In the last post, I talked about getting into the habit of reading 10k’s. Time to dogfood my own advice :), for this post, I wanted to look at a completely new industry than the usual fodder. LiveNation is my first pick (NYSE:LYV). Latest 10K for 2018.

What are the goals of this exercise?

- Understand the business model and a bit about the industry the company is in

- What are the key growth levers for the business? What is the flywheel/network effect?

- Who is the customer? What are the customer groups?

- A brief look at the numbers

- And finally – What is the competitive advantage of the business?

So let us begin!

What business is LiveNation in?

The company says it best in their 10k

We believe that we are the largest live entertainment company in the world, connecting over 570 million fans across all of our concerts and ticketing platforms in approximately 44 countries during 2018. We believe we are the largest producer of live music concerts in the world, based on total fans that attend Live Nation events as compared to events of other promoters, connecting nearly 93 million fans to almost 35,000 events for over 4,500

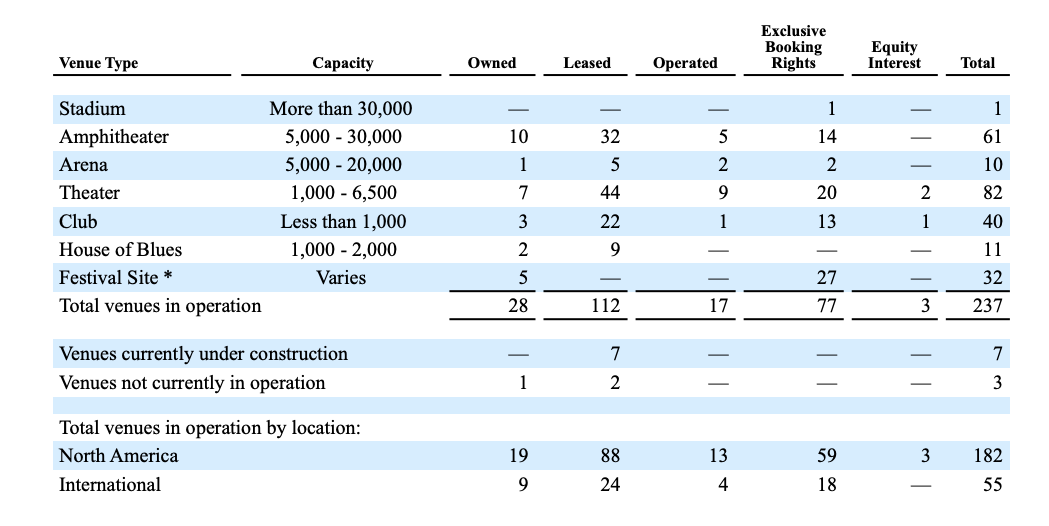

artists in 2018. Live Nation owns, operates, has exclusive booking rights for or has an equity interest in 237 venues, including House of Blues® music venues and prestigious locations such as The Fillmore® in San Francisco, the Hollywood Palladium, the Ziggo Dome in Amsterdam, 3Arena in Ireland, Royal Arena in Copenhagen and Spark Arena in New Zealand. We believe we are one of the world’s leading artist management companies based on the number of artists represented. Our artist management companies manage music artists and acts across all music genres. As of December 31, 2018, we had nearly 110 managers providing services to more than 400 artists. We believe our global footprint is the world’s largest music advertising network for corporate brands and includes one of the world’s leading ecommerce websites, based on a comparison of gross sales of top internet retailers. We believe we are the world’s leading live entertainment ticketing sales and marketing company, based on the number of tickets we sell. Ticketmaster provides ticket sales, ticket resale services and marketing and distribution globally through www.ticketmaster.com and www.livenation.com and our other websites, numerous retail outlets and call centers, selling over 480 million tickets in 2018 through our systems. Ticketmaster serves approximately 12,000 clients worldwide across multiple event categories, providing ticketing services for leading arenas, stadiums, festival and concert promoters, professional sports franchises and leagues, college sports teams, performing arts venues, museums, and theaters.

