Sooner or later, everything old is new again

– Stephen King

The thesis expressed today is that financial services are no longer a separate vertical component in consumers’ life. Consumers are going to be better served where they already hang out. So the natural extension for business with a large number of customers is to start offering financial services to their user base. In this model, financial services transition from a vertical component to a horizontal capability that all businesses will offer to their users. Hence the popularity of the term embedded finance.

Is this thesis valid? I’ve been thinking about this for a few years and this post is an attempt to work out a mental model and answer this question.

Short answer – this thesis is wrong. Long answer- it’s nuanced.

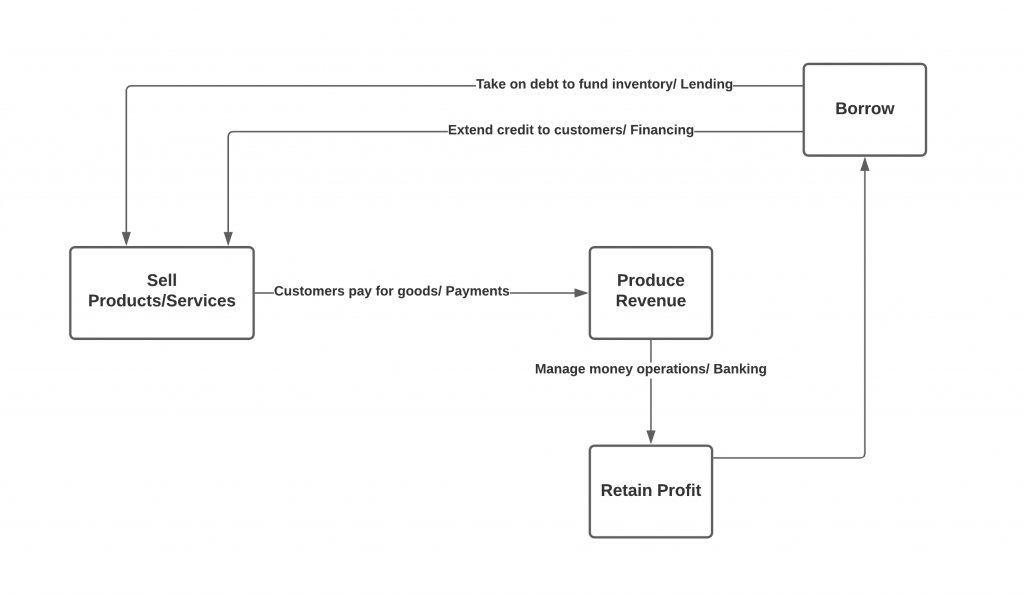

Let us start by describing a model of what is the core jobs to done for a business and a consumer concerning all things money. The core job of a business is to generate revenue. Everything about the business is to further that goal. To get revenue a business exchanges its product for money from the buyer of its product. To collect maximum revenue the business wants to make this process of exchanging goods for money as simple and friction less as possible. Sometimes the buyer does not have all the money required to buy the product. To get over that hurdle businesses will sometimes offer financing to its buyers (extend credit). This extension of credit makes the exchange possible and hence increases revenue. Once revenue is collected a secondary job to be done for business is to administratively manage that money. With this mental model, the core b2b finance space can be modeled as follows

