I’m a broken record on this topic :), reading 10ks is the best free learning tool if you want to understand how businesses work. We have a 10K a month group as part of the Fintech PM guild and this month we tackled the travel behemoth, Booking Holdings.

What is Booking holdings?

Booking Holdings is the holding company for a constellation of brands and is an Online Travel agent company (OTA) that primarily serves the international market (Ex-US). It was previously known as the Priceline Group, renamed to Booking Holdings in 2018, and is listed on the NYSE (BKNG). The founding of the company has its roots in the acquisition of booking.com by priceline.com in 2005. They are headquartered in Amsterdam with operations in multiple countries. Their main brands are Priceline, booking.com, Kayak, OpenTable, and Agoda. In 2019 they did ~$15B in top-line revenue and their current market cap is ~$62B. A majority of booking.com revenue is driven by hotel bookings.

Business models in the OTA space

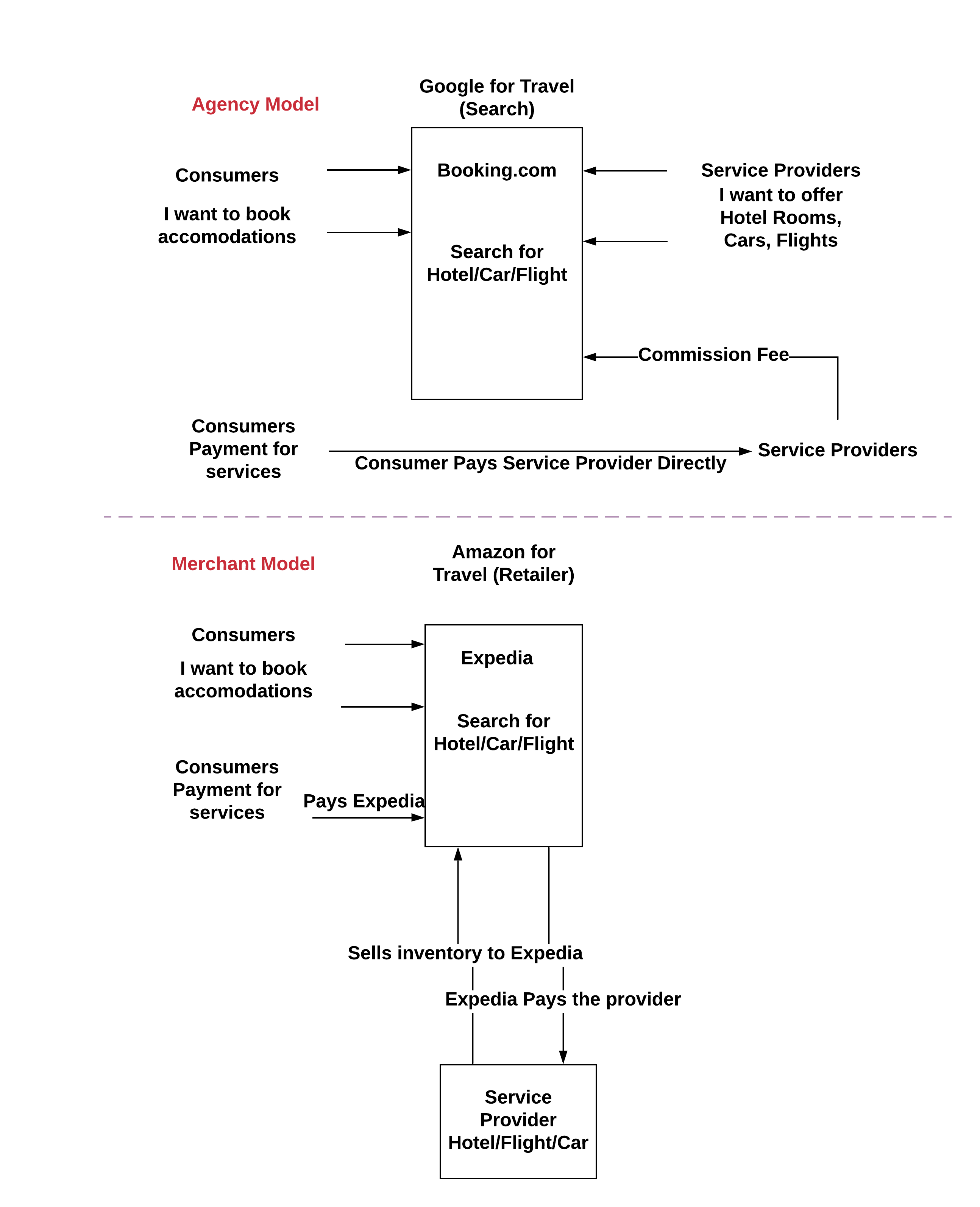

The online travel agent industry (OTA) has two dominant business models, the agency model and the merchant model. In the agency model, the OTA functions as a marketplace that connects consumers and service providers (hotels, car rental agencies, and airlines). The OTA facilitates discovery and administration of the booking process and collects a commission for the “sale” from the service provider. The financial relationship for the travel is between the consumer and the service provider, i.e. the consumer pays the service provider directly so the OTA does not need to get involved in the payment flow. The service provider controls the pricing for its inventory. In this model, the OTA is akin to Google with a focus on travel i.e. a travel search engine. Booking.com follows the agency model and can be thought of as Google search for travel.

In the merchant model, the OTA acts as a true middleman between the consumer and the service provider. The service provider sells their inventory (hotel rooms for example) to the OTA at a negotiated price and then the OTA marks up that price and sells the inventory to the end consumer. In this model, the financial relationship is between the consumer and the OTA i.e. the consumer pays the OTA for the full cost of the travel. The OTA then turns around and pays the service provider the negotiated rate thus the OTA controls the final pricing of the service to the end consumer. In this model, the OTA is akin to Amazon (the retail side) with a focus on travel. Expedia follows the merchant model and can be thought of as Amazon for travel.

Each model has its pluses and minuses.