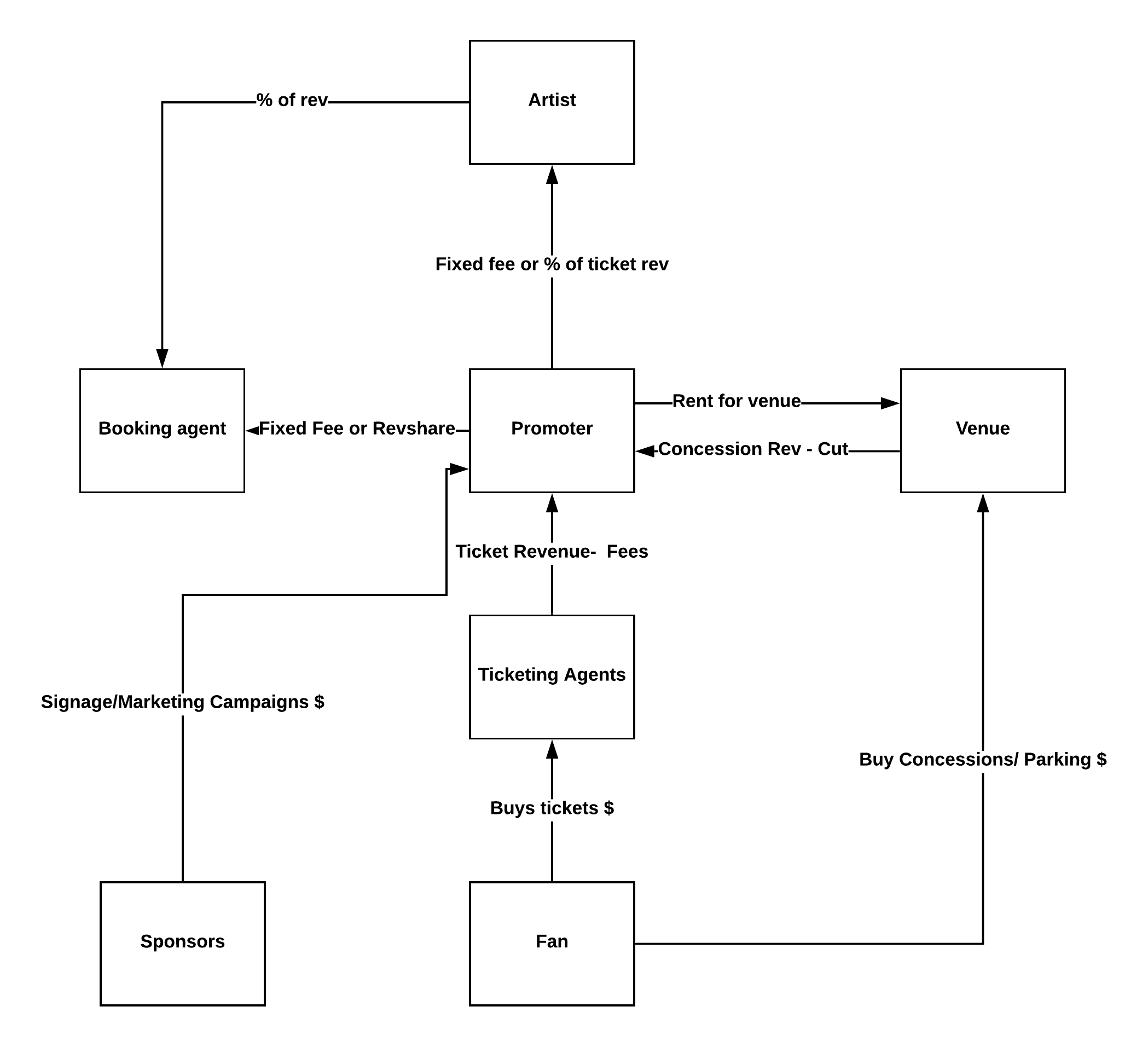

LiveNation is at its core what I would call a vertically integrated live entertainment company. The core components of the various players in the business are

- Artists: The creators, these are the folks we as fans are here to see.

- Booking Agent: An agent whose primary job is to arrange for concerts on behalf of the artist.

- Promoter: The promoter is the main player in the live show machine. This is the entity that actually produces the concerts, arranges for the venue as well as getting the fans to the venue (tickets)

- Venue: The actual venue where the live event is held

- Fans: You and me, we want to see the show and get entertained!

- Sponsors: Wherever there is an audience there is advertising and sponsorships. You the fans are an audience and there are sponsors wanting to market to you

This handy chart shows you how the various players interact and the financial relationships that exist between them. This chart is really a synthesis of the industry that LiveNation is in.

