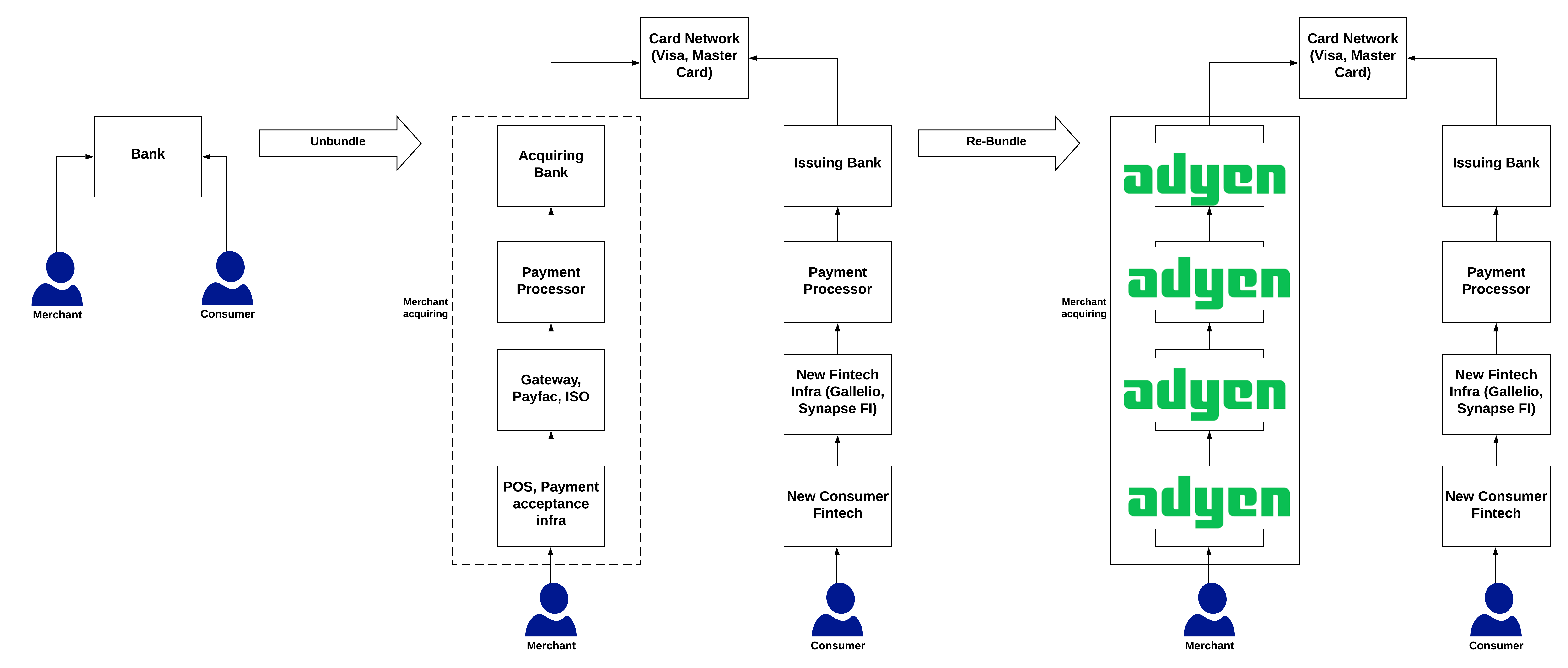

“Only two ways to make money in business: One is to bundle; the other is unbundle.” – Jim Barksdale

In the last post, I talked about the history of merchant acquiring and how the industry evolved. This post talks about the natural progression of the trend and the rise of the full stack acquirer.

A quick recap

The core jobs to be done for merchant acquiring is to enable a merchant to accept credit card payments. It started with one institution, the bank, and then unbundled into a plethora of entities. We now have a complicated ecosystem consisting of the card networks, issuing banks, acquiring banks, payment processors, and the alphabet soup of PSPs and MSP’s. Merchant acquiring transitioned to being a commodity business and scale became king. The need for scale caused the companies to grow via acquisition.

