Today’s post is of the wonkish type. A few of us in the fintech pm group started chatting about certain macro trends and that discussion sparked the idea for this post. BTW this is one of the many reasons I really like having a curated private group – it leads to broader and deeper conversations. Today’s topic is inflation!

What is inflation and what are its causes?

Inflation is defined as the increase in the level of prices. When we talk about inflation what we really care about is the rate of increase in prices rather than the absolute price level. Inflation is important to you as a consumer – the more prices rise, the more it costs you to live your daily life. It is important to you as an investor because as prices rise, asset prices have to adjust to new expectations. Rising inflation is generally negative for asset prices. Inflation affects us all.

A good mental model for causes of inflation is to think of two distinct modes.

1. Prices can rise because the cost of making goods has increased. This is the cost pull model – a good example is inflation caused by rising oil prices since oil is directly or indirectly an input to every good.

2. Prices can also rise if demand outstrips supply. If consumers come into a lot of money and chasing fewer goods, they are willing to pay more and hence prices rise. This is the demand-pull model.

It is usually not clear cut that it’s one or the other, but these are good starting points.

There is also the monetary theory approach which ties inflation to the quantity of money. If there are abnormal rises in the money supply in the economy i.e. more money in the hands of financial market participants (banks) which eventually flows to the real economy (consumers) through the lending channel (aka velocity of money). This can also be the mechanism by which consumers get the extra cash that jump-starts inflation as described by the demand-pull model.

Will we get finally get inflation after COVID-19?

The monetary theory approach has dominated since the GFC. With the fed increasing liquidity into the banking system, it was expected that inflation would skyrocket. That did not happen, at least by the common CPI measurement. You can make the argument that the measure is flawed, but that’s a whole another discussion :). Essentially there was little to no inflation at the consumer price level. An explanation is that the liquidity created in the banking system never made it to the end consumer as banks just pocketed the spread by parking the extra liquidity at the fed (via IOERR). Also, they invested in financial assets and thus never lent the money out. The “velocity of money” model broke.

Fast forward to today. COVID-19 has unleashed liquidity in the system with one key difference from 2008 – money is being funneled directly to consumers via stimulus checks and the extension of unemployment benefits. Cash is also reaching main street small businesses via the PPP program. So 1. input prices of commodities such as oil are at historic lows and 2. cash is directly reaching consumers and. Is this the double whammy required for inflation?

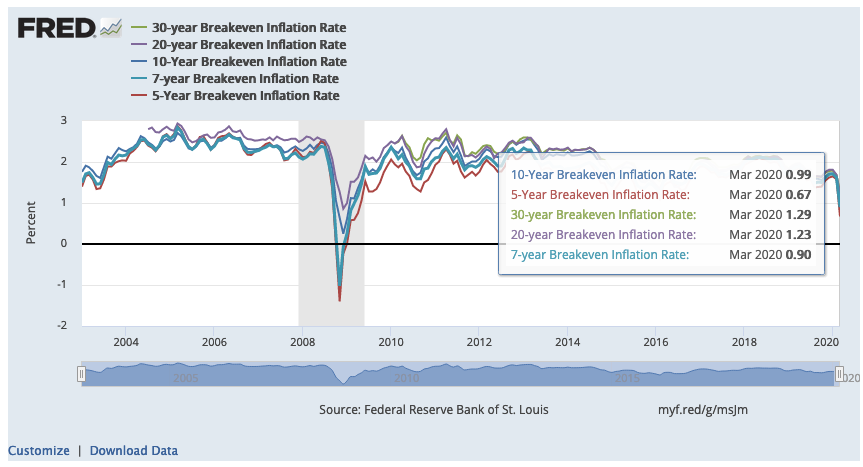

Let’s check in with the markets. TIPS are bonds issued by the US treasury where the principal adjusts upwards with inflation, thus preserving your purchasing power. Breakevens are a method to get a read of what the market is thinking about inflation. Say you have a 5 yr TIPS bond and a 5 Yr US treasury bond (UST). Both bonds have the same credit risk, the US government. TIPS are protected against inflation and thus do not carry inflation risk. However, the UST equivalent does have inflation risk. So the difference in yields between TIPS and UST of the same maturity is a good indicator of what the market expects inflation to be. If you look at 5 Yr and 10 Yr TIPS breakevens the market is not pricing a spike in inflation.

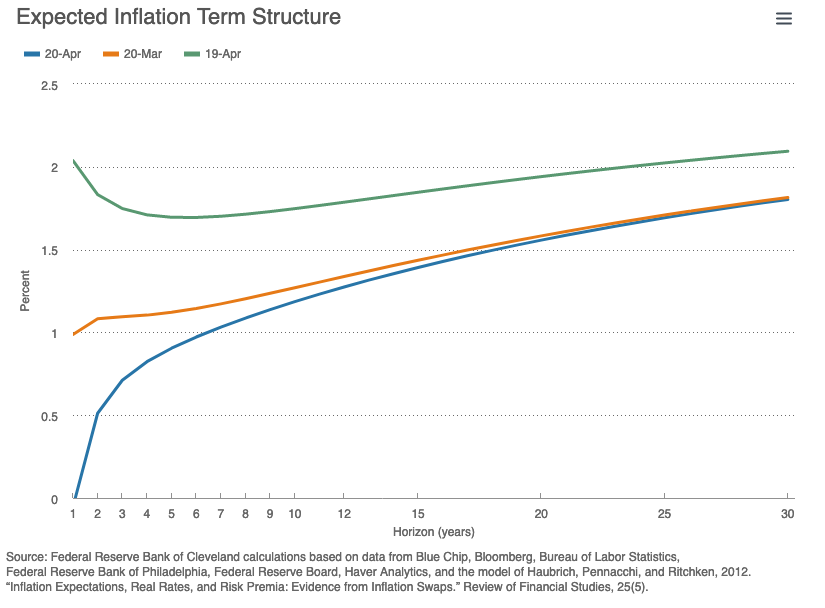

The Cleveland Fed also maintains a model that adds in inflation swaps to the mix and forecasts inflation. The current forecast is 1.19%. Market measures, thus far, do not indicate a spike in inflation.

What gives? We are pumping massive amounts of money into the system and directly to consumers – why are expectations of inflation still low?

My thinking is that the explanation lies in the behavioral realm. We are defined by the traumas we experience. The COVID-19 induced recession is turning out to be the worst recession the US has ever experienced. Consumers who are getting the fiscal stimulus will look to save as much of that money as they can since the future has become very uncertain. Why would I resume spending, when I could lose my job again in a heartbeat? Demand is not going to come roaring back.

Another driver for inflation is increasing wages. In addition to more money in consumer’s pockets, it increases confidence for the future. My skills are valuable that’s why I’m getting paid more and my confidence increases, I am willing to spend a bit more. I don’t see this scenario playing out either. As we come off the highest level of unemployment, folks are just going to be happy to have a job. Employer power is just going to increase further, wage increases are unlikely.

Despite massive fiscal and monetary stimulus – there is a good chance that we will not see inflation – we may, in fact, see deflation. We may have exhausted all the policy ammunition we have.

So the million-dollar question – what happens then?