Warning: Stream of consciousness follows! This week has been wild in the markets and I wanted to put my thoughts on paper and #timestamp my thinking. Standard disclaimer applies; none of this should be taken as investment advice!

RIP good times again?

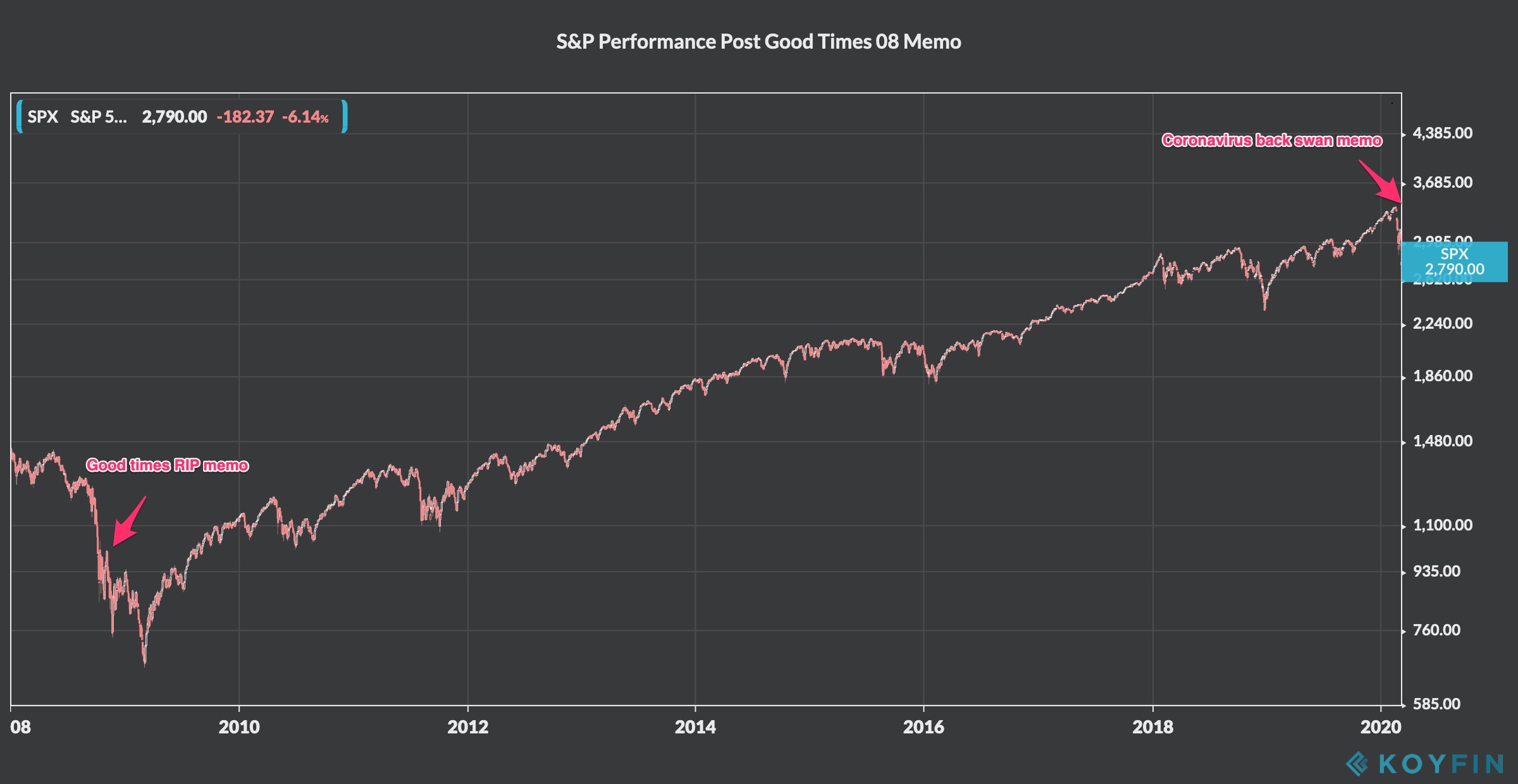

Sequoia published version 2.0 of its RIP good times memo, catchily titled Coronavirus black swan of 2020. Taleb is furiously deadlifting somewhere right now 🙂 What was public stock performance since RIP good times? Looking back it looks like the S&P ripped up since its publication in October ’08. Is this the ultimate contrarian indicator? Are VC’s the last group to point at markets crashing? Is it all upside from here?

Is this the Great Financial Crisis (GFC) 2.0?