Rise of the global omnichannel

The internet has enabled merchants to expand their footprint to the whole world. Merchants are no longer restricted to local customers and every person in the world is a possible customer. With globalization came the need to accept payments in every currency and any method. Selling also became complex. Merchants have many distribution channels. They have their online stores, their retail stores as well as partner retail stores and online stores. Their customers in this global world interact with them via many different channels. They interact via mobile, web, and store visits with many customers utilizing multiple channels simultaneously. There is a need to power payment acceptance in this complex global omnichannel environment.

Adyen is out to solve this problem.

What is Adyen

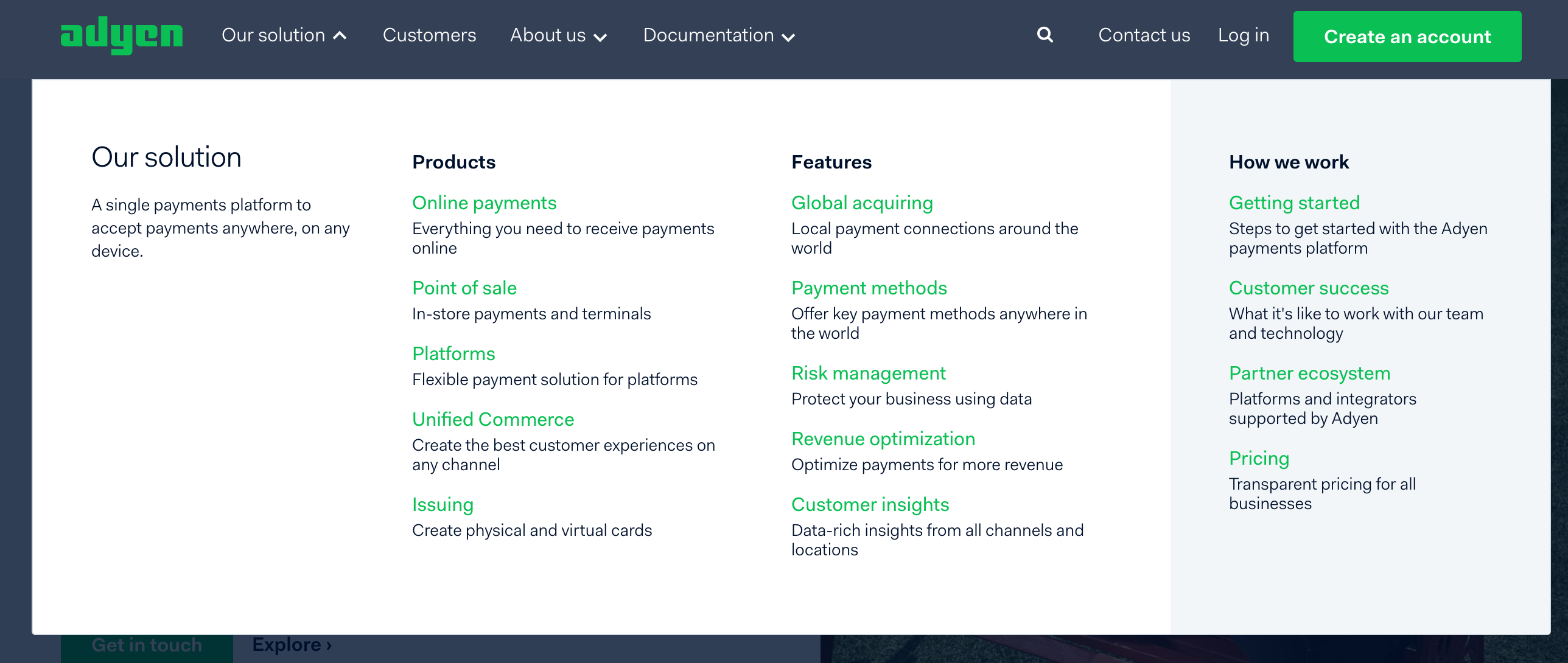

Adyen is a global payments platform that re-bundles the alphabet soup of merchant acquiring to provide a streamlined solution for merchants to accept payments across all sales channels. It is a full payment stack integrating – gateway, risk management, processing, acquiring, and settlement, that works in every location where the customer shops (online, retail, mobile).

