Product engagement is a hot topic. As a product person, you are always looking for the quantifiable metrics that indicate that your product is solving your user’s problem and that you are on your way to product market fit.

The conventional metrics for product market fit usually sound like the below with the trend line going up and to the right

- User engagement measured by DAU MAU

- Time spent on your product (Session time)

- Core loop (# of times your core customer value transaction is executed)

An area which I’m deeply interested in is – do these same metrics hold true when we are dealing with anything related with money? Our relationship with money is very complicated. In silicon valley we see everything as a technology problem, is that true with money? is the success of digital products that deal with money more of a behavioral finance problem than a technology problem?

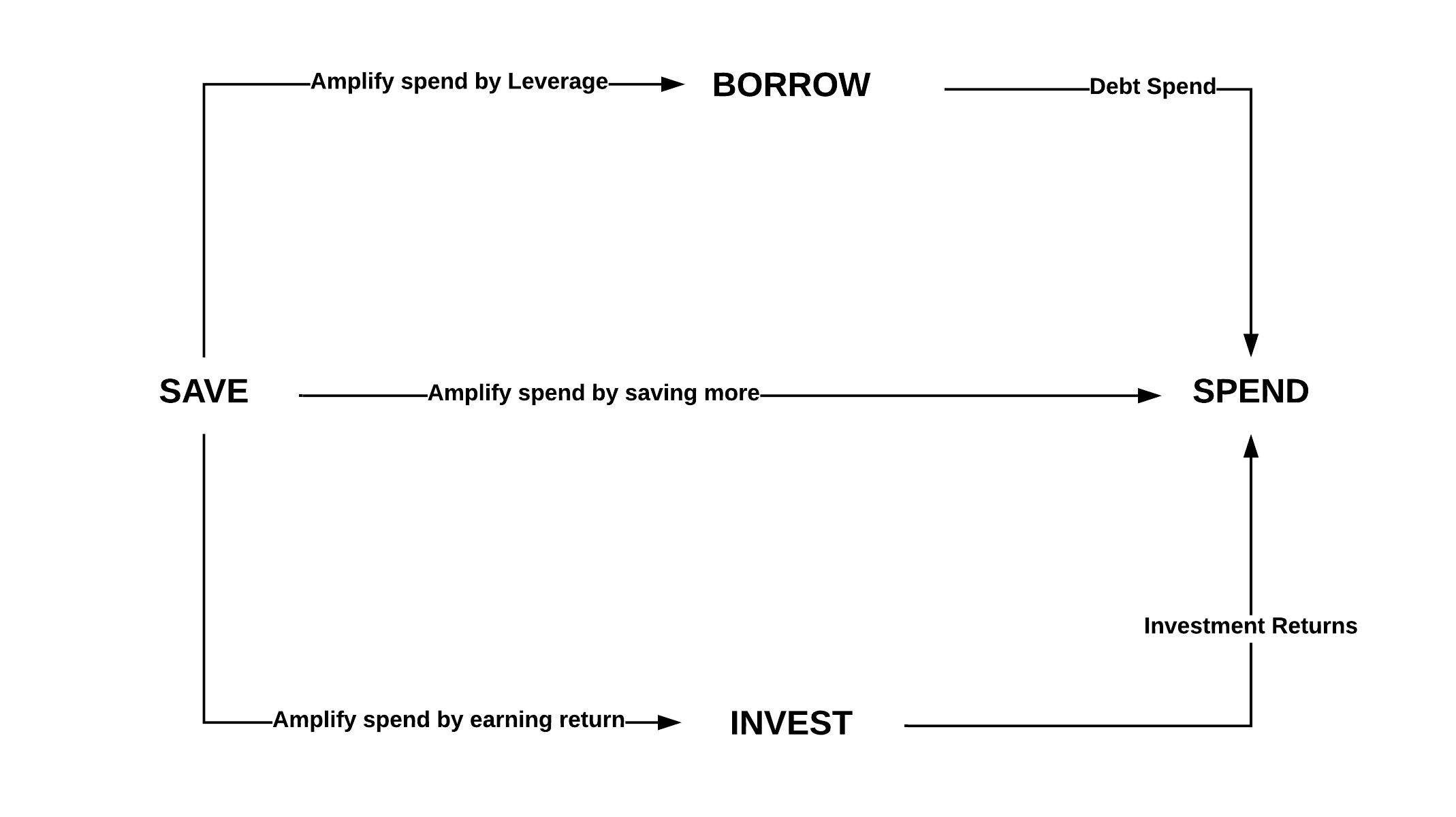

My simplistic framework “aka personal money lifecycle” goes something like this.

Its really about spending in the long run. The first step of the cycle is that we need to save to finance future spending. There is a whole class of products that encourage you to amplify this future spending directly by improving your savings behavior. Savings accounts, automatic savings applications such as acorn are examples of products in this category. You can amplify your future spending capability by either borrowing or investing. All lending products fall in the borrow category (mortgages, personal loans for example) and all investing products fall the invest category. Products in the spend category are too many to list, its pretty much everything in our capitalist economic system 🙂

Let’s explore just one piece of it – the investment side of things. First a detour into behavioral finance. Conventional economics is based on the base assumption that humans beings are rational creatures and behavioral economics takes the view that human beings are predictably irrational. Two concepts I’d like to highlight.

Prospect theory: aka losses hurt more than gains give pleasure. What that means in practice is that we tend to feel very bad when we lose money and don’t feel that great if we gain an equivalent amount of money i.e the emotional response to the same amount of gain or loss is non-linear. Losses hurt a lot. We all vividly remember that one investment that we lost money on. How this plays out in the investment landscape is that as markets fluctuate, since we tend to be really fearful of losses – as it hurts more- we sell our investments – at exactly the wrong time. We follow the buy high and sell low philosophy! i.e we make the wrong and irrational decision.

