A16z’s Angela Strange has a very correct take on where financial services are heading. In the future, every company will need to offer financial services in order to compete. Complete vertical integration from click to purchase reduces the most friction for the user, which leads to the best customer experience which leads to a competitive edge. For companies, this is a source of extra high margin that can offset their low margin core business. It also makes the users more sticky – why go anywhere else? I recommend watching the entire presentation in full, very spot on where fintech is headed!

Another way to think about this is the natural evolution of software companies is to end up as the conglomerates of the digital age. So it is inevitable that they will offer financial services. It’s bundling all over again.

One particular statement made my ears perk up,

In the future every company will be a financial services company and will get a significant portion of their revenue from financial services

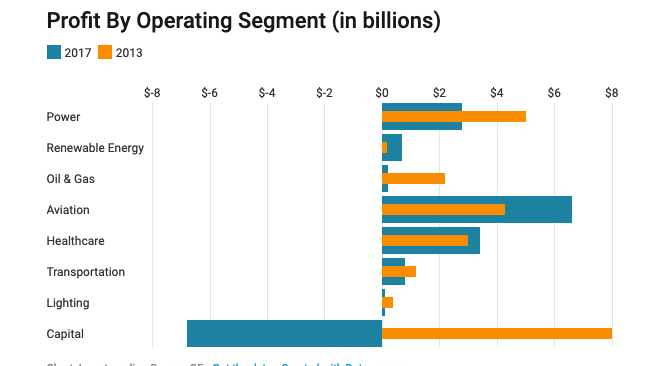

Why did it grab my attention? Let’s take a walk through memory lane. There was a big company in the ’80s that was an industrial behemoth, an exemplary of what it means to be a conglomerate. Similar playbook – let us add financial services as a layer – it will help our customers. It will keep em sticky and generate an extra margin for us. Fast forward a few years and the financial services unit is responsible for a majority of the profits at the company. The CEO took victory laps in all the usual places.

Then 2008 happened and it all came crashing down. The extra margin via financial services became a drug that fueled risk-taking which almost BK’ed the company. It was extremely negative to its core industrial business. If you haven’t guessed by now, this company was General Electric.

Why does this happen?

Booms and busts are part of our economic circle of life and a lot of busts can be traced back to the “search for yield”. Simply put, investors are looking for a return (yield) and will stretch their understanding and risk-taking ability in order to get greater and greater yield. I mean who wants less right? 🙂 This search for yield behavior leads to speculative mania and bad risk management that eventually causes busts. This cycle is as old as time, we humans can’t help ourselves – this boom-bust cycle is going to repeat. Substitute investors with managers and yield with return and its the same cycle.

With that as context, today’s situation with software companies seems very similar. The core business is at scale but at a low margin and we need to expand margins. Adding financial services is an obvious answer! To wit Angela’s thesis. Can today’s software company CEO’s learn from history and not repeat the same mistakes? Is risk management something they that think about day in and day out?

History never repeats itself but it sure rhymes. Software CEO’s will need to start reading up on the history of finance, they are going to need it!

One Comment