A quick tour through the financials

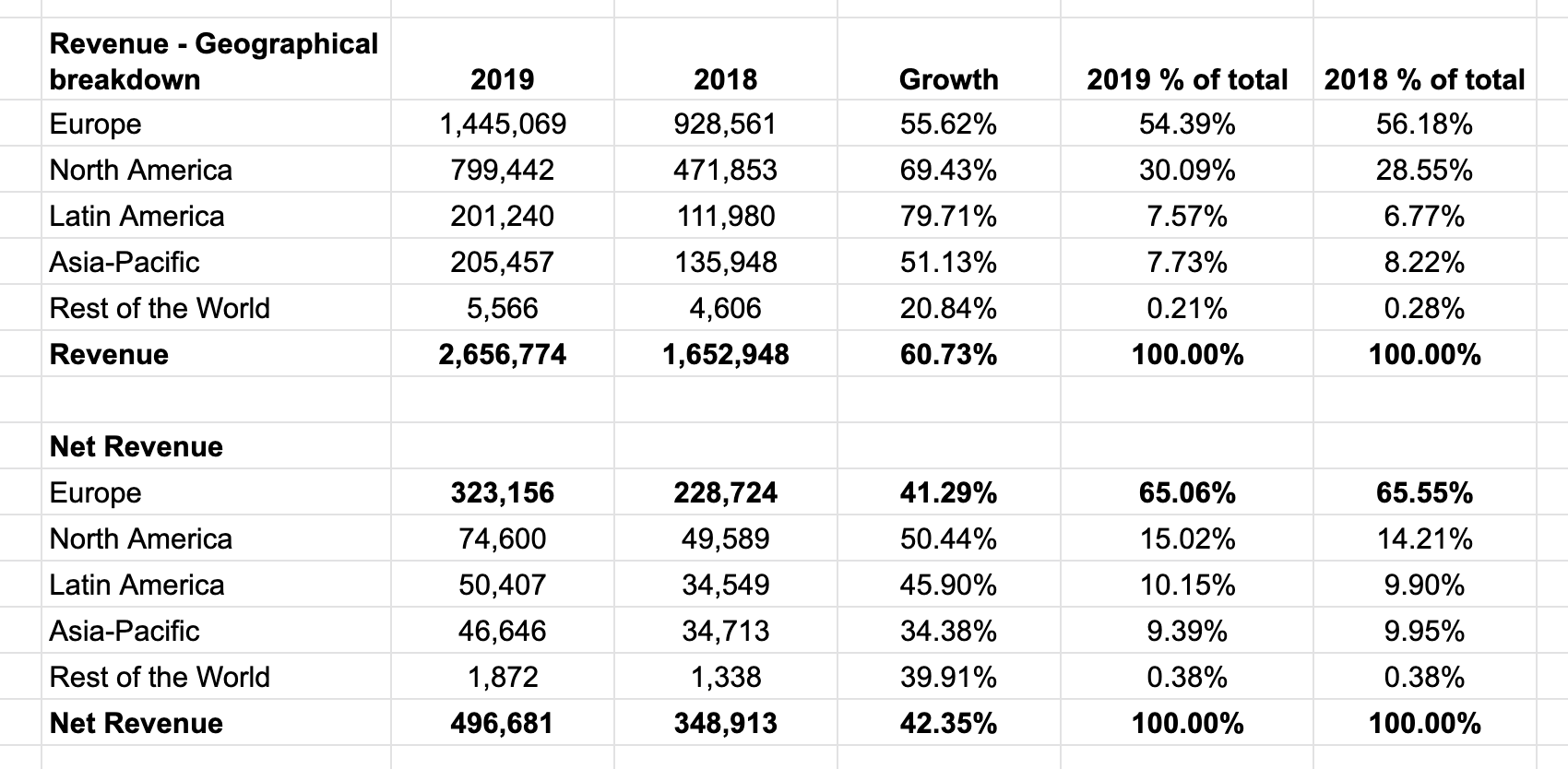

Giorgio has an in-depth look at Adyen’s financials so I won’t repeat myself. Do head over and read his post, it is detailed and insightful. A few high-level points. The business model is very straight forward. Adyen charges merchants a fee for the payment service. Growth comes from increasing the number of transactions for existing merchants and increasing the absolute number of merchants on the platform.

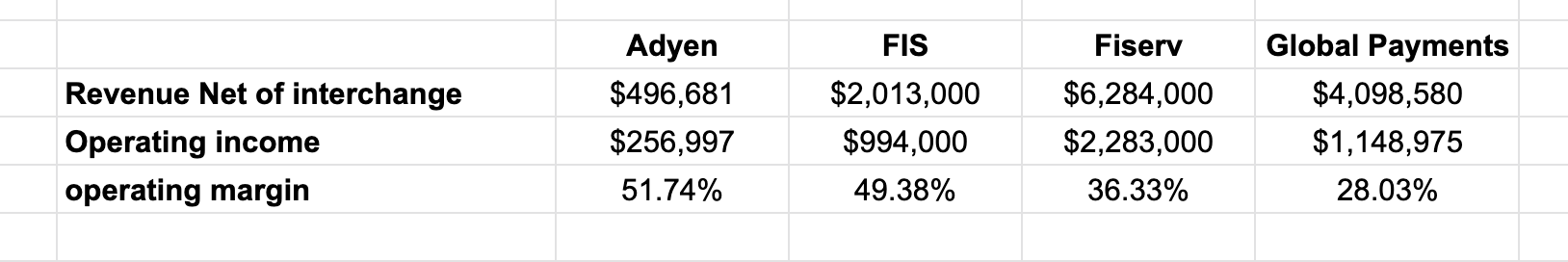

The business is extremely profitable. A quick back the envelope calculation shows that Adyen has the highest operating margin across a few competitors.

What is their competitive advantage?

Adyen is a great example of how technology can enable scale and provide a competitive advantage. Their single global platform enables them to provide a complete full-stack solution for merchants.

