The brilliant odd lots podcast had Richard Koo on to discuss his theory of a balance sheet recession. The central idea is that when a credit bubble bursts and the private sector and consumers both start to deleverage it causes the economy to go into a demand loss spiral, which is a counterintuitive result. If excess leverage caused the bubble then deleveraging and repairing your balance sheet is the most rational individual choice, but this de-levering in aggregate is the wrong choice for the economy as a whole. I would highly recommend reading this paper that goes into some details and also reading his book.

In the podcast, Koo also talks about the generational trauma that crisis’es cause and how that affects choice making for the future. I’ve experienced this first hand and have a strong belief that our financial habits and the way we think about money are closely linked to the closest financial crisis that occurred as you are entering/early the workforce. I joined the workforce in 2002 and the defining crisis for me was the 2001 dot com bubble. The wave and wave of layoffs that occurred from 01-04 is my trauma. To this day my biggest irrational fear is losing my job and I can trace all of that to the 2001 crisis. With every crisis also come beliefs that become a religion. Koo talks about in the podcast about how the generation that lived through the great depression considered frugality to be the ultimate virtue and it became an irrational religion.

Our last crisis was the 2008 financial crisis aka GFC – what are the prevalent trauma-caused-beliefs?

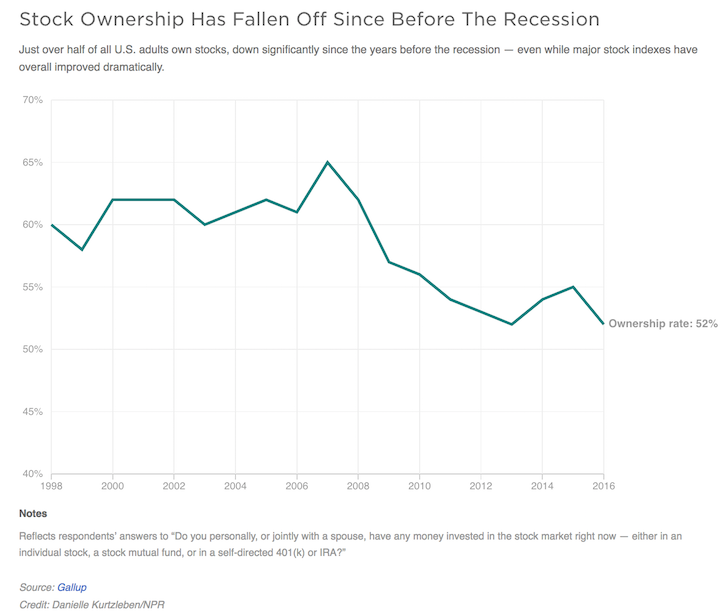

Stocks are a Ponzi scheme

We have seen retail participation in the stock market steadily decline. While there is the rise of robin hood et al, retail activity has not come back to pre 2000 levels. Stocks are no longer considered the asset class to invest in. All the kids are into crypto!

We will always have low inflation

Right post-GFC when the fed pumped massive liquidity in the banking system, the accepted argument was the since the money supply went up there is going to be massive inflation. However, Koo’s theory correctly predicted that in a balance sheet recession just increasing liquidity is not going to increase inflation. Lending also has to happen for the liquidity to actually cycle through the economy. But since everybody is deleveraging – the excess liquidity is not being lent out and hence no inflation. We have not seen inflation pop above the fed target of 2% since the GFC. This low inflationary period now has become gospel, i.e We will always have low inflation.

Permanent bubble watch

I can sheepishly attest to be in this camp. 08 scared everybody so much that we have been on bubble watch ever since. We’ve had a massive bull market in risk assets since 08 and this has been perhaps the most hated bull market in history. We are all waiting for the next recession and are expecting it to be just like the last one. Always fighting the last war.

So if the above is the consensus view due to trauma – what is the contrarian view? I am venturing into speculation/prediction so please do not consider this as financial advice, please do your own research to inform your choices 🙂

Bubbles and manias happen when everybody believes that only one thing is true. With so many voices calling for a recession to happen, there doesn’t seem to be a lot of mania around. I expect the stock market rally to continue – it probably still has some ways to go. Once everybody starts thinking stocks can only go in one direction and that is up – will I start to get concerned.

The one tail risk I am most worried about is inflation risk. We’ve had an entire generation that hasn’t seen inflation over 2% for a long time. Every theory, every data point seems to point that continued low inflation will be the case – but this is what scares me. The tail risk of inflation surprising to the upside will be magnified by us not expecting it to happen. Do read macro tourist for his thoughts on how to trade inflation – its absolute gold.

What are your trauma-caused-beliefs and are they still valid?

One Comment