Agency Model

- Plus

- Quicker to scale

- No inventory risk

- No supplier conflict

- Leaner operating model

- Minus

- Lower margins

- No control on pricing

- Indirect relationship with the end consumer

Merchant Model

- Plus

- High Margin

- Direct relationship with the customer

- Control on pricing

- Minus

- Slower to scale – adding new supply is slow

- Fatter operating model – have to spend on brand advertising

- Supplier conflict

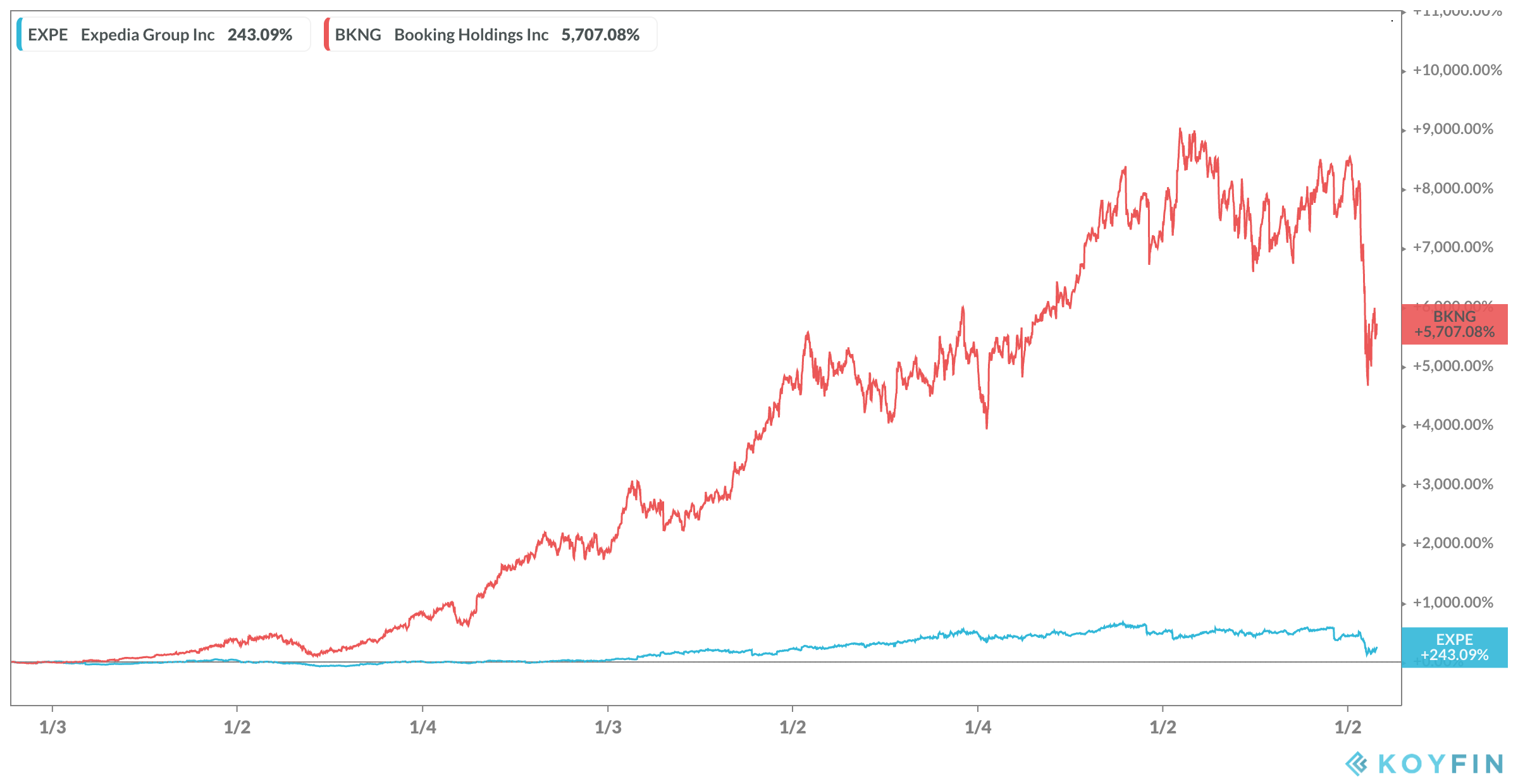

Booking.com has grown tremendously on the back of the agency model. Expedia ceded the market to booking and couldn’t change business models fast enough. The stock market performance shows the over-performance of booking relative to Expedia.