Decision fatigue: aka the more decisions we have to make the worse our quality of decisions. The central concept in decision making is that we have a limited and finite cognitive capacity to make decisions. The more decisions we need to make the less good decisions we make as we are exhausting our cognitive capacity pretty quickly.

An in ideal investment product needs to counter these behaviors and protect you the user! With that context – what should an ideal investment product look like for an individual investor? In my opinion, four broad areas need to be thought through

- Identification of goals and risk tolerance

- It always starts here. What are your goals as an investor? What liabilities in the future (retirement, kids education, healthcare) do you need to fund and what time? How risk averse or risk seeking are you? A great digital experience has to address this.

- Frictionless

- This is pretty straightforward UX 101. Focus on making the process of adding cash to your account really easy. Combat decision fatigue by automating the process for the user and narrow it down to just one decision experience. How much do you want to initially invest? what should it be invested in? and on what recurring schedule? – Just set it up once!

- Dissuade trading

- Dissuade trading as much as possible – this is to protect users from buying high and selling low! Avoid the mistakes predicted by prospect theory

- Provide safety cues

- You want to know that your money is safe. You want to know that this is not some fly by night operator/Ponzi scheme that is going to run away with your life savings.

- DAU/MAU

- Ideally, DAU shouldn’t matter. If you’ve automated everything and dissuaded trading – the user should have no need to check his portfolio every day! MAU’s are worthwhile to track on a cohort basis – you’d like your users to at-least check in once a month to execute on the safety cues. Is my money safe – log in and check.

- Session time

- If we did everything right. Session time should be minimal. Login check, everything is ok, get out. There is no need to engage with your product for long periods of time in a single session.

- Core loop

- What is the core loop in an investment product? I’d argue that the core loop is the automation of the cash “transfer in” process and deployment of that cash into investments. If we did this right – the core loop is used only once!

The customer is best served by engaging with your product very infrequently!

One Comment