I’ve often talked about 10K’s as being the perfect way to get up to speed in a new industry. Once a month a few of us PMs get together and do a deep dive on a particular company via its 10k. We call it our “10K a month” club :). Drop me a note if you want to be added to the group, the more diverse viewpoints the better the learnings! Last month we researched and chatted about Zillow. Highlights from our conversation follow.

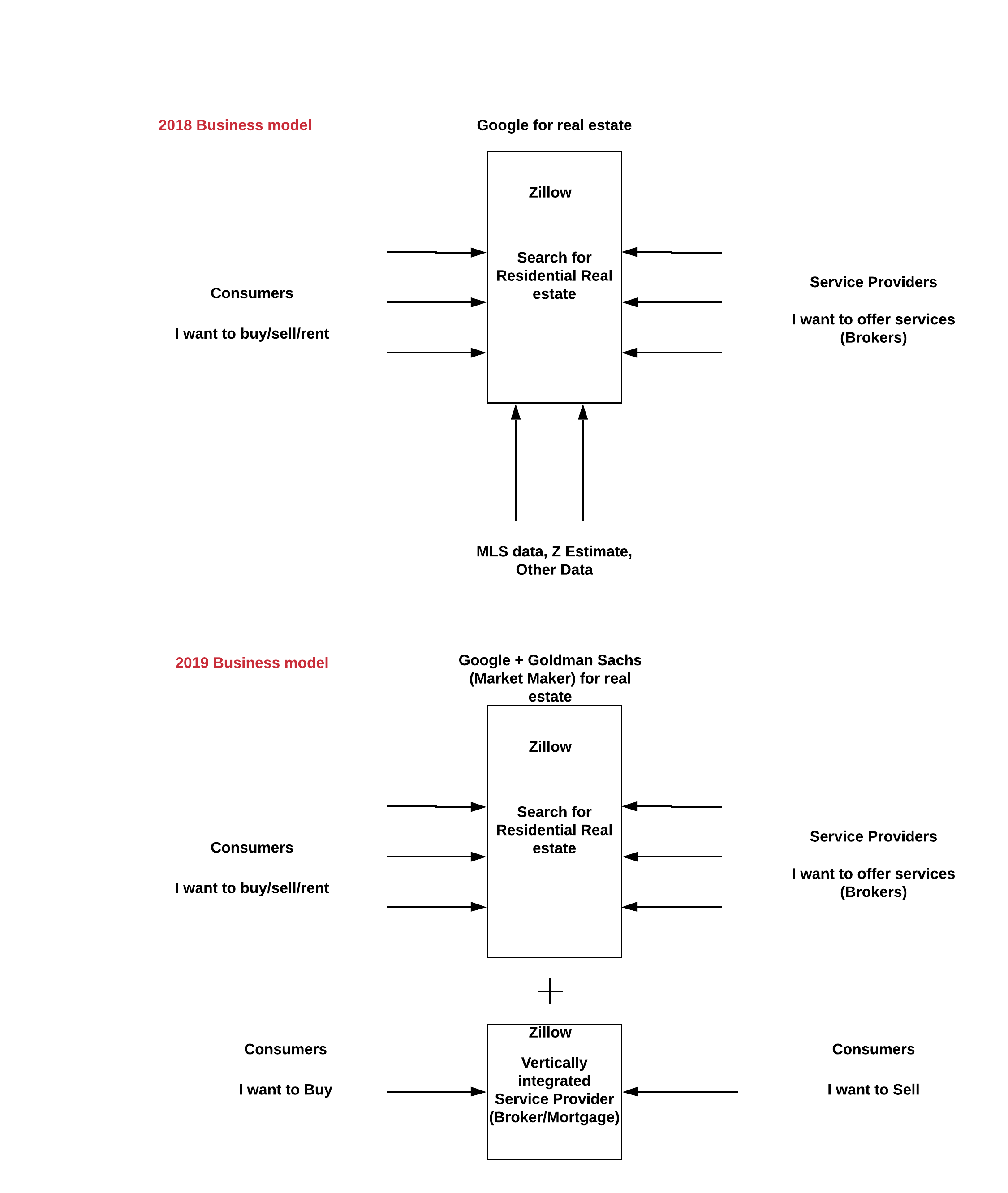

Zillow’s Business Model

Zillow capitalized on two behavioral insights, voyeurism and confirmation bias. Real estate is the biggest asset on consumer’s balance sheets and everybody loves to check on how it is doing. Using MLS transaction data and other data points, it consolidated all that data into a single estimate of the price, the Z-estimate and provided a near-realtime mark to market for residential real estate. Consumers love this price watching as at some point they want to own a house or upgrade to a new house (voyeurism) and those who own houses like to look at their prices rising (confirmation bias) :). Zillow aggregated user demand on the consumer side by offering the Zestimate for free and then sold that demand to real estate agents and brokerage houses, i.e a lead generation based monetization model. Since its founding, this has been the primary business model – a classic internet business. Remove the information asymmetry and connect buyers and sellers of residential real estate.

