Continuing the deep dive on the BNPL players, the next thing I wanted to look at is their go-to-market strategies. How do they get their customers? Links to Part 1 and Part 2. A word of caution, all the research and numbers are from an outside in perspective and based on publicly available information. There is a possibility that I’m completely wrong in my analysis!

My simple mental model for go to market is,

- Who is the target customer? Are there many target customers?

- What is the narrow sub-segment of target customers?

- What is the value proposition and positioning for this customer?

- What are the channels that are used to reach out to this customer? Is there a low-cost acquisition channel in the mix?

Who is the target customer?

The dynamics for BNPL players are marketplace like or maybe closer to a B2B2C model. There are two sets of customers, merchants, and consumers. The core revenue source for the business is merchant revenue and hence merchants are the core customer. Additionally, merchants are also the core acquisition engine to get consumers (i.e the merchant’s customers). The model could be that you acquire customers first via some direct mechanism and then go sign up merchants with validated demand – but that is much much harder and a roundabout way of getting going. Focusing on getting merchants first is the better bet.

What is the narrow customer segment for merchants?

The natural fit for all the players is any merchant that does business online. This is pretty much everybody in the retail space. Since Klarna and Afterpay’s main offering is the split into 4 product, their target merchant is a category where the order value is relatively low – fashion is a big target market. Affirm’s has a natural advantage here due to its product being structured like a loan with availability in longer terms (up to 36 months). This allows them to target higher-order value items such as Peleton et al. Klarna and Afterpay’s split in 4 product is not a fit here. I cannot imagine a consumer buying a peloton on a split pay product as they can only spread that purchase over 2 months. This doesn’t make any sense for a $2500 peloton, you need a longer duration product to have the consumer switch over from a one-time payment to a loan option.

Each player does segment merchants via revenue and certain sub-segments (data gathered from the merchant application process on their websites)

What is the value proposition and positioning?

The main value proposition to merchants is increased revenue. By providing a BNPL option to your customers you increase the chances of them buying your product and they will also come back often to purchase more. Your average order value and repeat purchase frequency will increase over time.

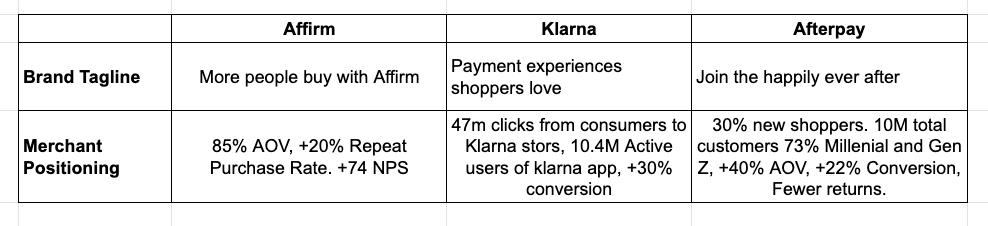

Each of the three players differ a bit in their positioning. Affirm’s positioning is very functional. They talk plainly about their product is great and for shoppers and great for business. Klarna’s positioning is also functional but it focuses on payment experiences as the main position. Afterpay is the most brandy of the bunch with their positioning of – Join the happily ever after. Brandy is code for I don’t understand what this means!

Which marketing channels?

