Monetary musings goes listicle, buzzfeed style. My good friend Sidd Singh has a post on his blog on why he is long AAPL, which got me thinking, what does the 10Q say? I’m bearish by nature so there is a downward bias :), bear with me! Here are the 6 things that are interesting questions for investors from their latest 10K. By no means is this list comprehensive, just some observations based on a quick read.

Down the rabbit hole we go.

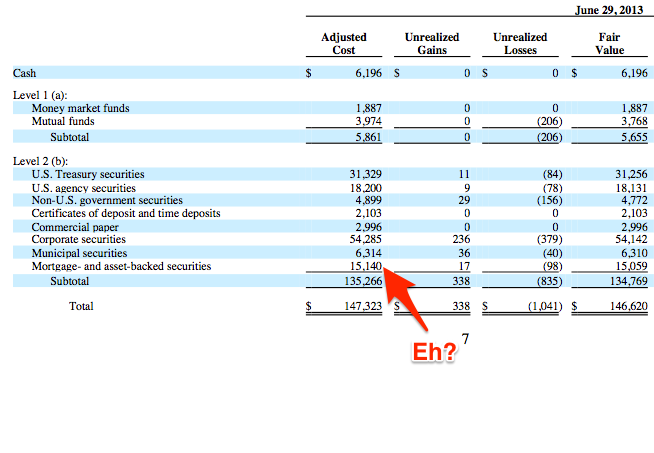

1] Is Apple a hedge fund?

$15B of MBS on balance sheet? Whoa, why would a tech company need to hold that much MBS? Liquid/Illiquid?, Benny stops buying MBS what happens?

$15B of MBS on balance sheet? Whoa, why would a tech company need to hold that much MBS? Liquid/Illiquid?, Benny stops buying MBS what happens?

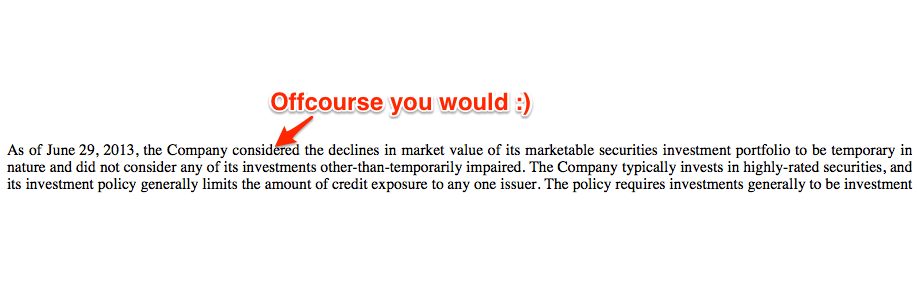

2] Marketable securities, mark-to-unicorn?

Off course you would say that its temporary 🙂 But wait, mark-to-market or mark-to-unicorn?

Off course you would say that its temporary 🙂 But wait, mark-to-market or mark-to-unicorn?