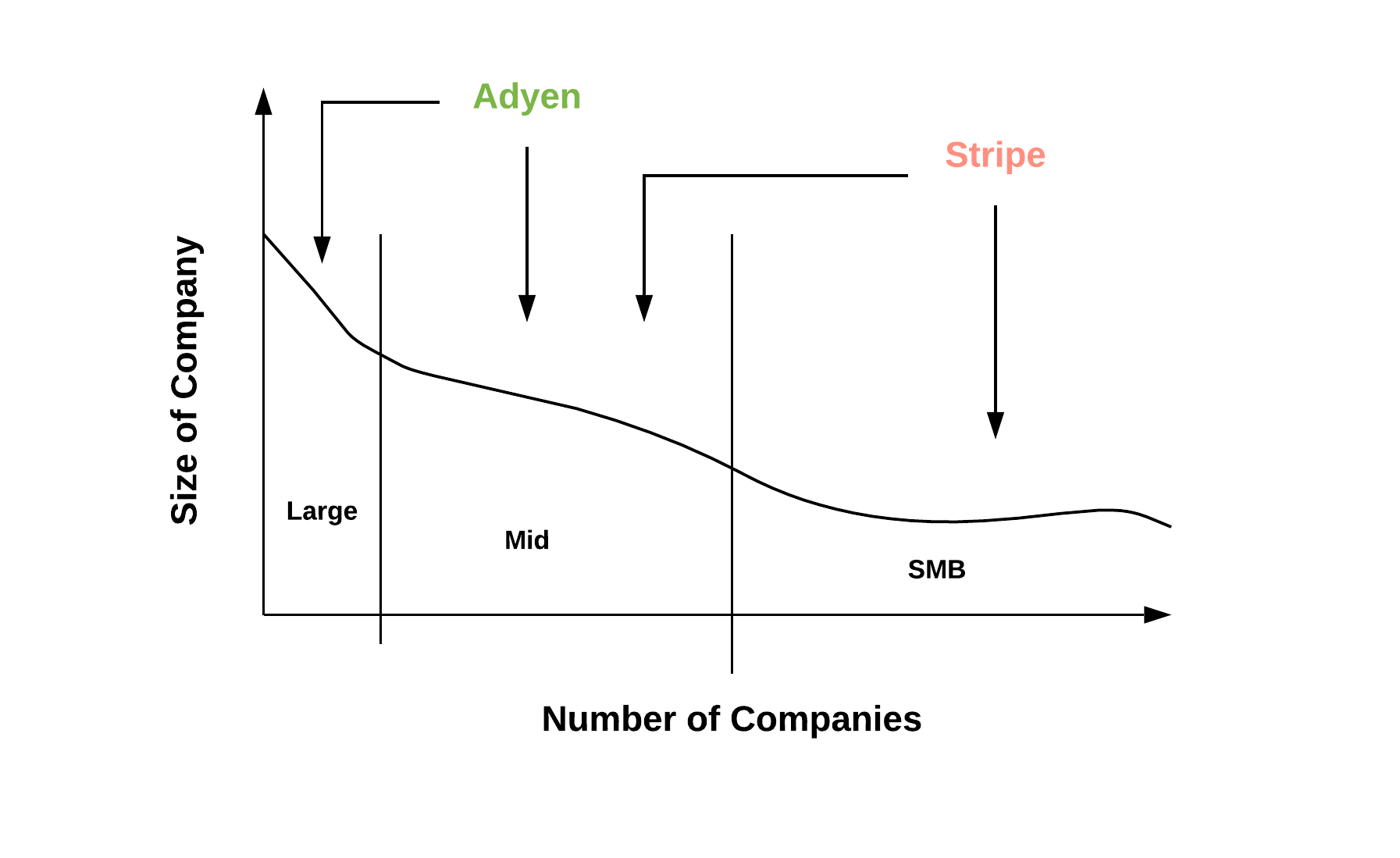

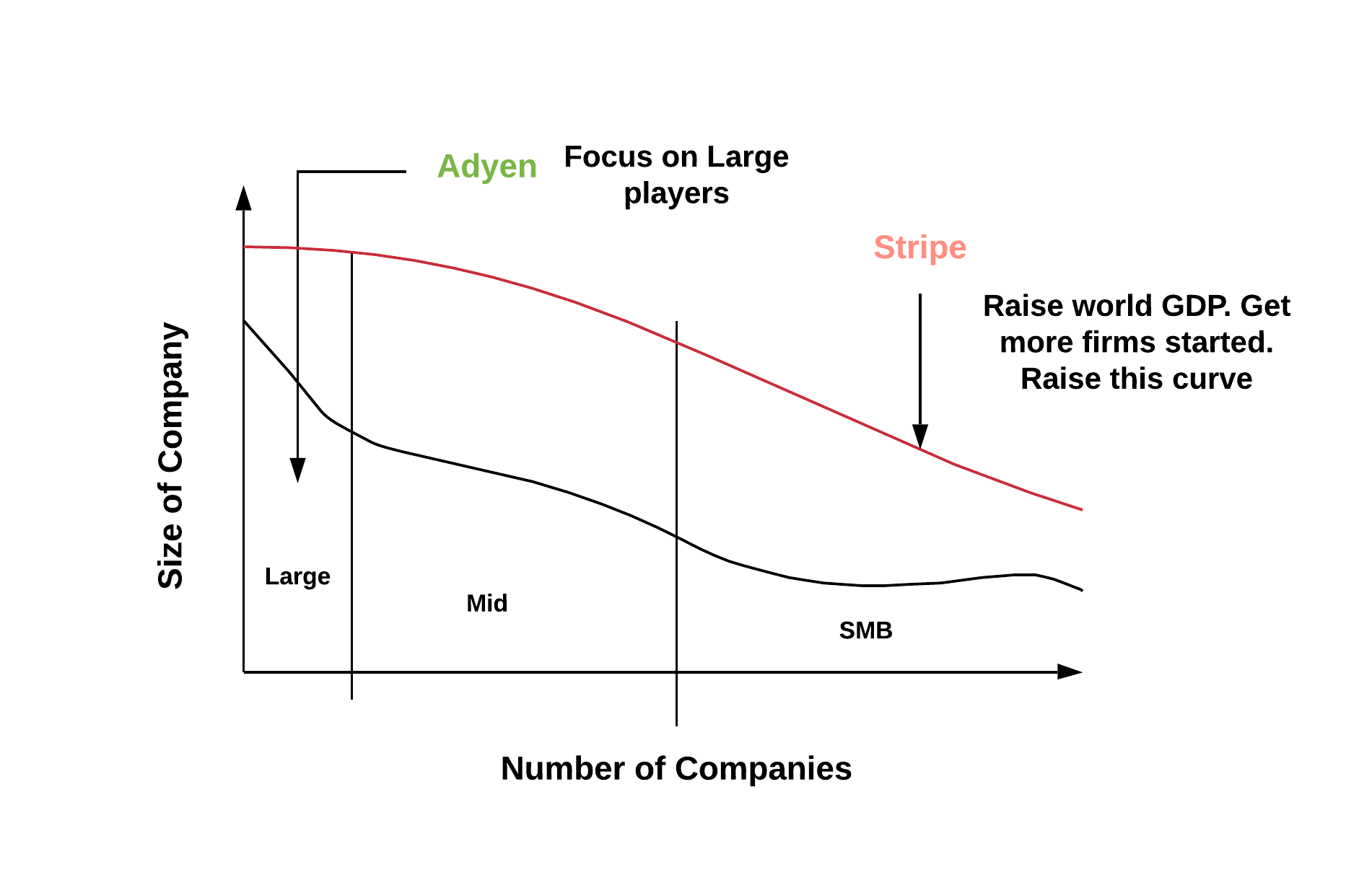

They are also laser focussed in the enterprise and mid-market segment. Larger merchants have the scale and understand the complexities of omnichannel. Adyen knows that they have a good full-stack solution for this large enterprise customer and thus they have an unwavering focus on this market.

Merchants care about growing their business and providing a seamless way for their customers to pay them wherever they are. The incumbents have a hard time creating a coherent feature set to solve this problem. They have grown through acquisitions and thus their technology platform is a mix of different systems acquired from the different companies. Platform migrations are by nature hard and painful hence naturally the incumbents continue to run these patchwork systems. They suffer from the curse of legacy systems. As a result the merchant never gets an all-encompassing solution, they get a patchwork of badly glued together solutions.

By sheer luck or timing, Adyen has managed to sidestep these problems by building a global system from the bottoms up that sidesteps the legacy curse. Their entire platform is homegrown and built for this omnichannel world. Merchants have one best in class provider that works seamlessly across all their use cases. One provider to interface with, one provider to negotiate with, one provider to get reporting from.

How do they differentiate?

Adyen is very clear that they are focussing on the enterprise market and want to be a core payment provider. They do not have the SV style “change the world” philosophy. They are pretty down to earth – we want to be a payments company, period. Their pricing shows that focus, they are pretty upfront on their fee and follow the interchange-plus pricing model.

A slight detour on credit card processing pricing models. As there are many players in the credit card ecosystems, every player takes a cut of the transaction as its fee. Broadly the main components of the fee are

- Interchange fee: This is the fee paid out to the issuing bank. This is the largest chunk of the fee as the issuing bank takes the largest risk in this transaction. The consumer can walk away from the credit card causing the issuing bank to lose a lot of money.

- Network Fees: Visa/Mastercard has to their cut. They build the rules and set pricing for the various parties and provide the authorization infrastructure.