Last year Zillow ventured deeper into the real estate ecosystem and launched its I-buying product. In addition to connecting buyers and sellers, Zillow wants to be a vertically integrated solution for residential real estate. Zillow buys homes directly from consumers and sells them directly to buyers. It takes an inventory position in the real estate transaction i.e. function as a market maker in the residential real estate market. They also bought a mortgage originator to facilitate this shift in their business model.

I can understand the strategic reasoning behind this shift,

- Selling a house is greatly simplified. Zillow has the data, instantly offers me a cash offer and I don’t have the hassle of open houses, real estate agents, etc – it’s super quick

- Buying a house is greatly simplified. Zillow branded homes have passed some quality checks, so I don’t have to worry about getting surprised about repairs on the house. I can get a mortgage and insurance etc from Zillow – all in one place and one transaction.

- Zillow captures a lot of the economics in the real estate transaction and can cross-sell a lot more adjacent products such as insurance, mortgages and future renovations. This increases customer LTV significantly.

A brief tour of the financials

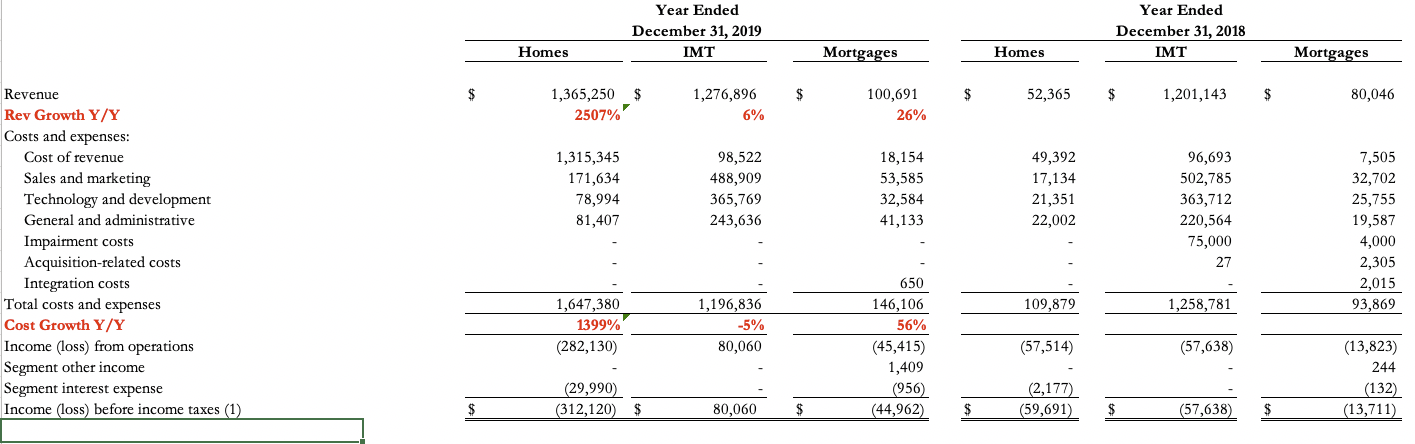

Zillow splits its reporting into three segments: the Homes segment, the Internet, Media & Technology (“IMT”) segment and the Mortgages segment. Homes represent the market-making business, IMT represents the lead gen business and mortgages is self-explanatory.

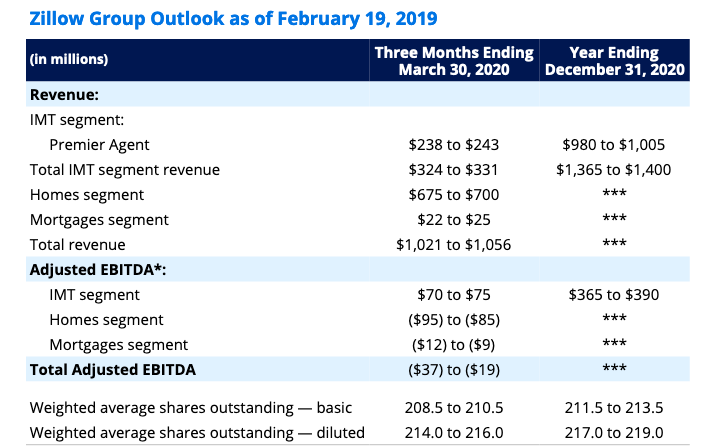

Headline revenue growth in 2019 was strong and driven primarily by the homes segment. While this is spun extremely positively by management, we should take it with a grain of salt as home revenue also comes with higher costs. The large magnitude of the increase in revenue is because you are moving large inventory items (homes) which also have a higher cost of revenue. Out of the three segments, only IMT generated positive cashflow – primarily due to some revenue growth and cutting marketing costs.