What are the key growth drivers for the business?

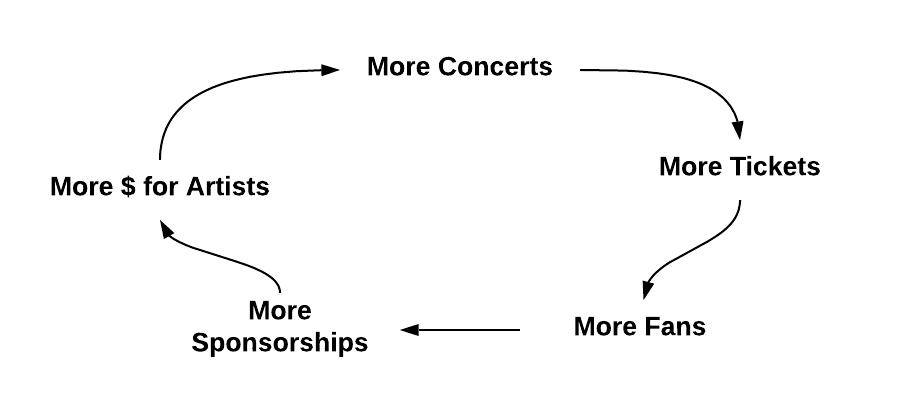

LiveNation is a vertically integrated player in the live concert space with strong network effects. In the above chart, LiveNation is the promoter, sponsorships seller, ticketing agent, and venue. It owns a variety of venues outright or has exclusive relationships to them*. It owns a monster ticketing franchise in Ticketmaster and has its own sponsorship sales and marketing team to sell inventory to sponsors. In effect, it offers a turnkey solution to artists or anyone else (sports teams for example) to put on a live event as they own the venue, can produce the entire event and have a massive distribution advantage via the ticketing arm. Their main growth cycle can be described as below

So who is the ultimate customer?

At the outset it might feel that the live concert business caters to fans, they are the ultimate customer. However, in my opinion, the artist is the ultimate customer for LiveNation. The talent is what drives the fan base. The fan base is here to see a great show which eventually rests with the artist. So from a growth perspective, the more they can attract talent on to their platform – the more they can spin the flywheel of more events, more tickets, more fans and eventually more money in the hands of artists. More money in the hands of artists will eventually lead to more concerts/more artists and the flywheel spins and spins. As with any network effect business even if the core customer is on one side of the network (artists) care has to be taken to not piss off the other side of the network (fans). One of the big risks to LiveNation is that they neglect the fans, by giving them a bad experience (high ticket fees, bad venue management, etc). Since they control a large number of venues they do have pricing power over fans – but there is only so far you can go before either fans completely boycott you or regulators step in.

A brief look at the numbers for 2018

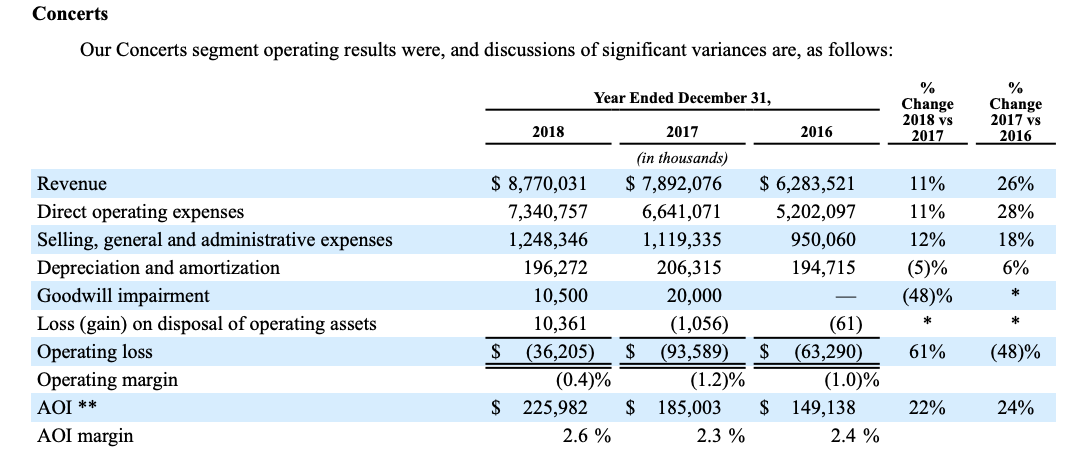

LiveNation breaks out their reporting into three segments concerts, sponsorship, and ticketing

Concerts are the majority of the revenue in the business but don’t contribute much to operating cash flow. $8.7B in revenue (81.1% of total) with -.4% operating margin.

