For our last 10K club we discussed Shopify ($SHOP). Giorgio has a fantastic post going into the 10k details. The bull case for Shopify is all over the interwebs but to truly understand the company, it’s useful to formulate the other side of the argument. In this post lets deep dive into Shopify’s business model and strategy and work out the bear case. Standard disclaimer: this is not investment advice and I do not hold any positions in $SHOP. This is a thought experiment using the good business/bad business framework.

What is Shopify’s business model?

Shopify wants to arm the rebels. Their core product enables businesses to sell online. They are constantly compared to Amazon so I’m going to use that comparison through this post.

Amazon has a direct relationship with the buying customer. It’s classic Ben Thompson aggregation theory. Amazon has built a consumer brand. Buyers come directly to Amazon; it aggregates consumer demand. Suppliers come to Amazon to fulfill this aggregated demand. Suppliers are a mix of first-party (Amazon) and merchants on its merchant marketplace. Amazon takes care of everything for the supplier on the order fulfillment side. It is a fully vertically integrated retail business that owns the consumer relationship from order to delivery i.e. a B2C company.

Shopify, on the other hand, is indirectly connected to the consumer. The business selling to the consumer (the merchant) is Shopify’s primary customer. Shopify provides an e-commerce store solution that enables merchants to sell their products online. Shopify is not a customer destination, it is an infrastructure business that helps merchants sell their products i.e. a B2B company.

Merchants are responsible to build their own demand i.e. they have to market themselves to generate consumer demand. All Shopify provides is the tools to enable the sales on the internet. You can see their approach via the products they talk about on their main website (Start?Sell?Market?Manage)

What do they invest in?

Shopify breaks out its revenue into the subscription solutions and merchant solutions segment. The subscription segments contain revenue related to the fees charged to customers to access the Shopify core platform. This is all SAAS revenue. The Merchant services segment contains all the variable revenue that is tied to the merchant’s transaction volume. Shopify Payments, Shopify Fulfillment, and Shopify Capital sit here.

Another way to think about this is that

(a) subscription revenue is proxy for the number of new customers (acquisition) that onboard onto the platform

(b) merchant revenue is a proxy for the growth in transactions of the existing merchant (retention) base.

For example, the more a merchant sells, the more transactions flow through Shopify Pay and this increases revenue in the merchant segment. With that lens, the growth in revenue is largely from the retention segment.

Merchant services is certainly a focus for Shopify and especially products in the payments/lending portion space. A large number of announcements at Shopify Reunite were in this area. They have formed a super talented Shopify Money team. Alex Danco, one of my favorite writers, has recently joined the Money team. They believe that everything is fintech 🙂

Is this a good strategy?

This is an interesting question. Signing up new customers on the platform is super profitable compared to the merchant segment. The merchant segment is mostly comprised of fintech verticals (Pay, Capital and Fulfillment services). From the lens of good business/bad business, these both seem like bad businesses – they are hitting the cost side of their customers (merchant’s) business. It is more likely that margins are going to compress further in these areas.

Is there value in building these fintech products as a first-party? Another route Shopify could have taken is to partner with various fintech providers and offer an easy way for these partners to integrate with Shopify, aka the Salesforce partner model. They could have continued to monetize the user base indirectly by charging subscription fees to these partners. This would generate more SAAS revenue and merchants would still be adequately served for all their financing and payment product needs.

The only rationale I could come up with is that this is really about control of the consumer customer. This struggle has repeated across many industries. A similar pattern was visible when we analyzed Expedia vs Booking. Booking holdings started as a service provider marketplace to hotels to bring them online to connect with consumers who were looking to travel. Expedia started as a vertically integrated travel provider that aggregated consumer demand and fulfilled it by striking contractual partnerships with hotels as the suppliers. Both pure-play models can’t survive as pure plays anymore and are converging to a hybrid model with a bit of each. Expedia has moved into the marketplace model via its pay at hotel options and booking has started to move into the vertically integrated model by implementing payment options as well as doing branded ad campaigns. Expedia realized that marketplace models can grow quickly and booking realized that a consumer brand needs to be built for continued success.