A tour through the financials

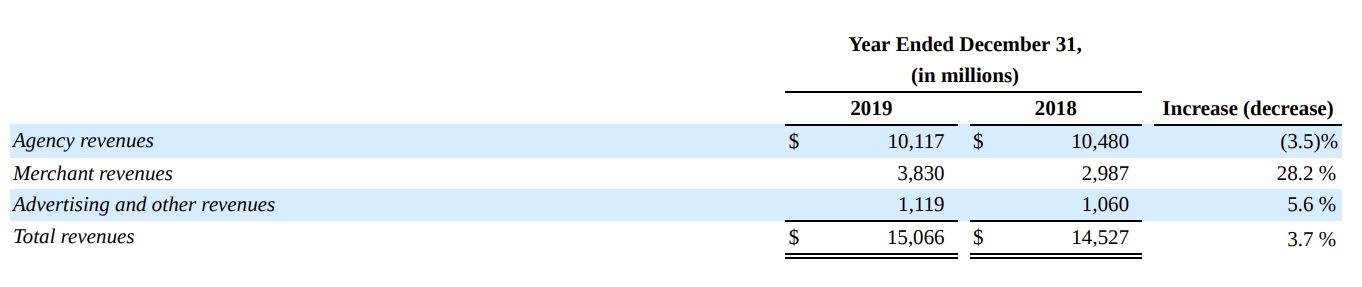

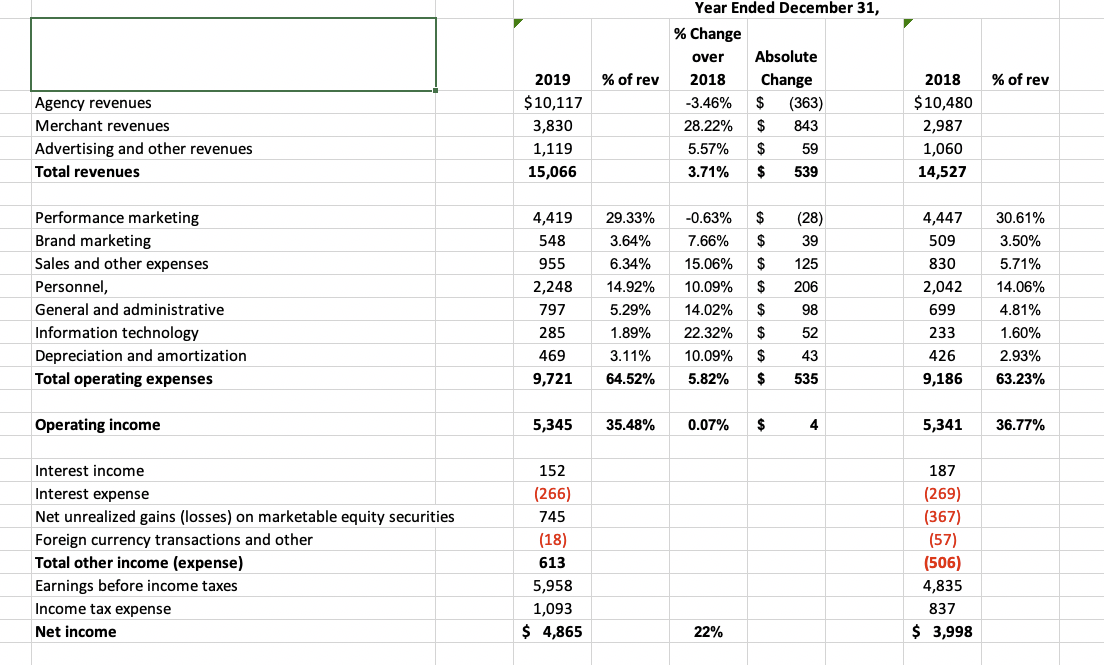

Booking breaks out revenue based on agency (the majority of its revenue), Merchant (new segment), and advertising (Kayak, OpenTable). Agency makes up 67% of the ~15B$ in revenue for 2019.

The merchant segment is newly reported and doesn’t 100% align with what we think of as the OTA merchant model. The traditional definition of the merchant model involves taking on inventory which booking.com explicitly does not do. Instead, it is developing its own payments stack and facilitating the payment flow between the consumer and the service provider. In the past, it would leave collecting the payment up to the service provider. By inserting themselves into the payment flow they are reducing friction for the end consumer by improving the overall experience as well as getting additional opportunities to monetize and cross-sell ancillary products such as travel insurance. One of the key benefits of the merchant model is the ability to control pricing and offer discounts etc. By offering payments as a feature, booking.com can flex a little bit on the pricing front as they