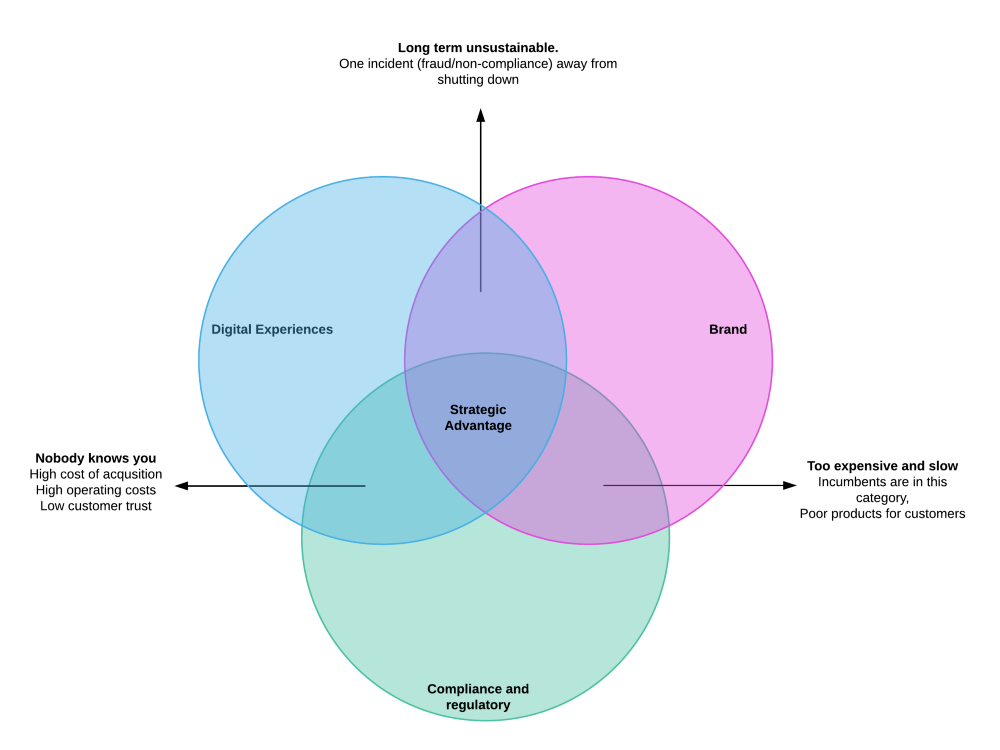

In the fintech businesses the core product is money. Money is a commodity — and when the core product is a commodity, what provides strategic advantage?

There are three strategic components that have to be nailed to be successful in the fintech business.

Brand

The total amount of US$ hard money in circulation is ~$1.46 trillion while the total liquid currency in circulation as defined by M2 is $12.8 trillion. Liquid cash is ~9X the actual hard cash in circulation — this implies that a large swathe of what we call money is just entries in a database at a bank/financial institution. Our monetary system only works if you trust your financial institution and believe that the database entry is managed safely.

In addition to being the lubricant of world trade, money is a very personal construct for humanity. As the saying goes, money doesn’t buy you love, but it gives you a great bargaining position 🙂 Money opens doors, provides security — money is a very emotional construct.

In short, money is all about trust.

How do you build trust, when you are essentially dealing with a commodity? It’s all about the brand. Would you trust your money to somebody you haven’t heard of? Would you trust your money to a company that is known to be scammy and of ill-repute?

Nope.

To capitalize on this strategic area, building a brand that showcases trust is essential for any fintech business to succeed.

Digital Experiences

This is the ‘tech’ part of fintech. The fundamental advantage against the incumbent players in this space is the value new players can deliver to customers via native digital interfaces.

Externally to users, these entail simplicity of access (anytime, anywhere) to speed of access (instant gratification, faster funds now) to cheaper prices than incumbents. Internal to companies, there is the advantage of having a lower cost structure as a result of being digitally native. For example, fintech business broadly utilize digital distribution channels and are less reliant on maintaining physical assets such as branch infrastructure. In addition, being digitally native greatly speeds the delivery cycle of getting product to customers.

Successful companies concentrate on technology as an engineering organization. Typically, in incumbent financial institutions digital interfaces are considered information technology (IT) functions. This is a fundamental flaw. IT is always configured as a support function and is optimized for buy decisions (lets just buy software off the shelf). Engineering organizations have the right balance between buy and build. To get the advantage of speed of delivery as well as native experiences that are extremely tailored to your customers, you need a collaborative product development culture that is reflected in engineering organizations.

To capitalize on this strategic area, building a software-centric product and building an engineering organization that delivers on the digital experience promise is essential.

Regulatory and Compliance

This is the ‘fin’ part of fintech. Money is a central part of humanity and as a consequence, a central part of governments/laws worldwide. Customers want to have peace of mind that their funds/assets are safe and are legally sound. Regulation and compliance are the methods to express and verify this peace of mind. A great quote that succinctly expresses the need for focus in this area is (via David Saks), “Compliance is like oxygen, without it you die.” Robust regulatory and compliance is also a good barrier to entry for other smaller players who cannot afford the cost.

To capitalize on this strategic area, building a strong regulatory and compliance framework as well as embedding it in the company culture from the get-go is essential. This has to be in your DNA.

What do you think?

Are there single silver bullet’s in fintech? Are there other areas where competitive advantage can be gained? I would love to get your feedback!

If this article resonated with you Please tap or click “??” to help to promote this piece to others. Thanks!