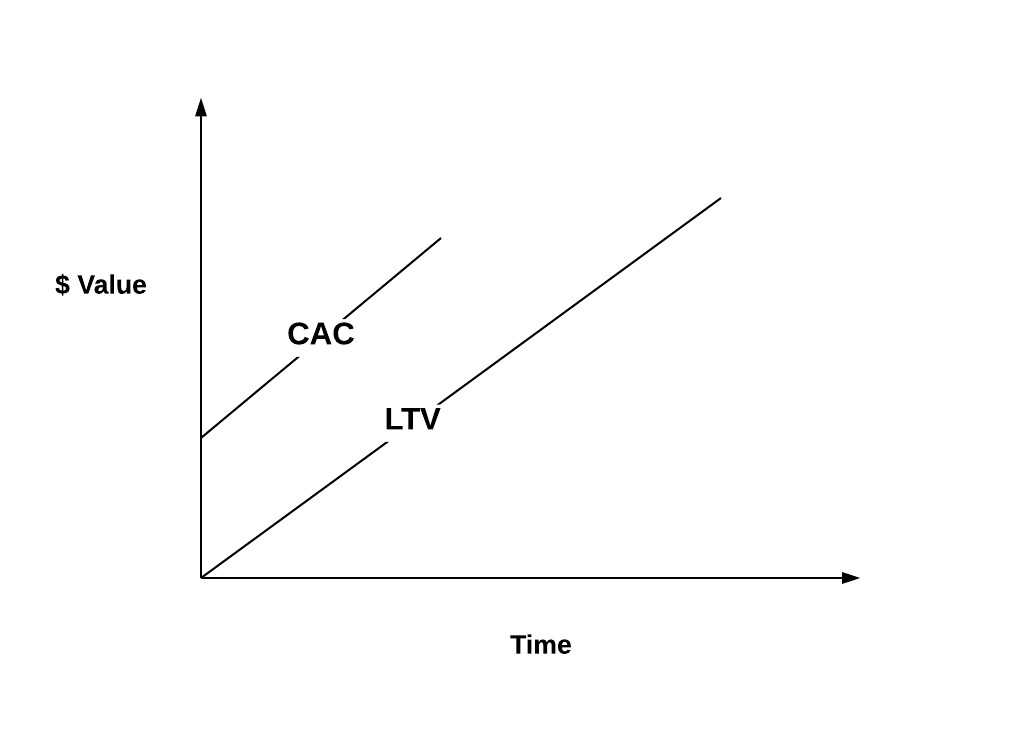

A question I wonder a lot about is, What is the long-run curve of a direct response paid marketing channel? The intuitive theory is that in the beginning, you expect your cost to be high relative to your LTV. The starting curve looks like the below

