Everything is fintech is the meme of 2020 in Silicon Valley and beyond. The nerds that we are :), we spend a lot of time digging deeper into this topic in the fintech pm group. The banter back and forth is the reason why I am super bullish on this small curated private community. This post is an attempt to describe my framework.

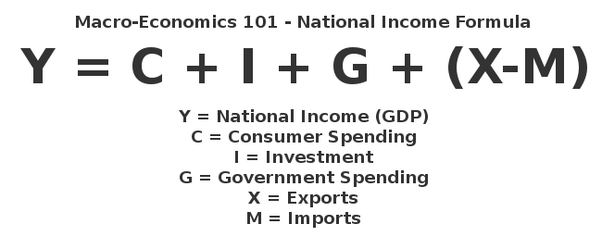

How should we think about everything is fintech meme? Let us start with the macroeconomic accounting identity of an open economy

If you stare at this hard enough, a fact hits you – everything is consumption. Investment today is to produce something in the future that will be consumed. Government Expenditure (in benefits or investments) is also for something that is going to be consumed in the future. The same is the case with the current account (X-M)

Another way to think about this is that a business exists to produce goods (real or virtual) to sell to somebody to consume. Production’s end goal is consumption. To enable this consumption you need some unit of account to transact with. Money is that unit of account. With this mental model, you can think of Credit(debt) as pulling in consumption from the future. Consumers take on debt to consume faster. Businesses take on debt to invest. They use this investment to get goods to market faster, which are then consumed faster.

This mental model explains why every company producing goods extends credit to their customers. You give your customers credit (money), they use that credit to buy things now instead of in the future. You also want to make the process of consumption as easy as possible. A strong case for offering many payment options to your customers. If you follow that logic, you are already offering your customers credit and you are in the main payment flow for their consumption. Why not manage everything they do with their money? i.e every company will be a fintech in the end :).

This line of thinking provides an explanation but its not complete. Digging deeper, It is useful to call out the nuance between a finance business (fintech) and every other business. I define a fintech business where money is the good. Wealth Management, Banking, Payments, and Lending are all fintech businesses. Money is an intermediate good. Money by itself isn’t useful, it is only useful when used to transact and perform actual consumption i.e its use is in exchange for a good. A good that a consumer wants. I define a regular business as an entity that produces a product (real or virtual) that satisfies a consumer’s desire and need. The, every business is a fin-tech meme does not capture this nuance. It does not mean that every business becomes a bank and changes its business to make “money” their primary good. In my opinion, every business will add fin-tech as a core layer to their business. This is essential to bring forward consumption, but it won’t become their main business. Booking.com is still going to be in the business of travel, Uber is still going to be in the business of transportation. They are not going to change and become banks. They will have banking as a service, but they aren’t a bank. A good way to think about it is that fintech 1.0 is a standalone finance business. Fintech 1.0 has money as the good. Fintech 2.0 is a real good business that has money management as a horizontal feature.

So where does it leave fintech 1.0 businesses? If every business is going to be adding fintech as a core layer – do fintech 1.0 players transition to being b2b or infrastructure plays rather than pure consumer plays? It is way harder for a fintech 1.0 business to get into the business of selling real goods than the other way around. i.e it is way easier for uber to get into financial services than say a chime to get into transportation. Are current market prices already reflecting this outcome? Enterprise and SMB payments (Stripe) and infrastructure players such as Plaid are highly valued. Public online lenders such as Lendingclub, Ondeck, and Funding Circle not so much.

Maybe the right meme is – Fintech is dead, long live fintech 🙂

Loved the post Rohit! Excellent way to distinguish between Fintech and every other business. I do wonder what would you say is the good / product for businesses such as Stripe and Plaid?