Similarly, Shopify started as a pure-play service provider that served merchants. Its brand is in the backseat and the merchant’s brand is at the forefront. The entire value proposition is to be the anti-amazon. The pitch to merchants is that we will always help you serve your customers and never take your customers away from you. Every service provider business has to project an air of neutrality towards its user base, in this case, it’s the merchants.

But ultimately it’s the person who controls the end customer relationship that builds a big business. The end customer in this retail chain is the consumer buying the goods from the merchant. The consumer does not know who Shopify is. It’s like a large power utility that is behind the scenes. To truly compete against Amazon they have to aggregate consumer demand. A key flaw from the consumer standpoint is that in the Shopify world, product discovery is hard. There is no central place that I can go search for products. Yes, Google exists, but Amazon is much better for product searches. Similarly, for a merchant in the Shopify world, you are solving a key problem of being able to sell online – but to truly help the merchant you have to serve the revenue side of the house. You have to enable merchants to get demand.

How to generate demand in harmony with the merchants?

I’m speculating here, it looks like Shopify’s strategy is to first invest heavily in merchant services to increase retention of its merchant base. Merchants should only care about creating and marketing their products to generate sales. Shopify will take care of everything else aka become the AWS of e-commerce. AWS type of businesses have great retention!

Secondly, Shopify is building out these merchant services as a first party. They are partnering behind the scenes with other companies such as Stripe (for payments) but from a merchant perspective it is a Shopify software product. This ensures that all the transaction-level data flows through Shopify systems. With access to this data, Shopify can get an accurate picture of how the merchants on its platform operate, what type of products are selling, what are the profit levels of items, etc.

Finally, what they likely want to accomplish – build a layer of product discovery to enable product searches. The Shop app is the beachhead for this move. This discovery/product layer is key to this strategy. This layer converts the primary demand generated by the merchant to secondary demand for other merchants on the platform. A concrete example would be to imagine a user who comes to a specific Shopify merchant to purchase a pair of jeans. As they browse the Shop app to get status details about their order they are shown a related item such as a pair of shoes that matches well with the jeans that they just purchased. This customer who came into the Shopify ecosystem to transact with a merchant selling jeans can now be directed towards another merchant selling shoes on the platform. In effect, each merchant generating demand is helping generate demand for other merchants on the platform.

As this secondary demand flywheel starts spinning, Shopify gets better at directing consumers to the right merchants to fulfill their needs. As Shopify gets better at this, its brand becomes front and center in the consumers mind and they start to have control over the end consumer. The result is that you have a Shopify network of stores that offer the same functionality as Amazon in a decentralized fashion. In effect, from the outside, you look like a vertically integrated player like Amazon but on the inside, you are still a network of merchants.

Is that stock market valuation justified?

Stock markets whether you like it or not are all about the narrative :). Shopify currently trades at a 68.8X EV/Sales multiple. The bull case is that the growth story is similar to Amazon. Shopify GMV is still 5 times smaller than Amazon and growing similarly. Line the two growth stories side by side and since Amazon is worth a GAZZILION $, Shopify is at-least worth ~7% of that today (AMZN: $1.54T vs SHOP: $121B).

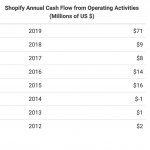

An area that still confounds me is that Amazon is incredibly cash-rich. They are a cash flow generating machine and over the years (thanks AWS) they have been generating operating cash by the spades. Shopify not so much. Most of the cash on the balance sheet has come from secondary offerings of stock (~3.8B and counting), the operating business does not generate that much cash.

This is the million dollar question. Are there enough rebel merchants in the world that can counter amazon and more importantly will consumers follow. Amazon has a huge moat with its focus on being the best destination for consumers when they want to buy something. Can a decentralized marketplace-lite model of Shopify counter this threat? Can there be a great curated product experience that makes finding products easier for consumers? Retail is still an end to end play – but can this distributed model work? Building a consumer brand is extremely hard. Strategically and culturally can Shopify pull this off? Its core mission and success have come from being in the back seat and now it wants to be in the front seat. Can you be in both places at the same time?

Questions I don’t know the answer to.

Secondary stock offering history

- $224.4M in 2016

- $560.1M in 2017

- $1B in 2018

- $688M in 2019

- $1.3B in 2020 (So far)