can now offer discounting as a first-party via coupons and other promotions. This was not possible in the “pay at the hotel” model but is possible now since they are part of the payment flow. So booking isn’t explicitly changing its model to become a true OTA merchant player. This shift into what they call “merchant revenue” is just better monetization of the Agency model.

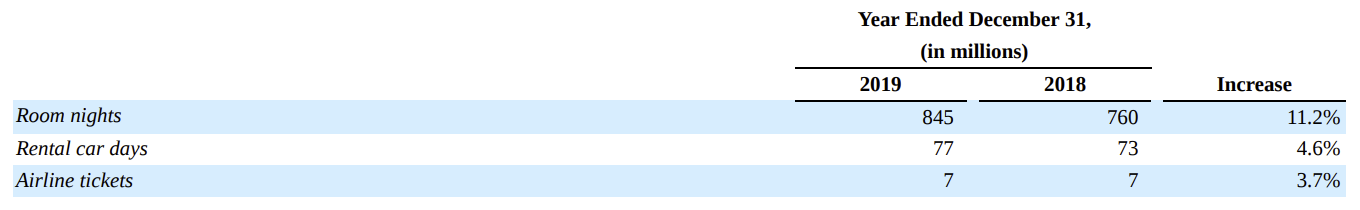

The leading indicator for revenue is gross bookings and that is growing nicely. The majority of the revenue and growth come from hotel accommodations.

Peeking through the income statement, the biggest expense is marketing. In 2019 booking spent a whopping ~$5B ( ~33% of its revenue ) in performance and brand marketing. Booking is a cash-generating machine with great operating margins (~ 35%). Y/Y comparisons are below.

On the cashflow side they generated ~$4.8B in cash in 2019 on the operating side and about $7B from the sale of investments in marketable securities. Whoever is running their Treasury has done a fantastic job in the last few years! However, most of the cash is spent on stock buybacks leading to only about $3.6B added to cash reserves in 2019.