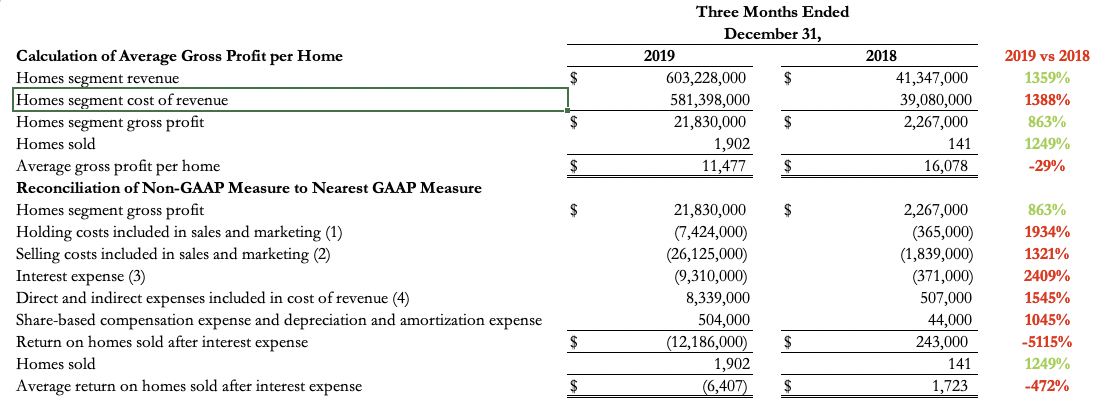

Digging a bit deeper into the homes segment, Zillow is scaling up its efforts but isn’t accruing the benefits of this scale just yet. In 4Q 2019 they sold a lot more homes but costs scaled much faster than revenue. Surprisingly the average net profit per house decreased as the number of houses sold increased.

