Great post over at FT Alphaville today that talks about the crazy low yields in the corporate bond market. Since the GFC (Great Financial Crisis of 08) investors have been running scared and looking for safety in large numbers. This has caused corporate bond yields to hit new multi-year lows. Remember in Bond Math, when there is lots of demand, prices are high and consequently yields are low. The yeild is the interest rate that the company issuing the debt has to pay out. Lower the yield, better for the company.

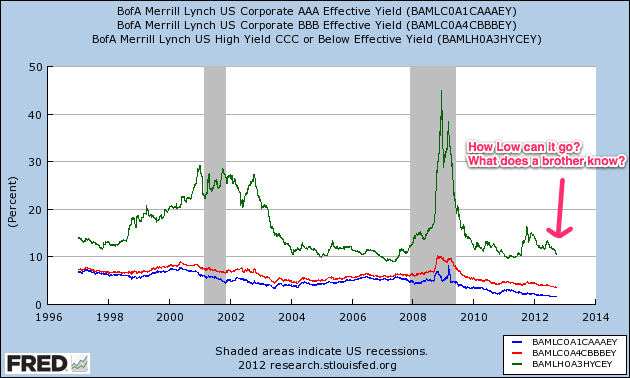

A quick chart from FRED (which is a FABULOUS resource BTW for data nerds) also confirms the multi-year lows.

At the same time there is also a hunger for relatively safe high yield (safer than stocks or other asset classes anyway). FT Alphaville said it best on what may happen next.

So for now, corporates’ ability to service their debt within their ratings category remains intact, and shouldn’t see much deterioration, as capital markets remain open. But the problem investors will soon face is how to generate good returns next year, not the 10% that we’ll see this year, but more like 5% or even 4%. And for that, investors will have to take on the higher beta names/sectors like T1, LT2, sub insurance, corporate hybrids and more peripheral corporates, which are currently the darlings of the market.

So as more people pour into bonds, yields keep going low, investors start chasing riskier and riskier bonds to get more yield. Demand for risky bonds starts rising, risky companies rush to take advantage and churn out more bonds.

Replace risky bonds with sub-prime. Sound familiar? What do you think?