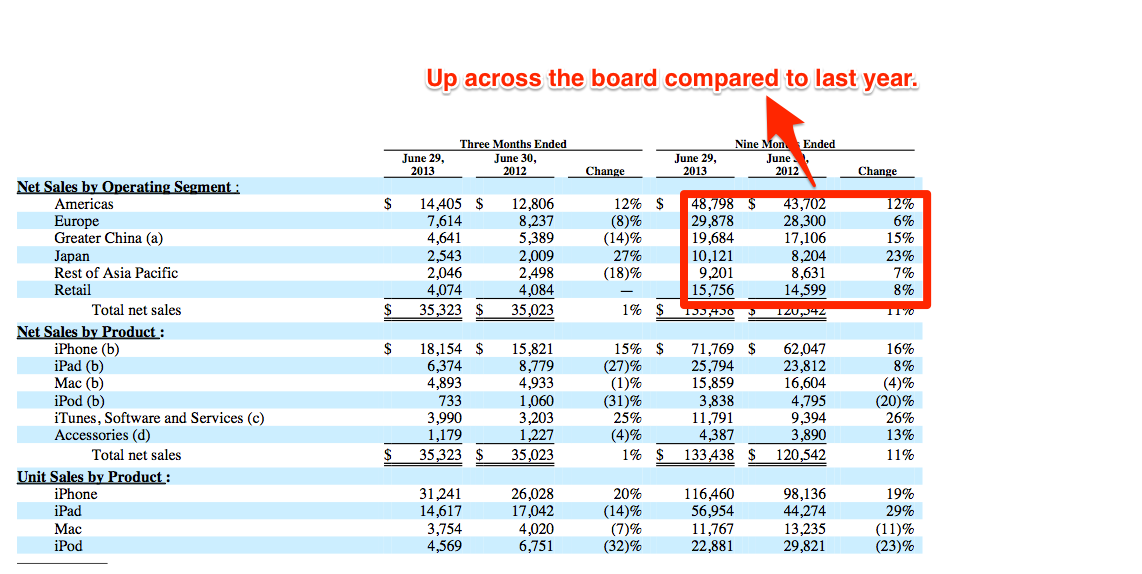

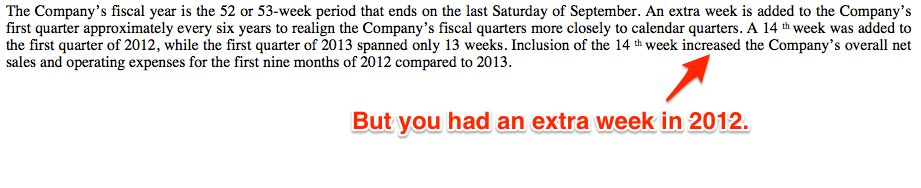

3] Do 9 month comparisons matter? (Read the fine print)

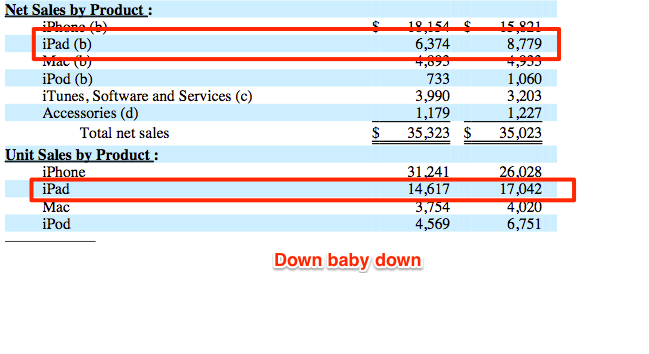

4] iPad Sales are down

4] iPad Sales are down

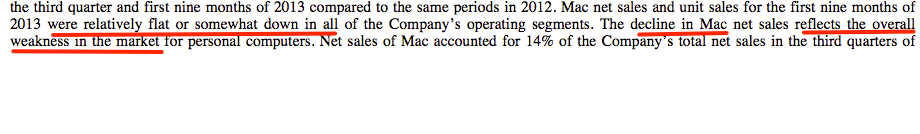

5] Mac Sales are down

5] Mac Sales are down

Behold the dip. Mac’s have good margins, is the death of personal computers finally hitting Apple too? Effectively is AAPL now a phone/tablet company? If you believe in Moore’s law, margins are only going to get squeezed in these product lines.

Behold the dip. Mac’s have good margins, is the death of personal computers finally hitting Apple too? Effectively is AAPL now a phone/tablet company? If you believe in Moore’s law, margins are only going to get squeezed in these product lines.

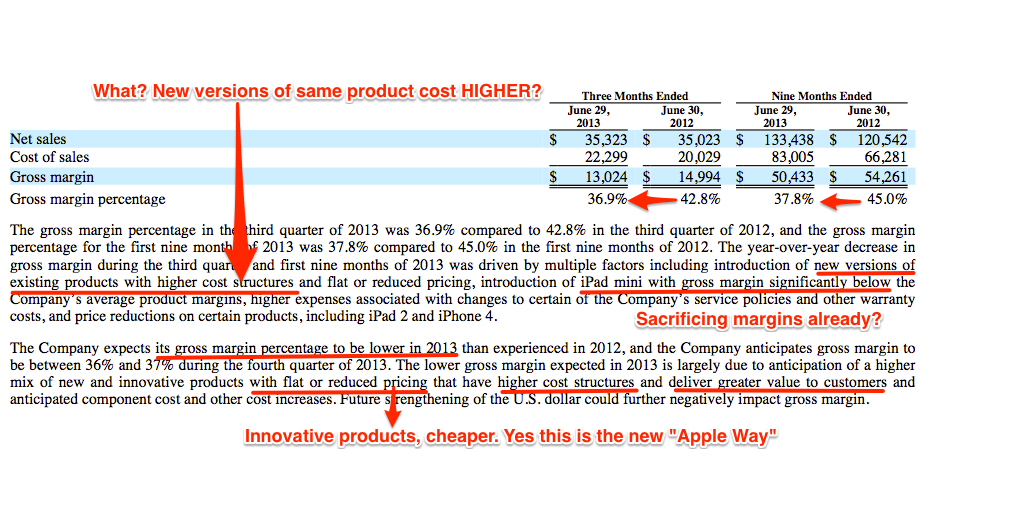

6] Margins are going down

I think Apple is still a good well run company and a phenomenal cash generating machine. Still a growth stock? Hmmm.

I think Apple is still a good well run company and a phenomenal cash generating machine. Still a growth stock? Hmmm.

Disclosure: No positions in AAPL at this time. No intention in opening positions for the foreseeable future 🙂