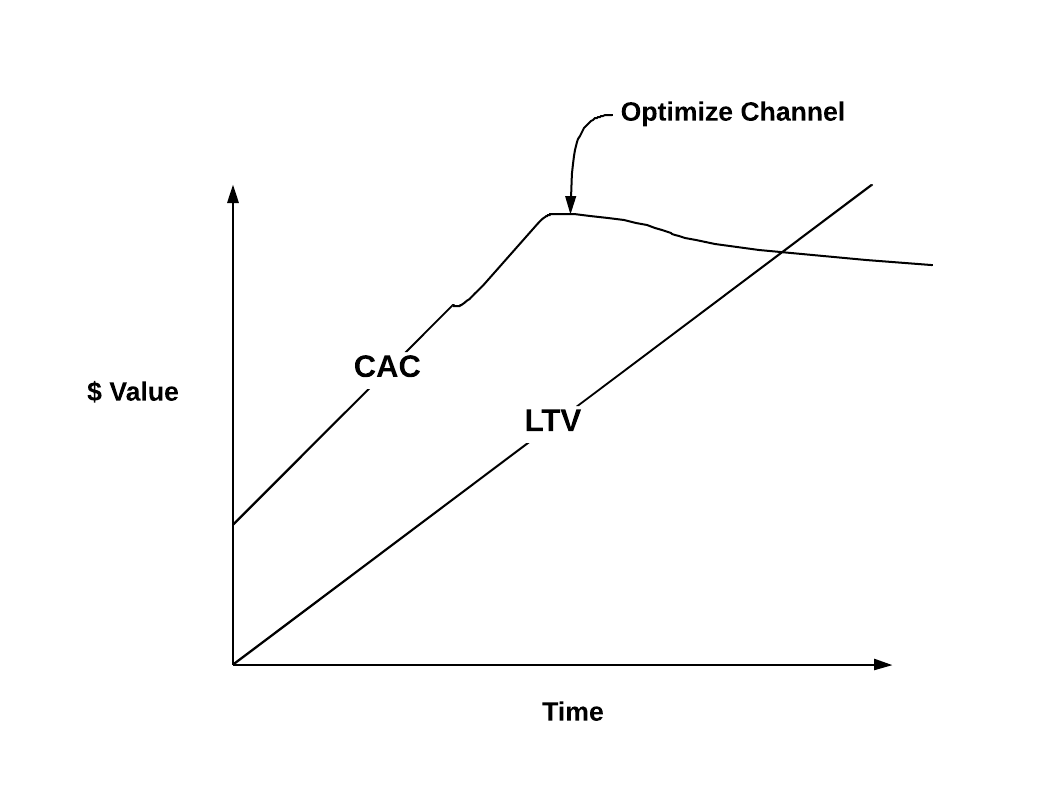

You gather some initial data and figure out what places you need to optimize. You start tightening the conversion funnel, you start experimenting with the creative (Ad formats and copy). You expect the curve to bend a bit. Still below LTV but getting to a place where you think you have a shot for CAC to be less than LTV. At some point in the future, you get super optimized and cross the LTV threshold and voila, success. You can now turn on the gas and start scaling that channel. You expect the curve to look like the below

You gather some initial data and figure out what places you need to optimize. You start tightening the conversion funnel, you start experimenting with the creative (Ad formats and copy). You expect the curve to bend a bit. Still below LTV but getting to a place where you think you have a shot for CAC to be less than LTV. At some point in the future, you get super optimized and cross the LTV threshold and voila, success. You can now turn on the gas and start scaling that channel. You expect the curve to look like the below

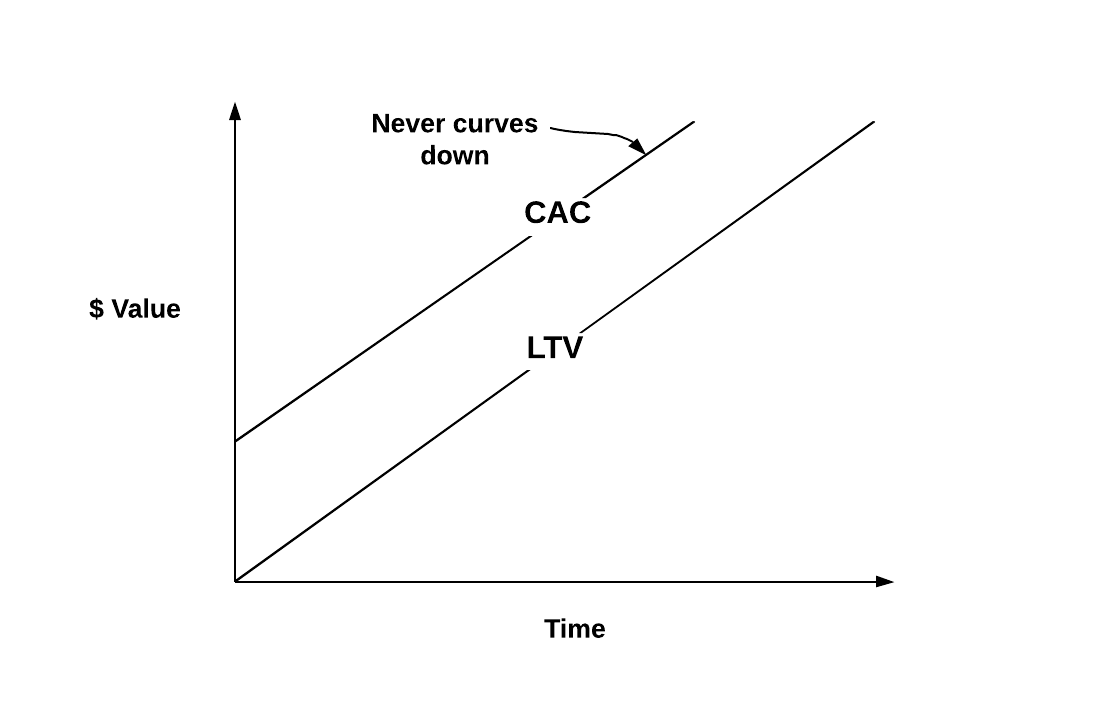

But what I suspect is that this cross over point is hard to get. i.e. in the long run a paid marketing channel never crosses that LTV curve. The curve, in reality, looks like the below

But what I suspect is that this cross over point is hard to get. i.e. in the long run a paid marketing channel never crosses that LTV curve. The curve, in reality, looks like the below

I hypothesize that the big paid marketing channels, in the long run, know how to price their products to perfection. Most of the big players follow the auction model for bidding for ads. Auctions are markets like financial markets. In this context, CAC can be thought of as the price of a stock. This price reflects in aggregate the market’s expectations. Remember price is always anchored to expectations, there is no magic algorithm that reflects true price in markets. Following this mental model, the price you pay for an ad (the bid) reflects the marketer’s view on the price they are willing to pay now, with the expectation that this gives them a future LTV.