Touring through the balance sheet, they have about ~21B in total assets and $15.5B in liabilities. However true cash on the balance sheet is ~$7B with current liabilities at ~5.6B. This ratio becomes important in light of the coronavirus situation. Pre-corona the balance sheet looks very healthy. From a financial perspective, the company generates a ton of cash which is used to make investments and buy back stock.

What is Booking’s competitive advantage?

At its core, Booking Holdings’ competitive advantage is the agency business model. The agency model allows for quick onboarding of travel service providers since there aren’t any long term inventory contracts to sign. Interests are aligned as booking only makes money via commissions if the travel provider makes money. The agency model enabled them to quickly scale the supply side. They were also pioneers on the customer experience front which enabled them to scale the consumer demand side. Booking was the first to launch the “x people are looking at this property right now” feature pattern that is replicated by every travel site today. Thus the agency model coupled with classic internet customer experience practices is their core competitive advantage. At scale, they also gained ancillary competitive advantages. Their marketing is super efficient and they now have relationships with most of the travel suppliers in the world. This deep partner network also gives them a competitive moat. Credit should also be given to Glenn Fogel who acquired booking.com and made the other acquisitions to create Booking Holdings. He has done a spectacular job of identifying who to acquire and then integrating the acquisitions.

Comparison with Expedia

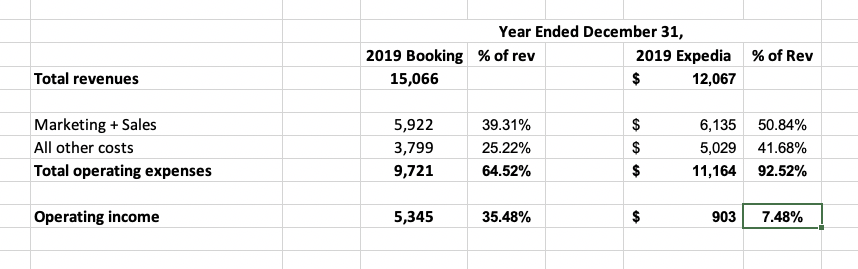

Expedia is the largest competitor to Booking and for 2019 it had about ~12B in revenue, but the cost structure is very different than booking.com. Since Expedia follows the merchant model, it has to invest a lot on the brand to attract consumers and that shows up in the marketing spend! The comparison below shows the superiority of bookings model!

So what do I make of all of this? As product managers, we tend to over-index on the product innovation angle and business model innovation tends to be an afterthought. It was very instructive for me to learn that the core business model has an outsized effect on the success of the business. Some closing thoughts.

Everything is fintech

With their payment platform initiative booking is demonstrating that adding fin-tech capabilities to a product set enhances monetization and provides a sticky customer experience. We generally think of fintech as a vertical but I’m convinced more than ever that fintech is horizontal. Every company that operates in this world offline or online will eventually converge to adding “money” capabilities into its core product set. Everything is fintech!

Automation is a theme

Booking is working on rolling out its “connected trip” concept to its customer base. At its core it’s an automated engine that takes out all the complexity of booking an entire packaged experience as well as adjusting the experience if a certain portion of it is canceled. From a customer perspective, this is like having a personal concierge that handles all the aspects of the travel for you. Automation is a theme that fintech companies have been exploring for quite a while. For example, the first generation of Robo advisors was all about automating the investment experience and consumer companies like Credit Karma are all about automating the consumer finance experience. Everything is fintech part 2!

Coronavirus thoughts

Covid-19 has decimated the travel industry and its anyone’s guess how it would look like once this crisis passes. The only financial metric that matters at this point is the runway at zero revenue. Every company has now become a pre-revenue startup. Booking has about ~$9B in expenses; if we cut out marketing its about ~$5.3B. They had ~$7B in cash with the addition of ~$1B of debt due in June 2020. Assuming zero revenue – they had about a year’s worth of cash left! However unlike startups, they can tap the public markets for debt and equity – and they ended up raising about ~$4B. Post COVID-19 whatever shape the travel industry will be booking will be guaranteed to be one of the winners. For businesses, this crisis is all about making to the other side, alive. The big players can do that – post-crisis the big will get bigger.

Further Reading

An oral history of travel’s greatest acquisition- booking.com