BNPL is the hot space at the moment and the big players Klarna and Afterpay both released their full-year 2020 results last month. For a refresher on BNPL check out,

So how was 2020 for these two players?

Massive growth in 2020

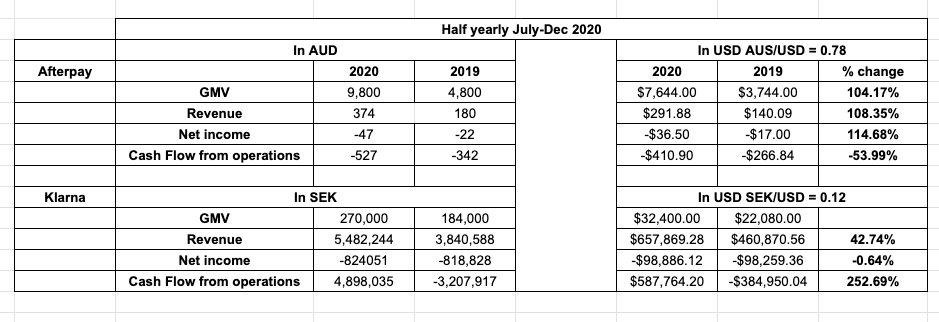

The financials bear this out. Both Klarna and Afterpay grew their top line fabulously in 2020. The table below summarizes the half year results for both. Covid has been a major accelerant for both of these players. Klarna grew top line at a healthy 42% and after pay grew at 104%. Both companies have losses on a net revenue basis at the moment which makes sense since they are still growing pretty rapidly. However free cash-flow tells a different story. Klarna generated positive cash flow from operations in 2020 while Afterpay is still losing cash from operations.

The USA is the new battleground

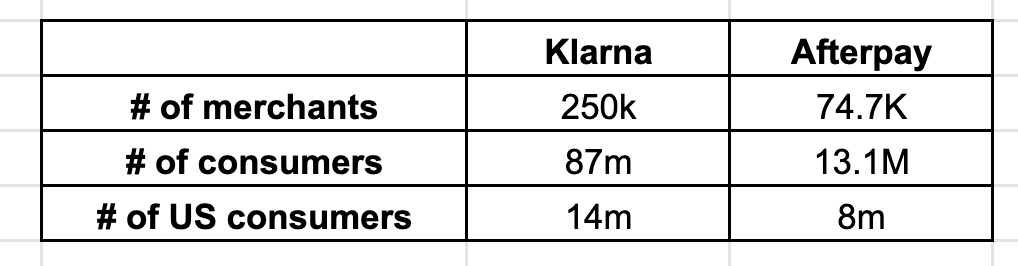

Both companies have invested heavily in 2020 to grow in the US. This is the new battleground. Both companies in their annual reports track and tout their growth in the US. Klarna is the behemoth globally with 87M active consumers (14M US), but Afterpay has increased its consumer presence in the USA massively (now at 8M active). This makes sense as the US is the largest consumer market in the world!

Klarna doesn’t break out US revenue separately and buckets it in the other segment. This segment grew from ~736M SEK in 2019 to ~1.6B SEK in 2020 a whopping 112% increase. Afterpay indicated in their update that the US now is 43% of their sales. Directionally both businesses are growing rapidly in the US!

Everything is neo banking

Both Afterpay and Klarna want to leverage their existing consumer distribution and provide more products to them. Offering consumer banking a product that both of them seem to be testing out. Klarna recently launched a bank account in Germany and after pay talked a lot about their banking product in their earnings conference call.

I guess that makes sense? Everybody wants to monetize their distribution more and more, but will consumers want to bank with their BNPL provider? Afterpay talks about having consumers switch their direct deposit relationship over to them – which seems a bit…farfetched? The neobank space is very very crowded and I just don’t see what differentiation the BNPL providers can bring to the consumer. Maybe higher rates (like affirm), but aren’t higher rates just a commodity – folks will switch out the minute they find higher rates somewhere else?

The core function of BNPL providers is to provide credit/credit-like functionality. I would have expected them to move into more credit building products as their next logical extension. This is an area where they have a natural fit, a possible competitive advantage. Moving into neo banking just seems like a me-too move.

Would love everybody’s feedback in the comments!