It’s been 10 years since the 2008 financial crisis. Astute observers will correct me and point out that the crisis actually started in early 2007 when the Bear Stearns High-Grade Structured Credit collapsed. This was the first collapse of a hedge fund that was loaded up to the gills with subprime CDO’s. If you were following FT Alphaville in late 2006/ early 2007, you’d be ahead of the game. The signs were there! Some great coverage to relive and re-read

So how does this relate to you, young product manager? Some obvious and simple lessons articulated below.

Bad things happen slowly and then very very rapidly

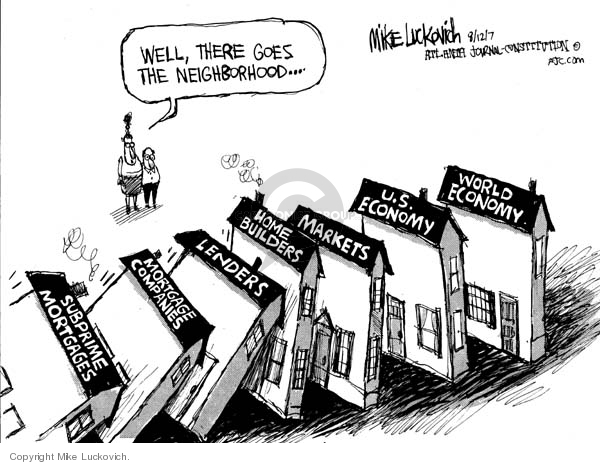

The crisis started slowly in July 2007 when the Bear Stearns hedge fund had to stop redemptions. The common narrative then was that this was an isolated incident, just a small blip, “its all contained, we will be fine”. As mid-2008 approached, things snowballed rapidly and the financial system as we know it was on the verge of collapse.

Be absolutely paranoid. Sweat the details and really dig in when something is not working. Ran a bunch of A/B tests that you thought should have worked but didn’t work? Don’t just move on – dig deeper and make sure that you have an understanding of why things are not working. Maybe your instrumentation is all jacked up, maybe your page load times are too long – users didn’t even see the B version. Find the kinks early before its too late.

It works until it doesn’t

Securitization, subprime, and leverage – all these concepts make sense in isolation. The three things together worked great 2000-2006 and made tremendous profits. But good things can get taken too far and then stop working.

Generally speaking, you will try some things based on a strategy, discard the things that did not work and double down on those that did. However, keep reminding yourself that everything will work till it doesn’t. For example, say you found a particular growth channel that works spectacularly for you and you doubled down on it. At some time that channel is going to saturate due to various reasons (total reach penetrated, competition etc.) You can’t rely on it forever. The minute something works, double down on it but continue experimenting to find the next thing that is going to work.

C.R.E.A.M

At the end of the day, the financial crisis was a run on the shadow banking system, a full-blown liquidity crisis. Cash is King when the shit hits the fan. It is the only thing that’s gonna save your bacon.

This is a more macro point for pm’s. Work in areas/companies where you see that there is a clear business model a clear path to generate free cash flow. Yes you can raise a shit ton of VC money in the beginning, but at some point – it works till it doesn’t ?