“Did you hear about the accountant who became an embezzler? He ran away with the accounts payable!”

JACKIE MASON

Bill.com is an AP automation company that makes it easier to manage the accounts payable and receivable process for SMB’s. This blog always likes to dig deeper, so let us start at the basics, what are accounts payable and receivable?

A good mental model for companies is to think of them as product transformers. They take inputs (raw materials) and transform them into outputs (products). Value is created when the finished products can be sold to the consumer at a higher price than the cost it took to procure and transform the inputs. Inputs for one company can be outputs of another company – its specialization all the way down.

Imagine that you in the business of making clothes for babies, cotton is your input, and ready-to-wear baby clothes are your output. Your expertise is making clothes and not growing cotton, so purchase cotton from another company whose expertise is growing and harvesting cotton. You call the company up, take a look at their product and negotiate a price to purchase. You send them a formal piece of paper indicating the amount to be purchased and the total price – i.e. a purchase order. Now you have two choices here as the clothing company. You can either pay upfront for the cotton or wait till the cotton gets delivered to you and then pay for it.

For most of human history, transporting goods across the world was a risky affair. Modern trade heavily reliant on maritime shipping and boats can sink, get raided by pirates, get exposed to bad weather – in short, there was no guarantee that goods will always reach their destination. So if you were a clothing company you’d prefer to see the cotton delivered to you before sending a payment through. This embedded risk in the transport of goods led to cash on delivery as the only option that made sense.

So following along, once a purchase order is received, the cotton company turns around and dispatches the cotton to you via rail, ship air, etc. The cotton company then also sends you a formal piece of paper that indicates the amount of money that the clothing company now owes the cotton company. This is commonly referred to as the invoice. The cotton takes say X days to reach the clothing company. The clothing company verifies the cotton and pays the invoice. This process eventually led to a cultural/business norm that a merchant gets paid X days after they have fulfilled their obligation of sending their goods to the receiving merchant. If X is 30 days, you now have net 30-day payment terms. Another reason why this norm stuck around could be that this transportation delay created credit in the system. If you have to pay your suppliers X days later in effect, the supplier has given you a credit. You can use the raw material to create your products, sell them and create revenue without incurring the costs of the raw material.

Whew, now that history is out of the way :), let’s switch to double-entry accounting. You have to account for these time-lagged transactions. The cotton company ships cotton to the clothes company and records the amount as receivable i.e it is expected to receive this money from the clothing company in the future. This is recorded as an asset. Similarly, when the clothing company records the amount it is supposed to pay after receipt of the cotton as a payable. This is recorded as a liability. These assets and liabilities are called Accounts receivable and accounts payable respectively. Pre-internet this entire process was paper-driven. You needed teams of humans creating invoices, purchase orders, faxing them, mailing them to each other, and managing the actual money transfer between companies. As you can imagine, this process of record keeping and money management adds overhead to the business as well as is a huge cause of error and mistakes. This is exactly the kind of problem that software and automation can solve.

This is Bill.com‘s core value proposition, AP/AR automation for small businesses. Their recent 10Q investor deck does a succinct job of what problem they are solving for and their target market.

Core growth drivers

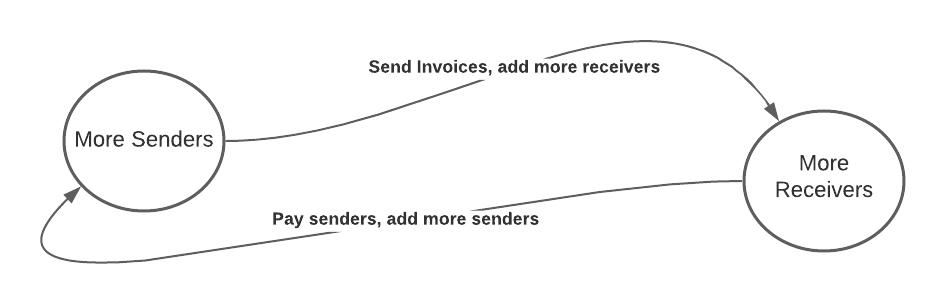

The core product has built-in network effects. Every company is both accounts payable and accounts receivable needs. For example, A company X using bill.com to manage its AR process (sender) sends an invoice to another company Y (receiver) who now can signup to bill.com to manage its AP process. Similarly, company Y can inturn be a sender and send an invoice using bill.com to company Z and so on. Every interaction with bill.com has the potential to net a new customer to its network. As every new SMB joins the network, it increases the overall convenience and value of using the network as all customers can easily link to that same SMB without having to repeat this process again. Additionally, for all participants in the network, there is no longer a need to individually maintain bank payment details for every participant. Bill.com maintains the master directory and keeps it consistent, accurate, and up-to-date.

