I’ve been deeply interested in understanding what actually makes a platform business a platform¹ business ?— are there any patterns? How do platform businesses actually win? Is there something unique about them or is it all just branding? This is a particularly insightful question to ponder on as, if you talk to any company today , you are certain to hear “ we are a platform”:). Everybody wants to be a platform or at least positions themselves as one. How does one separate the wheat from the chaff?

As I commenced my research, I got incredibly lucky and came across this book Platform Revolution: How Networked Markets Are Transforming the Economy — and How to Make Them Work for You, which I highly recommend reading, cover to cover. It provides a fantastic framework to analyze platform businesses. In this next series of posts lets explore together the answer to this question — are the current FinTech models really platform businesses?

In the author’s opinion platform business win by:

- Eliminating gatekeepers: True platform businesses succeed over the incumbent businesses by either completely eliminating them or by changing the dynamic between customers and suppliers in innovative ways (by using technology to reduce friction). For example Uber eliminated the Taxi Authority (you don’t need taxi medallions to ferry riders), Amazon eliminated the mail order catalog and Google made the curated directory of Yahoo redundant (we have everything you want, just search for it).

- Creating value by unlocking supply: This is a core construct. Value is created by unlocking scarce supply and bringing it to market. Uber created value by unlocking the supply of cars (drivers) that were available for the demand side (riders) to go from point A to point B. Airbnb created value by unlocking the supply of rooms by allowing owners (homeowners) to share their rooms with the customers on the demand side (renters). Neither Uber nor Airbnb own the actual underlying assets. However, they have created a platform where these encumbered and under utilized assets (cars and homes) can be shared and in effect unlocked.

- Data based feedback loops: Platforms are in the business of enabling feedback loops. Data is the core component that drives the loop. Amazon reviews on products drives more customers to buy more products. Feedback from viewers on Youtube enables content creators to tailor their content -> they produce better content -> content thus generated gets better reviews -> resulting in more viewers and content creators.

- Inverting the firm: The internal organization mirrors the kinds of users it supports in platform companies. The user is the most important constituent rather than its internal processes. In contrast to pipeline companies that arose post the industrial revolution, almost all of today’s business with significant digital products and distribution are already structured this way. The rise of product management as a discipline is clear evidence that companies are internally fully aligned with their customer at the core.

Using this framework, do the current FinTech companies have a shot at being platform businesses?

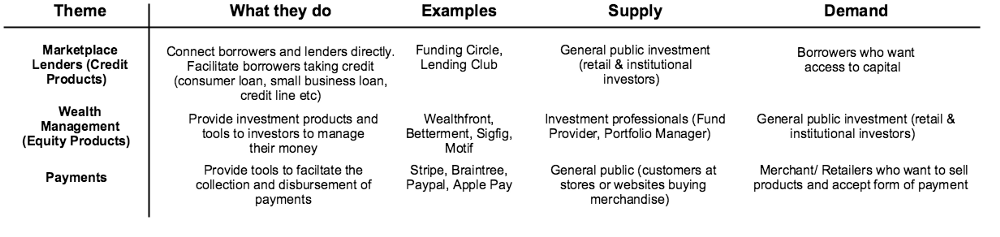

I’ve simplified the FinTech landscape to three themes to aid the analysis:

Lets tackle each of these in turn, how do they stack up with this framework?

Marketplace lenders

Eliminate Gatekeepers

Banks are the traditional gatekeepers in the online lending space and have traditionally intermediated between depositors (the general public) and borrowers. It is a closed ecosystem where the benefits of the lending interest spread accrue to the bank rather than to the depositor or the borrower. The traditional bank model does not allow a direct connection or interaction between the borrower and the investor Marketplace lending removes these gatekeepers and connects the investor directly to the borrower. All the benefits of the interest spread accrue directly to the investor and the benefits of the risk preferences of the investor accrue directly to the borrower (lower risk = lower rates).