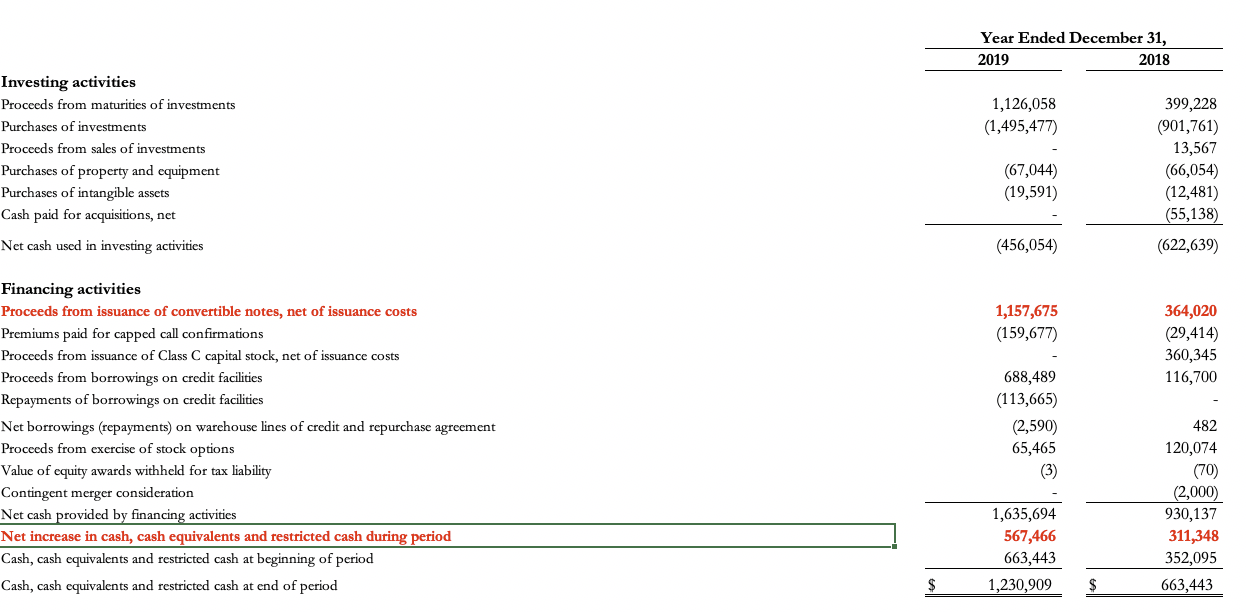

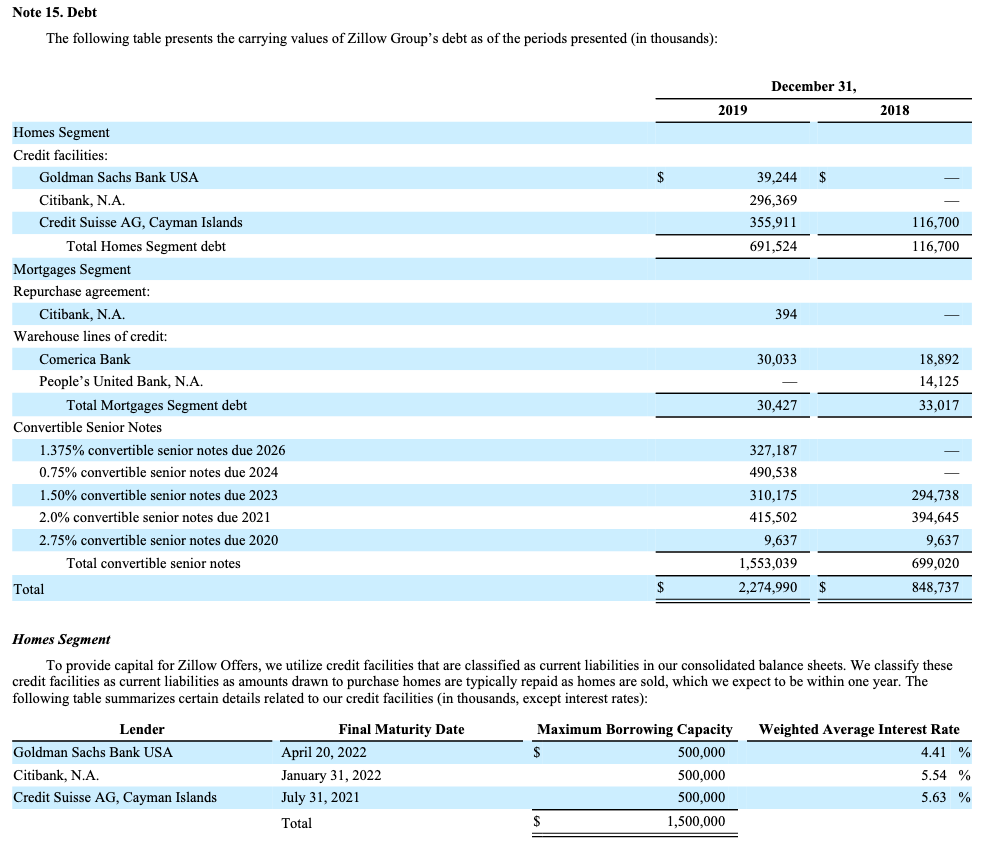

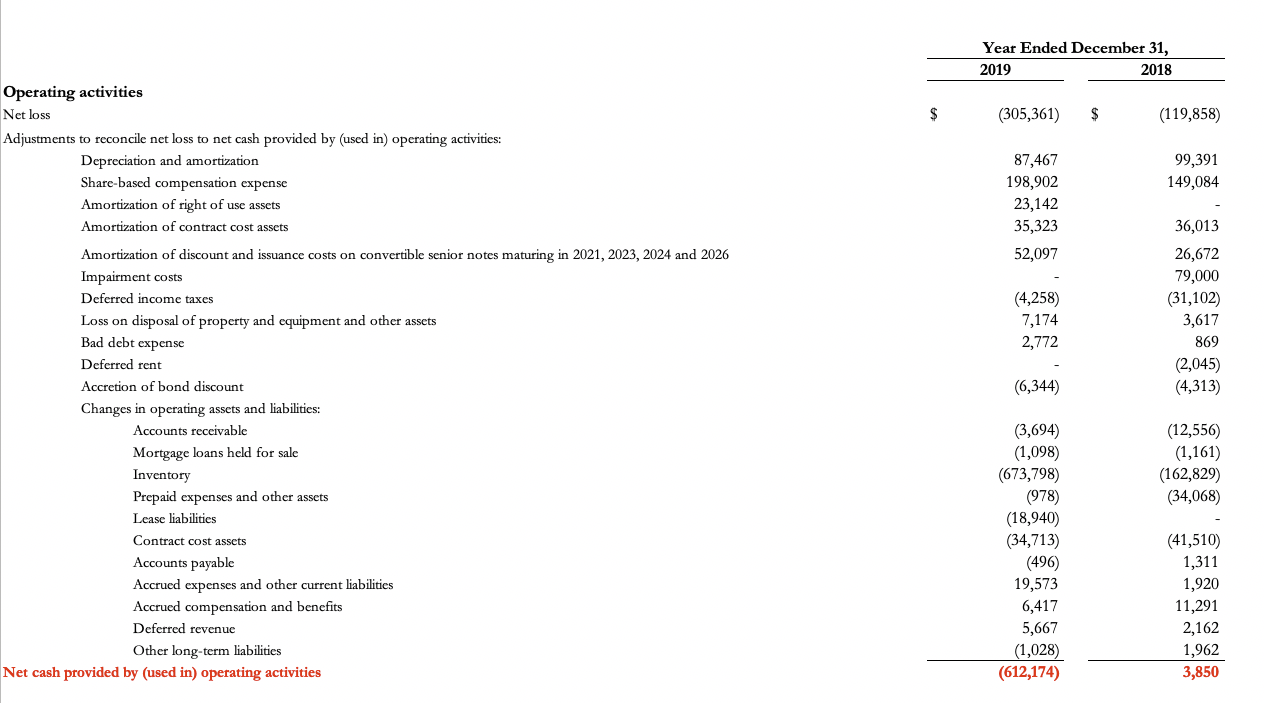

This scaling in the homes business is reflected in the cash flows for 2019. 2019 was an investment year and cash flow from operations was deeply negative (~-$612M) vs a positive cash flow of $3.8M in 2018. Buying and selling homes requires capital and that is reflected in the financing section, Zillow has raised a ton of convertible debt (~ $1.5B) as well as lined up additional credit lines (~1.5B) with the banks. Detailed cash flow statements and debt schedules are at the end of this post.

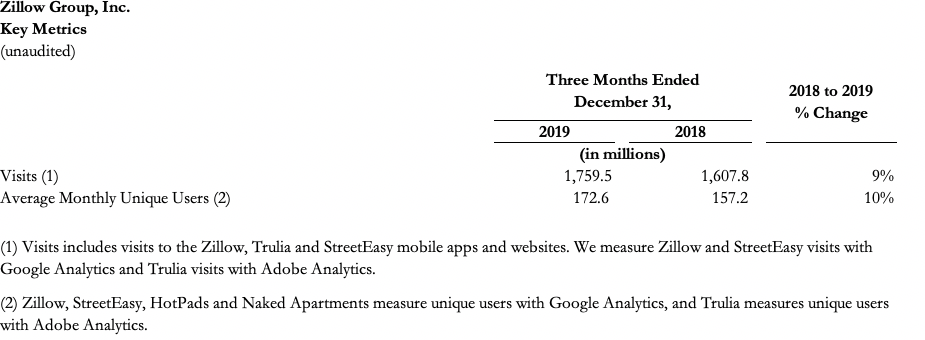

The key leading metric to watch is the number of consumers (proxied via website traffic) that are coming to Zillow. If consumers don’t show up, there is no demand and there is no business. Traffic is still growing year over year in the low single digits.

Competitive moat

Zillow’s competitive moat started out with the innovative use of data. By aggregating disparate real estate data and creating new data points like the Z-estimate, Zillow has managed to get scale and build a brand that is top of mind for consumers in the residential real estate vertical. With scale, it has built great partnerships with service providers such as brokers that only added to its competitive advantage. With the homes business model shift, it is seeking to capitalize on the brand further and completely own the entire real estate transaction further cementing its position as the #1 consumer destination for residential real estate.

Competitors

Its primary competitors in the US are Redfin and startups like Opendoor. As part of this exercise, I didn’t delve deeper into the competitors, a topic left for a future post.

Closing thoughts

Zillow is going through an interesting business model shift the outcome of which is very uncertain. From a strategic perspective, it makes complete sense – own the complete transaction. You have a captive market you can cross-sell a lot of products to this base. However, the economics of market-making is tricky. The cost of capital becomes a crucial issue and so do economic conditions. The general idea in market-making is that when conditions become strained, spreads widen. However, with illiquid assets such as homes, there is a danger that the spread is too wide or liquidity just evaporates. In such a situation Zillow will be stuck with the inventory (homes) on its books for a while till conditions recover. The coronavirus crisis is a perfect example of this situation – and Zillow did announce that they have suspended the homes program until further notice.

Appendix