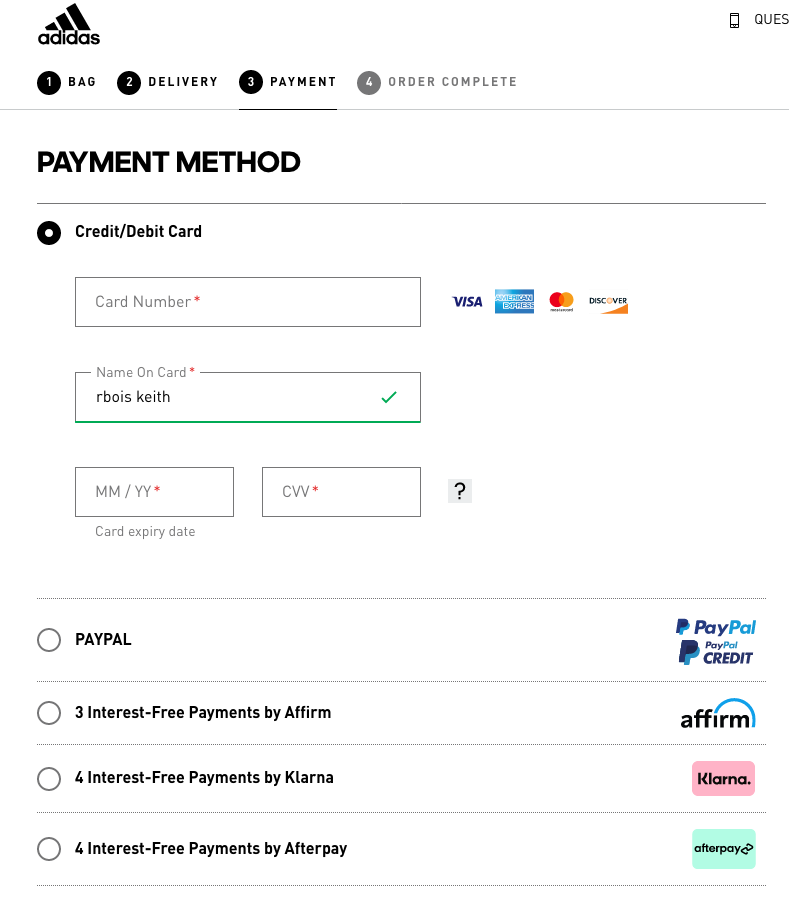

The most cost-effective way to scale customer acquisition is to sign up large retailers with well-known brands. You need big logos. All three players have leaned hard into this channel and always tout them in their press releases. Partnering with large retailers exclusively gets your brand recognition in the minds of consumers. Large retailers have large existing user bases that you can tap into. They also have huge marketing budgets so you can leverage their ad spend to acquire new customers for you. Exclusive retail partnerships are the best! Each player has a few large players that prominently feature in their collateral. Affirm has the largest retailer in the US Walmart and the hippest fitness brand Peloton. Klarna has Macy’s, Lululemon, and Sephora. After pay has the Gap and its sub-brands. Most of these relationships seem to be exclusive but looks like some retailers do signup for a couple of options. For example, Adidas on their website offers Affirm, Klarna, and Afterpay.

Affirm has a self serve merchant application process for merchants <5M in sales. Klarna has a self serve signup option if your annual sales volume is <500K and your AOV is <$499. Afterpay takes every merchant through a self serve application process. Affirm and Klarna bounces you to the sales team immediately after filling out a contact form for larger accounts. Large merchant partners are the secret sauce for low-cost acquisition for all the BNPL players.

Technical integrations and platform partnerships also play an important role in acquiring merchants. Each of the players has native integrations into the shopping cart providers such as Magento.

Affirm scored a big win in their partnership with Shopify to power their BNPL product. The Shopify product has not launched yet – but this is a very smart move by Affirm. Shopify is one of the largest enablers of e-commerce and partnering with them is a smart way to get more merchants on the platform. Afterpay announced a similar partnership with Google Pay. Afterpay hasn’t published any numbers on this partnership, so it’s hard to quantify if this was a big needle mover or not. But I expect more of these types of platform partnerships to be stuck shortly. The more places you can expose your product on the internet the more shots at-bat you have with consumers. It’s always about distribution!

On the digital marketing side, paid search traffic does not seem like a big driver of growth. The majority of the traffic to these players is still organic traffic.

On the paid ads side, affirm seems pretty focused on merchants exclusively. Klarna and Afterpay on the other hand seem to run the majority of their campaigns targeted towards consumers.

Both Klarna and Afterpay have a merchant referral program where they pay out $100 and $175 for a valid merchant referral. Affirm does not seem to have a merchant referral program.

The TLDR on marketing is that partnerships with large retailers are the biggest growth channel. Platform partnerships with players like Shopify is an upcoming channel. There is a little bit of paid digital marketing and paid referrals on the side.

What about consumer segmentation?

Since this product applies to every consumer on the planet, none of the players really segment or target the consumer customer base differently during signup. The post signup experience is also the same for everybody.

How are consumers acquired?

Merchants driven demand is probably the largest driver of consumers to each of the players. Consumers see the BNPL option in the checkout flow and get converted into users of the product. Affirm doesn’t seem to be running any paid ads targeted towards consumers. All their ads are targeted exclusively towards merchants. Affirm recently launched a cash savings product offering pretty good APR’s in this low rate environment (1%). This to me is a very unique way to get new users signed up for the product. Come for the high APR’s and start using the affirm mobile app to check your balances and transact. Affirm has established a relationship with you and can now push deals to you on the app and via email marketing. Affirm also generates user referrals via its mobile app.

Klarna does run paid advertising targeted towards consumers. A spot check of their ads on Facebook/google shows that they heavily skew towards consumers. They seem to have grown in their European markets via TV ads but I didn’t see any US-specific ads on their various media channels. Klarna does offer a rewards program as a retention and repeat spend tool. Every purchase you make earns a “vibe” that can be redeemed for gift cards towards various brands such as amazon and Starbucks. Instead of a referral program, they offer a 10$ amazon gift card once you make your first purchase. It’s structured as a reward for 1 vibe, which is the same as making at least one purchase. Just like affirm, klarna also markets deals available with its retail partners in its mobile app as well as via email marketing. Klarna does not seem to offer any user referrals

Afterpay is the most vanilla of the bunch. All I can glean is that they market to consumers via paid ads. They recently announced a rewards program similar to Klarna but haven’t rolled it out to the US yet.

Deals are used as a re-engagement vehicle by all the players. Deals and discounts are from its merchants are pushed aggressively via email and in-app placements.

Headcount statistics

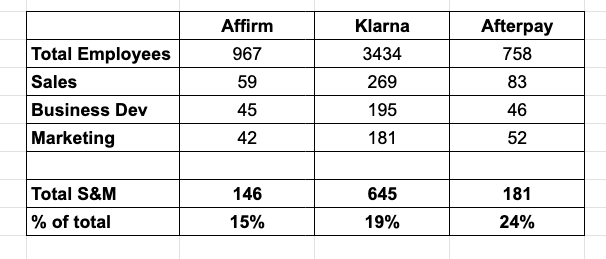

I find it instructive to get a picture of the marketing and sales headcount as a percentage of total headcount for a company. LinkedIn stats are not always exact but directional correct.

Affirm is the leanest of the bunch. I am looking forward to the S1 and figure out if I was close in my analysis!

To wrap this up – a summary picture of how I see the BNPL GTM playbook.

I would love feedback from insiders and experts in this space on this analysis. What did I miss, what did I get right? Drop me a note via all the usual methods!

Good analysis Rohit. Worth also analysing different growth dynamics of the three, which should have an impact on their valuations. For example Afterpay is growing revenue for y/e Jun 2021 by ~110% versus Affirm at 55%. You would also notice profit margins of APT and AFRM are different because of their risk profiles.