In the last post, I highlighted that SMB’s are mostly a long tail business with a majority of the market at the smaller end of the spectrum. An insight that I did not appreciate going into this market is the amount of sensitivity to price. The statement that “There are three things that are most important in SMB, price, price and price” is 100% true! With most small businesses being small and not really in it to grow this price sensitivity makes a ton of sense. So if you are a startup in this space you come across an interesting squeeze.

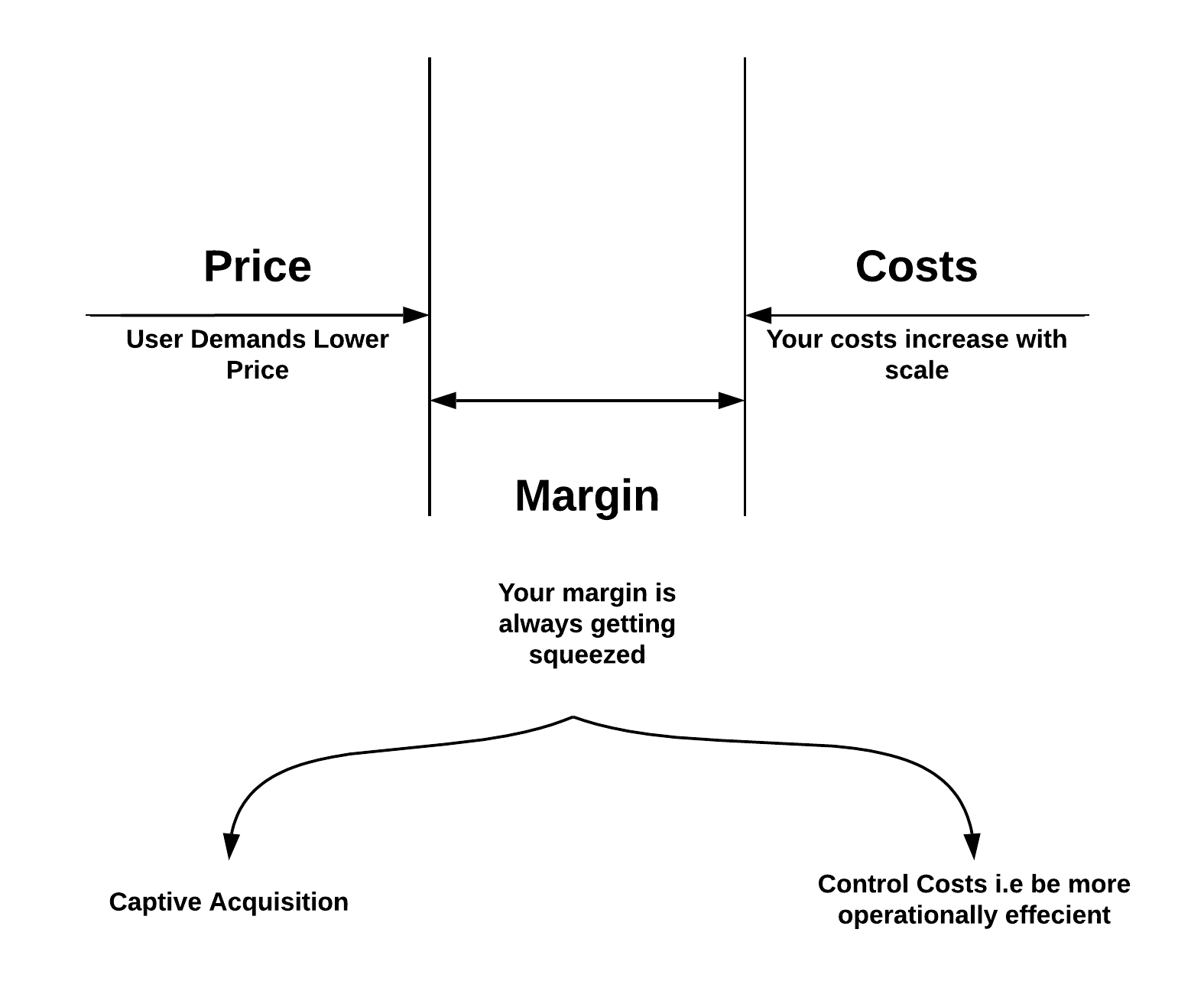

As you start scaling, on one end your customers being super sensitive to price need prices to go lower and on the other end as you scale your costs are going up (headcount/facilities, etc). Your margins are on the road to squeezedom.To get out of this situation you have to focus on two (obvious) areas – getting your costs in line (focus on efficiency) and how to scale distribution. A sidebar on the two models

Monoline model: This is your classic fintech 1.0 business. Bringing lending online to the internet is a classic monoline business. Offering stock trading is also a monoline business. You are directly competing with an incumbent (banks in most cases) on a specific feature/value proposition. Your value proposition is internetify’ing it with better product experience. In this model, your biggest cost drivers are the cost of acquisition as you are directly trying to capture your competitors/incumbents customers.

Captive model: In this model financial products are just an added feature that facilitates your core business. For example, Amazon’s core business is to provide customers with the widest selection possible and suppliers with the capability to service that demand by automating all the parts of the fulfillment chain. Once they have a captive customer base for their core product it is relatively easy for them to provide financial services to them. A captive user base makes the distribution simpler. Amazon offers short term financing to its customer and supplier base, Square provides its customers with financing via square capital and so does PayPal. This model is not new, every conglomerate has executed to this playbook in the past, remember GE capital?

I’m in the camp that the captive model is far far superior to the monoline model. As most financial products are considered and large ticket purchases, I’m not convinced that product experience alone will convince customers to pay a premium. With customers’ expectations of continuously reduced prices and the absence of any real network effects, direct acquisition is just going to get harder and more expensive. This puts monolines at a great disadvantage. Captive models are the winning strategy here as they have huge distribution advantages.

The other insight I have gleaned is that startups are all about growth but that gets conflated with growth in headcount. You want to grow your business metrics but have to be super careful about headcount costs. If your customers are SMB’s, efficiency is the other big lever that you have to succeed. You have no choice but to focus on automation. You have to build software whose primary aim is to have machines do most of the work so that you can keep your internal costs low. End to end automation is where the efficiency lies, this is what is going to give you the financial cushion to grow and succeed.