Whew, 2020 what a year. I’m glad that it is behind us. What does the future hold for 2021?

TLDR:

- 2021 most likely a strong bull market – think roaring 20’s.

- Violent inflation overshoot is the most visible risk, however, black swans are a key risk and nobody can predict them.

- I’m a reluctant bull – willing to invest in pre-tax accounts, but staying out of the markets in taxable accounts. Wheel option strategy to enhance cash on cash returns.

Let us take a deeper dive. What is going to make markets melt-up in 2021?

The consumer is strong and has a lot of dry powder

The consumer is the backbone of the economy and its balance sheet consists of assets (house, car), liabilities (all forms of debt), and income (job). In a recession, all or some components of the balance sheet get stressed. In the 08 crises, liabilities overtook assets coupled with job loss- the triple whammy. Recessions lead to massive deleveraging and it takes some time for the recovery to play out as consumers repair their balance sheets over time. The 2020 covid induced recession was different as the consumer was pretty healthy going into it. The shock in 2020 was completely external. Demand collapsed due to an external health threat. This recession was not caused by the normal excesses of speculation or leverage.

The fiscal stimulus was the right strategy as it put cash into consumers’ pockets directly and protecting the income side of the household balance sheet. As everything was shut down the consumer did not have a lot of avenues to spend that cash. So they did the right thing and ended up paying down debt and saving the cash. This shows up in the statistics, consumer liabilities are lower than in 2019 and the savings rate has increased dramatically. Consumer balance sheets are pretty strong and there is plenty of dry powder on the sidelines – priming the pump for the bounce back.

Vaccines release the pent up demand

Let’s be honest, everybody is tired of staying indoors all day. Humans are social animals and we need in-person interactions to live life. A less than scientific survey of my peer group points towards a rush to party when the vaccine rollout is complete. We are going to want to eat out and socialize every day! There is some early evidence from Australia (see a great Twitter thread here). Travel is up, hotel bookings are up – people want to PARTY. Couple this with the dry powder that consumers have, spending is going to be ginormous and that’s what drives GDP. You can see the GDP snapback in the forward estimates.

Accommodative fed policy is here to stay

When there is a large amount of spending power about to be unleashed into the economy, the biggest risk is inflation and more importantly the fed’s response to it. Pre-covid the fed’s stance was always inflation fearful. As soon as they had an inkling that inflation may reach their 2% target they raised interest rates. However, post covid the fed has signaled that they are ok with the economy running hot (i.e at or above the 2% target) for a while before they start tightening. Loose monetary policy has typically led to higher asset prices. The longer the accommodative time-frame, presumably longer the bull market.

What’s the bear case? Nothing in life is risk-free. What are the risks to this market?

Inflation comes back stronger and violently

Since the Volcker fed in the early 80’s, we have witnessed a secular decline in interest rates and inflation. An entire generation (including myself) has never seen inflation over 2%. We do not know how to manage portfolios, manage capital allocation, and live life in a higher inflation environment. How will the housing market react to mortgage rates being north of 6% (current 30 year fixed is hovering ~2.5-3%)? As we expect spending and GDP growth to hockey stick upwards, what’s to say that the same doesn’t happen with inflation? Current market pricing for 10 Yr TIPS breakeven doesn’t seem to indicate this scenario, but if 2020 has taught us one thing, its expect the unexpected.

A different strain of Covid that doesn’t have a vaccine

This risk is a bit low in my opinion. The mRNA method for the current crop of COVID vaccine is akin to writing software. New software can be written quickly.

Market Mania

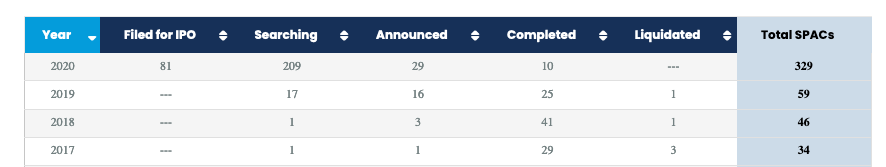

By any measure, the current stock market seems incredibly frothy. Everything is at all-time highs. To see signs of mania look no further than SPAC’s, the hottest thing in 2020. As of 2020, there are 329 spacs with a large portion of them still looking for targets. Everybody with a Twitter following or any name brand recognition is forming a SPAC. SPAC’s are the new memes of our generation. When Softbank raise’s a SPAC, it’s time to exit the market? ?

Retail trading has also come back a big way. The rise of free trading and pandemic-induced forced shutdown has driven a lot of retail participation. People were at home with nothing to do so let’s gamble on the stock market. The bull market starting in March 2020 has added to the allure of trading. Trading is now a meme!

True black swan

The unknown unknown is the one that kills you. Nobody had a global pandemic as the risk going into 2020. We truly do not know the black swan risk of 2021. Black swans by definition are un-quantifiable.

How to position?

I’m a reluctant bull in 2021. For my portfolio, I am extremely scared of these valuations and can’t stomach investing at these levels with post-tax money. My strategy in 2021 is to continue contributing pre-tax into retirement accounts as I benefit from the long time horizon and tax efficiency. In my taxable investment account, I’m expressing my view by being short gamma (i.e selling put options). I’d rather be a premium collector on the stocks that I am willing to own at a discount. If the market keeps going up, I get good cash on cash returns (puts expire and I get to keep the premium). If the market falls and I get assigned, I own the underlying that I was willing to own for the long term at a lower cost basis. I can also turn around and sell covered calls to further enhance my return (aka the wheel options strategy).

Wishing everybody a great 2021, may you compound your gains!

<std disclaimer : None of this is financial advice, please consult a professional>

test comment