In GFC 1.0, the banks were over-levered, consumers were over-levered, assets we thought were safe (mortgages) were not. In short, it was a structural and systemic crisis. Is coronavirus a systemic problem? Travel stops for a bit, so airlines and travel companies are hit for a while – but the virus ain’t gonna cause demand destruction, it is probably just going to shift demand out a bit. Based on the current fatality rates, it doesn’t seem like it will wipe out half the planet. So where is the wholesale demand destruction story coming from? Banks are in the best shape ever, overall leverage in the financial system (except maybe energy, but that’s the next point – hold on!) is well below GFC levels. This just doesn’t seem like GFC, just ordinary correction maybe? I’m in the – this is an overreaction camp! I get it – bad news sells much better than good news. Its stairs on the way up and the elevator down. But is the fear and paranoia getting out of hand?

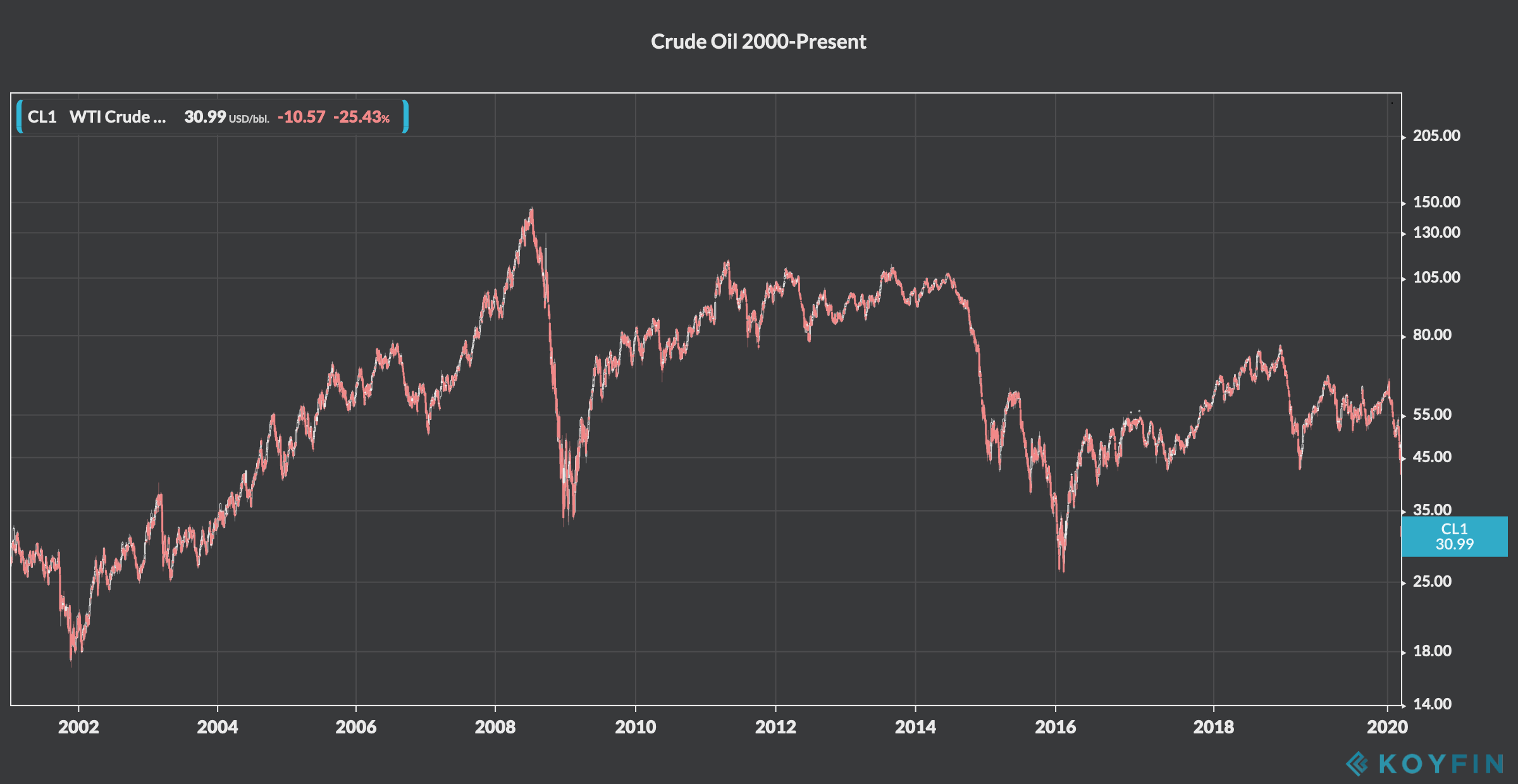

But what about oil – it’s at historical lows?

So what? Yes, it affects the energy producers and the over-leveraged shale guys, but one of the biggest expenses for the American consumer is gasoline. Gas prices going down and not requiring to commute to work due to coronavirus fears is a big positive for the disposable income of US consumers. Consumption drives the economy (spend, spend, spend!) – so oil dropping should be a net positive, right? In addition, the 30% drop in a day for WTI crude has more to do with Saudi Arabia playing some game theory and intentionally waging a price war to shake out Russia and the alternative shale-oil producers. Oil has been sideways since ’08!