- Acquiring fee: The fee paid out to the merchant acquirers/ payment processors like Adyen.

The exact amount of the fee depends on the type of transaction, the source, and destination of the transaction (cross border) and many other factors. Visa and Mastercard produce a detailed product catalog that describes these in detail.

With this context, there are two ways to price the merchant acquirer service. You can charge a flat fee per transaction – this abstracts the underlying complexity of the various transaction types. This is easier for the merchant to understand and easier for the merchant acquirer to sell the product. The other model is the interchange-plus model. You provide the merchant a fixed price that covers the merchant acquirer cost of the fee but the actual costs at the end of the day are based on the actual interchange paid out on their transactions. This pricing requires a bit more explaining to the customer. You also have to have good tools to help the merchant model out the ongoing cost of the service. Fixed pricing is easier but less transparent, interchange-plus pricing is harder to explain but is the most transparent.

Fixed pricing is typically costlier as the acquirer has to make allowances for managing the mix of transactions. They have to set their floor conservatively (higher) so that they can cover the interchange costs of most of the transactions that flow through them.

Interchange plus pricing on the other hand is closest to the true cost of processing the transactions in the system. The merchant is charged for the exact interchange fee. Another advantage is that the merchant acquirer is protected from changes in interchange fees. As the interchange rate changes, they pass on that cost to the merchant.

Interchange plus models are better suited for larger clients who have a large volume of transactions and also understand the complexities of the credit card system. Adyen by following this model is clearly in the selling to enterprise/mid-market camp.

Stripe, on the other hand, follows the fixed pricing model. Its focus is small to mid-market. They want to increase the GDP of the internet i.e effectively make the base of merchants larger rather than just focussing on existing large merchants. So far the target market seems to be the only differentiator between the two. Their product pages look very similar.

