Short post this week, heard an interesting quote attributed to Scott McNealy on the odd lots podcast this week. On a side note – do listen to this week’s episode with John Hempton, he is one of the sharpest short sellers on the planet. Onwards to the quote

At 10 times revenues, to give you a 10-year payback, I have to pay you 100% of revenues for 10 straight years in dividends. That assumes I can get that by my shareholders. That assumes I have zero cost of goods sold, which is very hard for a computer company. That assumes zero expenses, which is really hard with 39,000 employees. That assumes I pay no taxes, which is very hard. And that assumes you pay no taxes on your dividends, which is kind of illegal. And that assumes with zero R&D for the next 10 years, I can maintain the current revenue run rate. Now, having done that, would any of you like to buy my stock at $64? Do you realize how ridiculous those basic assumptions are? You don’t need any transparency. You don’t need any footnotes. What were you thinking?

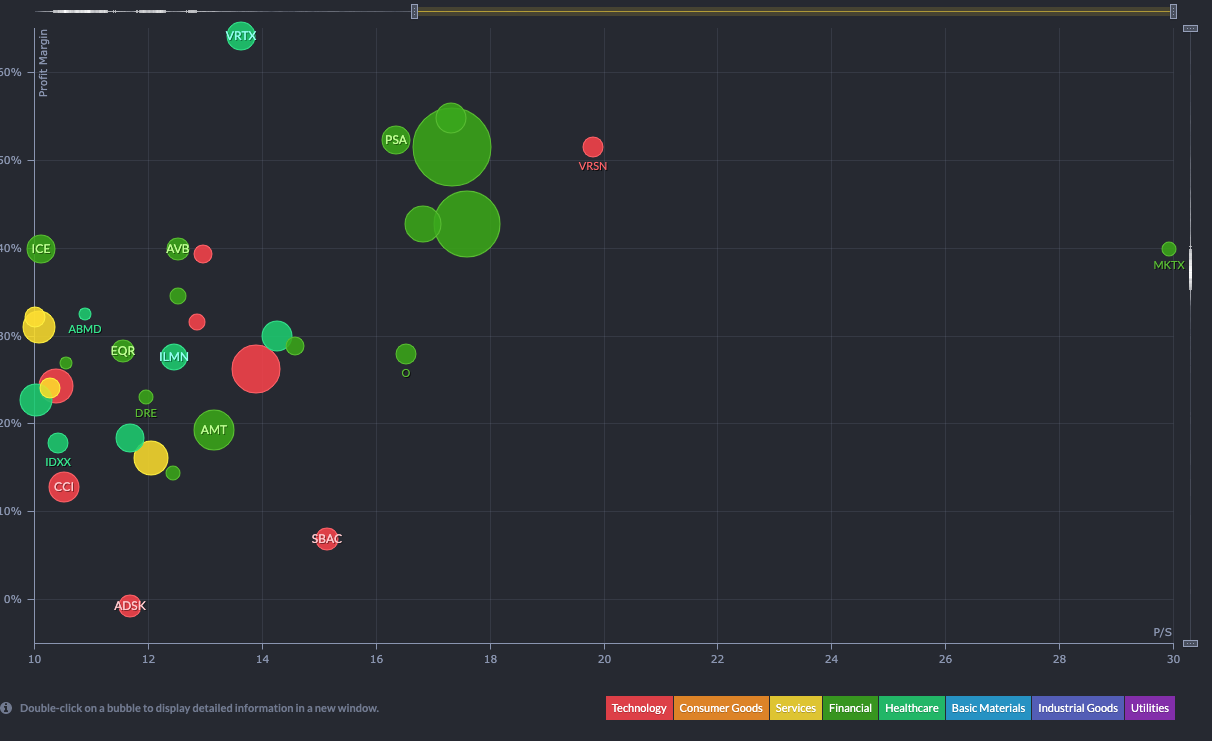

This quote was right at the peak dot com mania. How do things look today?

The two big green bubbles in the middle are Visa and MasterCard trading at 17 times sales! Verisign trading at 20 times sales.

Is it different this time?