Ok genius, so what should I do now?

You should not do anything in this market until you have your basics covered. If you don’t have a cash balance to tide you out, don’t try to play this market. If you need cash, this is exactly the wrong time to sell. If you don’t have excess cash, this is exactly the wrong time to lever up. Just stay calm and carry on. Do not log into your brokerage account, JUST DON’T look at the market. Focus on building that cash balance.

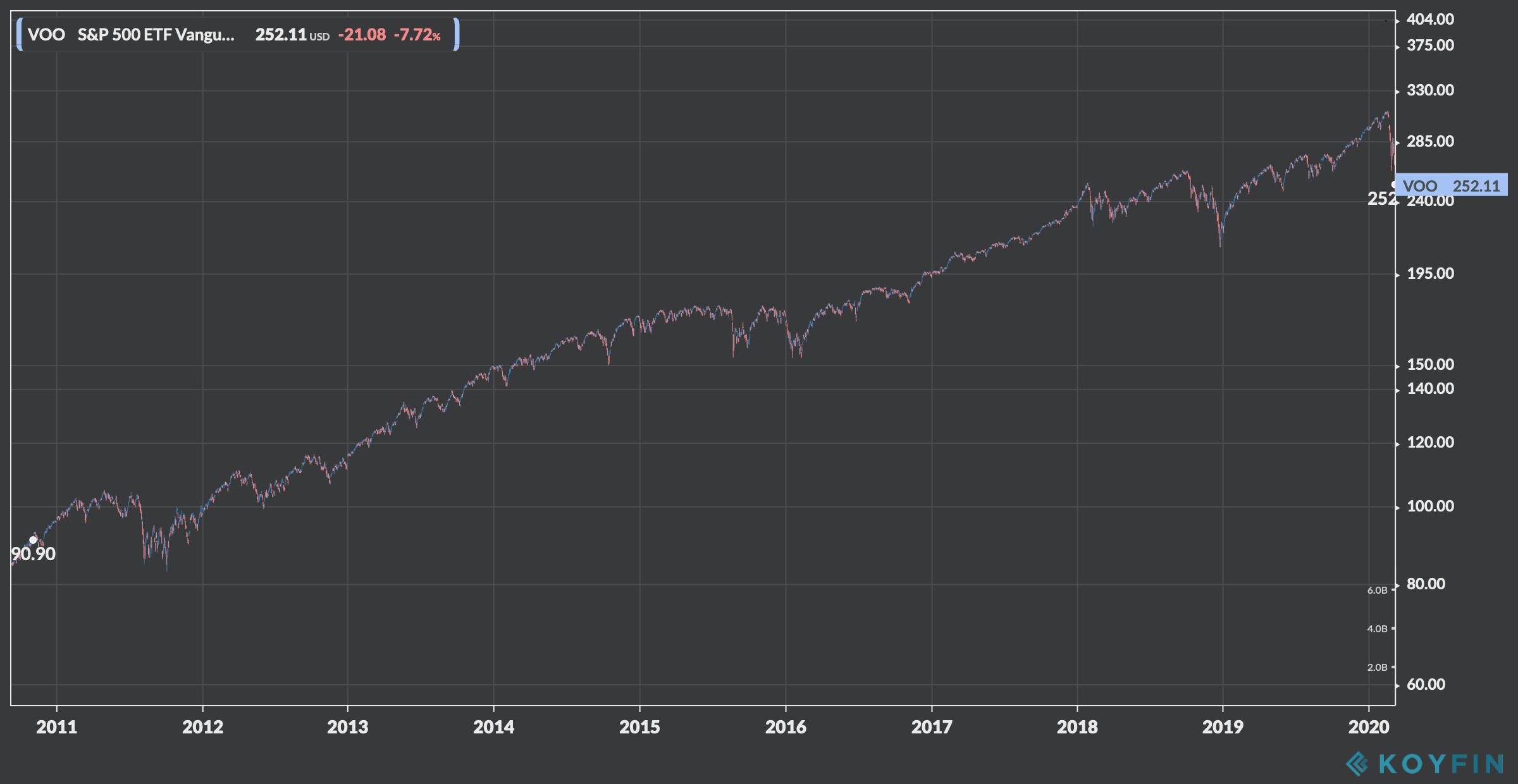

If you do have excess cash, in my opinion (I repeat, opinion, this is not investment advice!) this is a great opportunity to step into buying index products. I’m a big fan of VOO and am buying at these levels! The only advantage a retail investor like you has is the ability to have a long investment time horizon – use it!

This is either going to be like catching a falling knife, or the best investment call ever – however with a long enough time horizon it doesn’t really matter.