I hypothesize that the big paid marketing channels, in the long run, know how to price their products to perfection. Most of the big players follow the auction model for bidding for ads. Auctions are markets like financial markets. In this context, CAC can be thought of as the price of a stock. This price reflects in aggregate the market’s expectations. Remember price is always anchored to expectations, there is no magic algorithm that reflects true price in markets. Following this mental model, the price you pay for an ad (the bid) reflects the marketer’s view on the price they are willing to pay now, with the expectation that this gives them a future LTV.

Marketers are human and all humans suffer from optimism bias, so the marketer will always project a higher LTV than what is finally realized. Thus, in aggregate the initial bid for an ad will always be overstated. In parallel, new companies enter the market all the time, so there are also new marketing programs being spun up. This also increases the probability that there is always an increasing bid for an ad as the new programs that spin up are also optimistic about their projections.

This bid is only one side of the market, what about the other side, the ask? The ad network can decide how many times to show the ad to the consumer and tightly controls the frequency to optimize for user engagement and experience. Nobody wants to be bombarded by ads. So the supply (ask) is controlled by the ad networks and supply is kept scarce relative to the demand.

Ever-increasing bids with limited supply provides a natural pressure for prices to always inch higher. Facebook and Google have figured this out, and that’s why they are great businesses! 🙂 As, the price inches higher, more $ for them without any increase in their fixed cost! So in the long run you never get to the optimization curve down for your CAC, it is a straight line to the right.

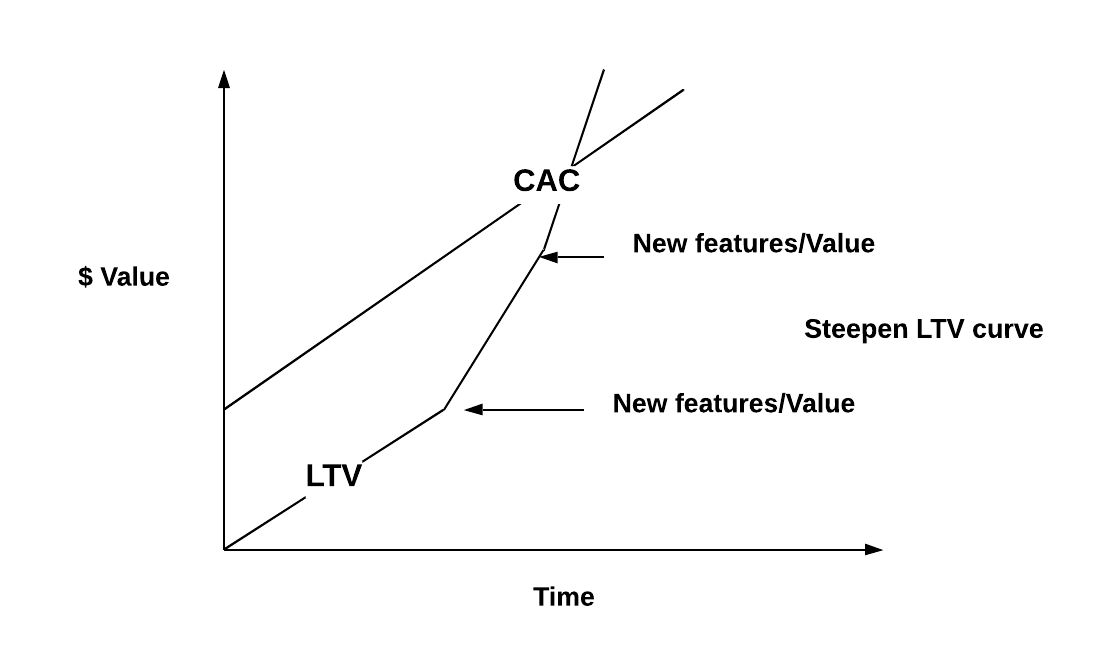

The only strategy then for this to work is to constantly tweak your product offering to increase LTV quicker than the increase in CAC. The value you provide to your customer is completely under your control. LTV is totally under your control.

In the end, it all comes back to the product. You have to continuously be providing more value to your customer. This is the only way to build a business.

In the end, it all comes back to the product. You have to continuously be providing more value to your customer. This is the only way to build a business.