Every business will eventually have to get into the financing business. Financing is a fancy word for lending and it has been around since the dawn of civilization. In this post, I will attempt to describe a simplified mental model for lending.

What is lending at its core?

Lending is a contractual relationship between two parties. One of them has something that the other needs. The lender, who has the thing and the borrower, who wants the thing. Since the dawn of mankind, the thing to want is productive assets. You start with borrowing a plow, borrowing some land, borrowing some seeds – you get the idea. As mankind progressed and the next abstraction of money came into being, money is the asset that everybody wants. Money is the path to get to productive assets. The lender of money wants to get compensated for giving his asset to the borrower. He is giving up the use of the asset and needs an incentive to compensate for the lost opportunity cost – this is the interest. Every contractual relationship has to have a time frame specified. In lending, this construct is described by the repayment term i.e over what period of time does the lender get their money back.

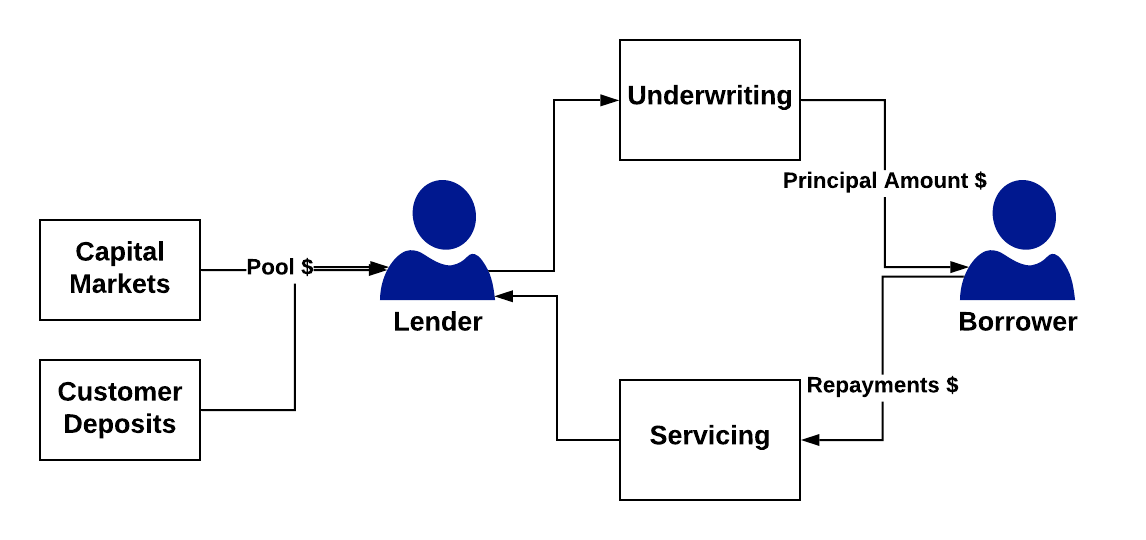

The core functions of lending then can be broken down into. Finding borrowers who want money, Getting/Having the capital to lend, lending them money, and getting the money back. aka Customer Acquisition, Capital Markets, Underwriting, and Servicing.

In simple terms, the person getting the loan (borrower) at the start of the loan period gets a lump sum amount (loan amount). The borrower over a period of time measured in days/months/years (loan term) makes repayments back to the lender with interest that is determined by the interest rate.

The economics of any business is dictated by the price and in lending, the price is the interest rate that the borrower is charged to get the money. This interest rate is decided by the risk model which underpins all lending. We can break down the interest rate further into two components – the base cost of capital and the expected risk of the transaction. What is the risk in this context? You give a lump sum of money to a borrower and expect them to pay it back over a period of time. Hence the core risk is that the borrower is not able to pay back over the repayment period. This risk (default risk) is what you are trying to quantify before giving out the money. Predicting default risk is the key outcome of the risk model. This process of accessing the risk is also known as underwriting. The term underwriting has roots in the Lloyds of London Insurance market. Ship captains would write down on a piece of paper the risks to their voyage and bankers would write their name under the risk line item to state how much they would charge ship captains (premium) to assume that risk.

What is the risk model trying to do?

At its core, the risk model is trying to decide if the borrower should get the loan and at what price. This process is a multistep process. First, the risk model takes in a bunch of inputs and outputs a numeric score that is called the probability of default. Depending on the risk appetite of the lender, borrowers above a certain score will automatically get rejected. For the remaining borrowers, the folks with a higher probability of default will get a higher price than the folks that have a lower probability of default. This is a classic risk premium model – higher the risk higher the price.

With me so far? Now that we have basics understood – let us dig deeper

Can underwriting be a competitive advantage?

Yes and no. There are two models to think through this.

You fundamentally believe that you have access to proprietary data sets that can make a better risk model than what’s out there in the market. In effect for the same borrower, your model can predict a lower probability of default using this proprietary data. Since there is a lower probability of default, you can offer the borrower a lower price than the incumbents. This leads to better conversion and growth for your lending operation. This is the better math (BM) model – your model prices the risk better.

You fundamentally believe that you have access to proprietary data sets that can make a risk model possible where previously there was no model possible. In effect for a borrower that was shut out of the market as nobody could underwrite the risk, you can now underwrite as you have a source of data that makes it possible. This is a new category (NC) model approach – you can price something that was unprice-able before.

I believe that BM models are harder to differentiate with. Lending is as old as time and the models used by the incumbents are pretty battle-hardened over the years. BM models are also always pitched as complex models with more proprietary data and hence they are better. Adding data sets to models runs the risk of overfitting but nobody got funding saying we have a simpler model 🙂 I am very skeptical about BM being a competitive advantage. For example in consumer lending, the FICO score in the US by itself is a pretty good predictor of risk.

NC models have more promise. You are going after a market that hasn’t been lent to before since the models didn’t exist. You are the first mover in this space. The risk is higher but so is the reward. I am bullish on ideas that come with this type of underwriting edge

Fintech 2.0 business has a unique advantage that is a special case that we should talk about. To recap, Fintech 2.0 business is a business where the money isn’t the primary good that is being sold. They have a captive audience for a core non-financial product that they now want to monetize further by extending financing to their customers. They are doing this to increase conversion and usage of their core product. Examples are amazon via its amazon lending product, square via square capital, and Shopify via its lending efforts. These businesses typically start with offering payment processing services and once they are in the payments chain of the user – they have competitive advantages that are a combination of BM and NC models. Since they are in the payments flow, they have a native view of the cash flow of the business. This transaction data acts as a simpler and more accurate view of the data that is traditionally used for underwriting. Its still BM underwriting but with a simpler and more accurate data set, which means you can price better than the incumbents model. Simple models work better than complex models. This transaction data also now opens up a whole new class of customers that wouldn’t ever be underwritten by BM as the data wasn’t available. This is the NC advantage.

Hopefully, this gives you a good framework to think through competitive advantages in underwriting. The next time somebody pitches you a financing product, ask what model are they – Better Math or New Category.