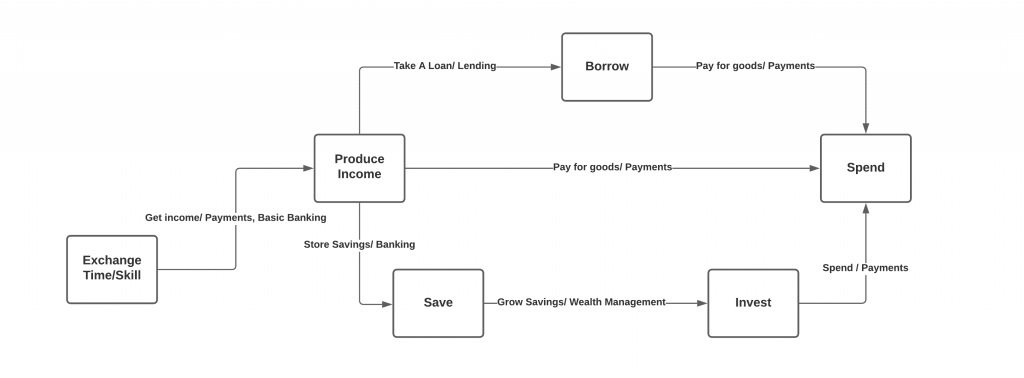

Similarly modeling a consumer, the core job to be done for a consumer is spending. All financial activities are indirectly related to spending. In a consumer’s case, they are exchanging their skills/time for money. They can spend the money as soon as they get it. They can also save a part of their income to spend later. Depending on their cash flow they can also borrow against it to get more money to spend now i.e pull forward consumption.

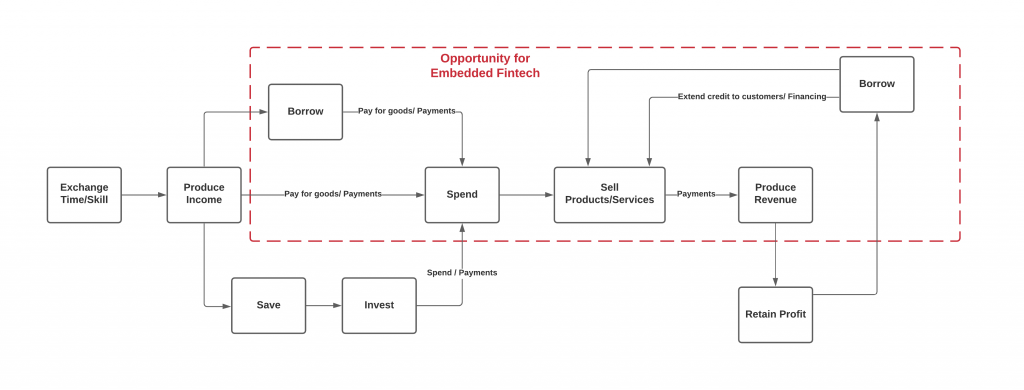

Now, lets put connect these two models and look at the full picture. Consumers and businesses are connected by spending. Consumer spending is Business revenue.

My nuanced thesis is that the further away from the revenue generation (business) and spending (consumer) you are the less likely you are going to find success in your embedded finance efforts. There are natural tie-ins in payments and lending between business and consumers as they are closest to the core jobs to be done for both of them. As you get further away from this core, towards saving and investing, there isn’t a strong use case for a single business to offer those services. The theoretical concept of Facebook offering the entire suite of financial services doesn’t play well in reality. Facebook offering mortgages are extremely far away from Facebook’s core competency! Also, the consumer’s job to be done on Facebook is miles removed from obtaining mortgages. Consumers come to Facebook for entertainment and maintaining connections with friends and family. They are not thinking of Facebook as a mortgage provider.

However, providing integrated payment solutions to make the collection of payments friction less on the Facebook platform makes complete sense. Integrated payments make it possible to buy goods in one click through an ad. This leads to more businesses advertising on the platform as more ads result in more sales. More ads equal more revenue for Facebook. Similarly offering to finance its advertisers also makes sense this leads to increased ad spend which leads to increased revenues.

The place to target for embedded fintech is to focus on the payments and extending credit areas of your core business. Anything else is flights of fancy – you are wasting your time and resources. Trying to become a full stack banking provider to your customer base is the wrong strategy.

The counter-example that is always bought up is the Asian super apps. I am now of the opinion that that is the exception rather than the rule. China had a unique set of circumstances that only existed in China that enabled the super app phenomenon. China leapfrogged the desktop internet and started on mobile. A large majority of the population was un-banked. With mobile phone penetration and use rising exponentially there was a massive one time opportunity to bring them into the financial services ecosystem. The super apps capitalized on this one time opportunity. However, this does not translate to developed markets. In these markets, the situation is reversed. Financial services are already well penetrated and there are lots of options available to consumers. It is much easier to become a super app when there are no switching costs. In developed markets having a successful super app involves being able to switch users from their existing apps into yours. This is very hard! As evidenced by the recent disbanding of the Uber money team.

I predict the next iteration for the term embedded finance is revenue finance ?. Sooner or later, everything old is new again.

One Comment