Bill.com has also used partnerships as its core growth strategy. It focussed on accounts and accounting software as its core on-ramps. It signed a major deal with Intuit QuickBooks to be the AP/AR automation provider. These are efficient modes of getting customers as these are many-1 relationships. One accountant serves many small businesses and intuit is a platform to acquire many smbs at scale.

A tour through the financials.

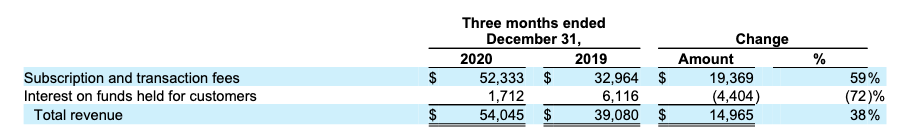

Bill.com has two sources for revenue (1) subscription and transaction fees, and (2) interest on funds held for customers. It charges SMB’s a SAAS recurring fee per month and charges for value-added services (ACH, Cross Border payments, and Credit cards ) on a transaction basis.

Interest on funds held for customers consists of the interest that it earns from customer funds while payment transactions are clearing. Interest is earned from interest-bearing deposit accounts, certificates of deposit, money market funds, commercial paper, and U.S. Treasury securities until those payments are cleared and credited to the intended recipient. This component is closely tied to the fed funds rate.

As per the latest 10K (FY ends in Jun 2020), the revenue numbers are impressive. Revenue for 2020 grew 242% over 2019. Float income made up roughly 13% of this revenue

The core KPI’s of the number of customers and total payment volume also shows impressive growth.

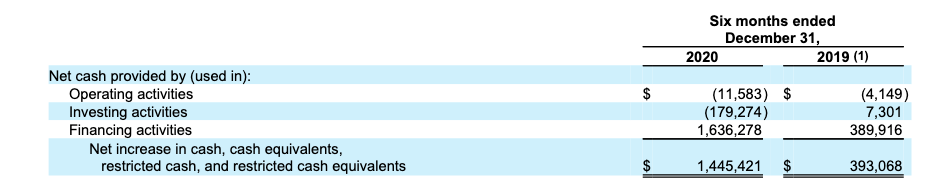

The company is still in growth mode and is still losing money. However, it has a strong balance sheet with more than half a billion dollars in cash in hand. The infusion of cash is primarily due to proceeds from the IPO ($225.5M) and a follow on equity offering ($307.5M)

Impact of Covid (Q2 2021 – ending Dec 2020)

The results for the back half of 2020 show that covid’s hasn’t affected bill.com‘s business. The only noticeable drop was in the interest income portion – t earned an average of only 36 bps of float vs 172 bps in the prior year. This line item shows the impact of the feds zero short-term rate policy.

The company took advantage of low-interest rates and issues a whopping $1.15B 0% interest convertible bond offering at a conversion price of $160.8 per share in November to add more cash to its balance sheet.

The market has rewarded bill.com stock, it has handily outperformed the QQQ.

Risks

The biggest risk bill.com has is its dependence on intuit as a platform partner. It doesn’t break out exactly how many customers it acquires via that channel, however, it is pretty clear that intuit is an important channel. It is the only partner called out as a major risk in the 10k statement. The intuit partnership ends in Jun of 2023, which will be an important milestone to watch out for. I am skeptical that a re-up of this partnership is possible. Intuit already has a backup partner on its network in Melio which is a direct competitor to bill.com. Melio recently raised a huge round and has bill.com squarely in its sights. It is playing the same playbook of targeting accountants like bill.com

This was a fascinating company to research. Bill.com is firing on all cylinders and built a great software b2b fintech business!