Unlocking supply

The traditional banking industry has ‘artificial’ barriers to entry such as regulatory and investment size limits, making it impossible for investors to directly extend credit to borrowers. Marketplace lending enables various types of investors to directly invest and thereby extend credit by creating a regulatory complaint structure along with the associated technology, in essence unlocking the supply of money.

Data based tools

This is where marketplace lending and any digital business shines. As described in this post, better data powers better underwriting which in turn provides better rates for both borrowers and lenders. This leads to more lenders and borrowers on the platform which leads to more data and the flywheel effect kicks in to enable scale.

Thus, marketplace lenders have a good shot at being a true platform business.

Wealth Management (Robo Advisors)

Eliminate Gatekeepers

This is a hard one with robo-advisors. The incumbents such as Fidelity, Schwab, Vanguard etc. are not really gatekeepers that exclude the general investing public. All retail investors have access to the same equity products via each of these companies. The robo-advisors, using technology, bring certain benefits that have existed for sophisticated investors (such as automated tax harvesting) over to the regular retail investors. However, it would be a stretch to say that they have eliminated the gatekeeper.

Motif is the interesting one in the bunch. The ‘create your motif’ is similar to ‘roll your own’ ETF and is an interesting concept, The ability to create niche investment themes existed only for sophisticated investors and by bringing this feature to regular retail, Motif has eliminated that particular gatekeeper. Its a stretch, but a plausible stretch.

Unlocking supply

Unfortunately I don’t see any of the new FinTech companies unlocking supply. Most or all of these companies use the underlying investment products provided by the big providers (vanguard/fidelity). Previously unused supply has not been unleashed because of these companies and their products.

Data based tools

Some feedback loops are possible through the gathering and use of data. Data about what investment products investors like and choose to invest in can be shared with portfolio managers who in turn can fine tune their products to what investors want. This will result in more investors and the cycle reinforces itself. I don’t believe there is as strong feedback loop with data at its core like it is in marketplace lending. I am a strong maybe on this one

Wealth management businesses do not have a shot at being a true platform .

Payments

Eliminate Gatekeepers

Payments is an interesting beast. The main components “rails” of the payment network in the US are ACH, Wire and the card networks (visa, master card, amex, discover). These are single mode networks and as a result consumers have to hold individual products that work with each of these rails (banks for ACH/Wire and the relevant cards for each of the card networks). There is no incentive for one rail to support the other rail as it will cannibalize their growth. Thus these rails are the ultimate gatekeepers from the consumers perspective. Most of the innovation in the payments space is happening one level up the stack. Payment companies such as Stripe and Braintree abstract away the payment rails to the end consumer. Merchants can now, with one interaction point, accept payments from multiple “rails” and consumers are given the choice to use whichever “rail” is convenient to them. Payment companies such as Stripe and Braintree are in effect not eliminating gatekeepers but by abstracting them from the end consumer, they are “hiding” them. You can argue that this similar to elimination — if you can’t see it, its eliminated ?

Paypal is different. The pure Paypal product (pay with Paypal account) has eliminated the card networks. It uses ACH as the “rails” and a pooled bank account to perform transfers. Bitcoin is the payment technology that truly eliminates the gatekeepers, however that is a whole different post!

Unlocking supply

Payment companies unlock supply in an indirect way. More payment methods supported -> Merchants accept more forms of payments -> Ease of use for consumers -> More consumers/ more purchases. Indirectly more consumers are added to the market and thus unlocking supply.

Data based tools

The biggest feedback loop in payment companies is with the use of transaction data to fight fraud. Fraud is the biggest source of leakage in payments businesses. The more data that flows through the system, the better the fraud prevention algorithms will be. This will result in more merchants which will result in more consumers and the cycle reinforces itself.

Payment businesses have a shot at being true platform business.

What do you think? Engage in the comments!

¹ What exactly constitutes a platform is very nuanced, marketplaces are inherently platforms however not all platforms are marketplaces. Would love to hear thoughts in the comments on how to nicely bucket platforms into various categories.

If this article resonated with you Please tap or click “??” to help to promote this piece to others. Thanks!