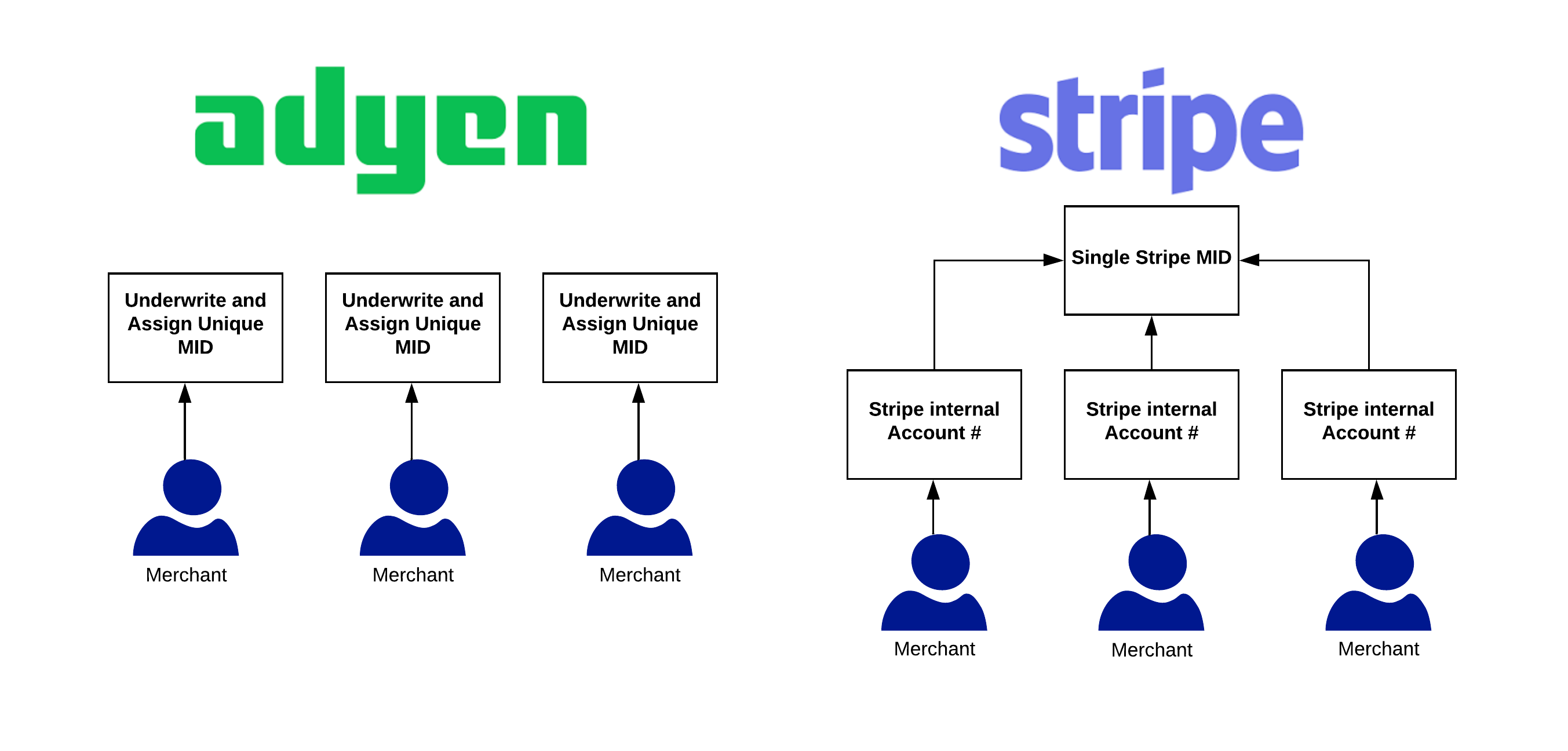

The way the two companies onboard their users also shows the different target markets that they are going after. Every merchant in the credit card ecosystem gets a global account identifier called the Merchant Identifier ID (MID). The merchant has to be assessed (underwritten) before providing them a MID. Adyen underwrites every merchant on its platform and assigns them a separate MID. Every Adyen merchant’s funds are segregated and ring-fenced. What this means in practice is that the merchant’s funds are not at risk from another merchant’s (bad) behavior on the Adyen platform. Since they have to underwrite every merchant, the onboarding process is elongated. Usually, only large merchants can support this process. This aligns with Adyen’s focus on the Enterprise.

Stripe on the other hand is set up as a Payfac. This means the bank partner behind Stripe, underwrites Stripe and gives them a MID. All the merchants on Stripe share that MID. Their funds are pooled and comingled under the Stripe MID. Stripe is now free to onboard merchants as they choose, using whatever risk process they want to. This does increase Stripe’s risk a bit as they are liable to the bank partner for any bad behavior of merchants on their platform. But as Stripe controls the risk evaluation of the merchant, they can enable the merchant to onboard really fast using automated underwriting techniques. This aligns with Stripe’s focus on the SMB market. SMB merchants value quick onboarding.

Who wins in this market?

Accepting payments is essential to every business so payment companies are going to be around for a while. I sense that this is not a winner take all market. Adyen/Stripe et all have started the re-bundling race but there is room for a few large players in this market. As the companies that use them get larger, just like any supplier relationship the larger the company the more pressure to at least dual-source a key component supplier like payments processing. The TAM for this market is pretty big, pretty much the entire world GDP so there is room for an oligopoly with a few players. Adyen’s growth has been primarily in Europe, so there is a lot of room to grow in other geographies.

Adyen and Stripe have very different philosophies on how they want to grow. Adyen is very focussed on growing along with their current existing large merchants. Stripe is very much about shifting the curve up – they want to add more companies to the economy at the small to mid-end.

Other thoughts

They do have a ton of cash in the bank (~1.7B Euro) and continue to add to that cash haul every year. Surprisingly, they haven’t been more acquisitive. In some sense, they are learning from history and understand that integrating the systems of the companies that they acquire would be a gargantuan exercise. They are very committed to the one global platform and acquisitions don’t fit in that strategy.

In summary, a global full-stack technology pure-play that generates massive amounts of cash with lots of room to grow. This is one company to watch!