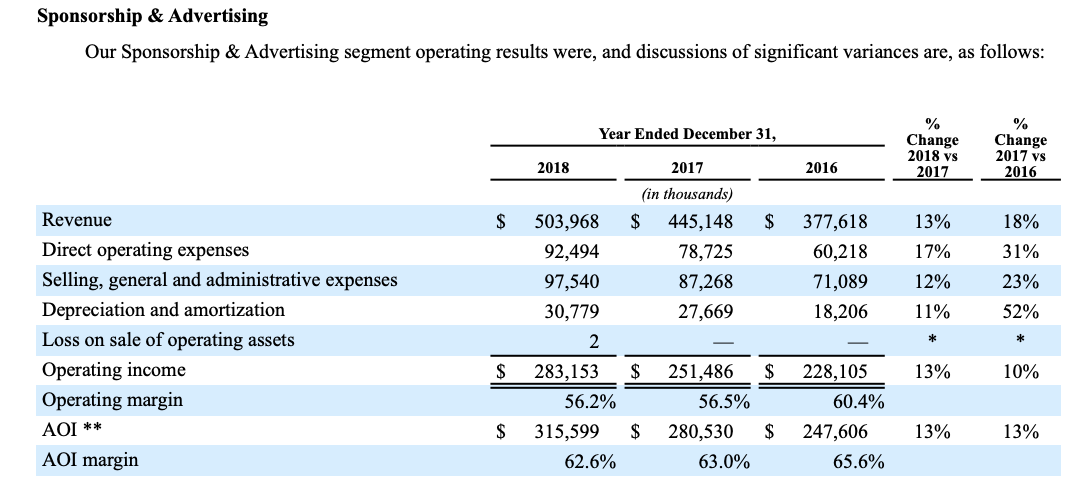

Sponsorships are a small percentage of overall revenue but are immensely profitable! ~$503M in revenue (4.7% of total) with a 56.2% operating margin.

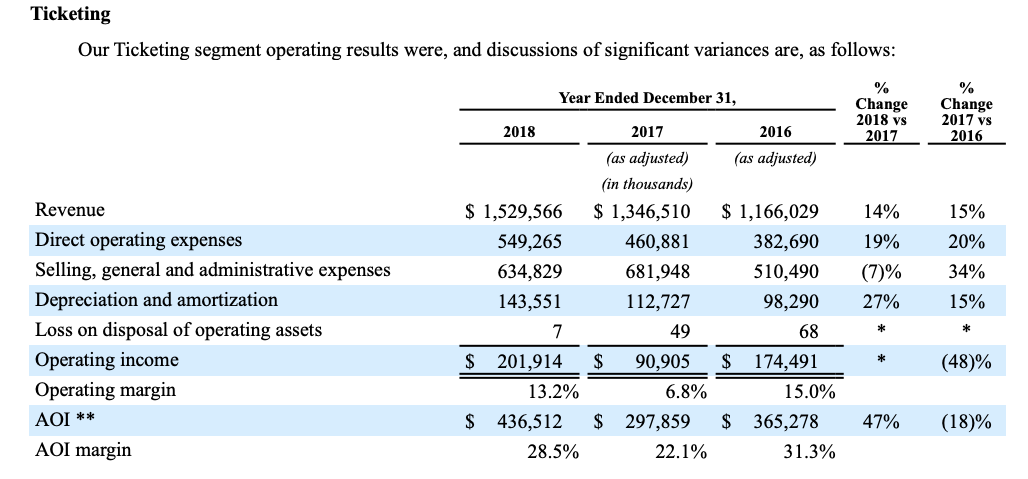

Ticketing is decent revenue and decently profitable as well. ~$1.5B in revenue (~14% of total) with a 13.2% operating margin.

Overall the company generates free cash flow (~$941M operating cash flow and ~$549M net cash flow. ~$2.3B cash and cash equivalents in the bank ) but as the numbers show the majority of the profits behind the cash flow come from the sponsorship and ticketing segments.

So what’s the competitive advantage?

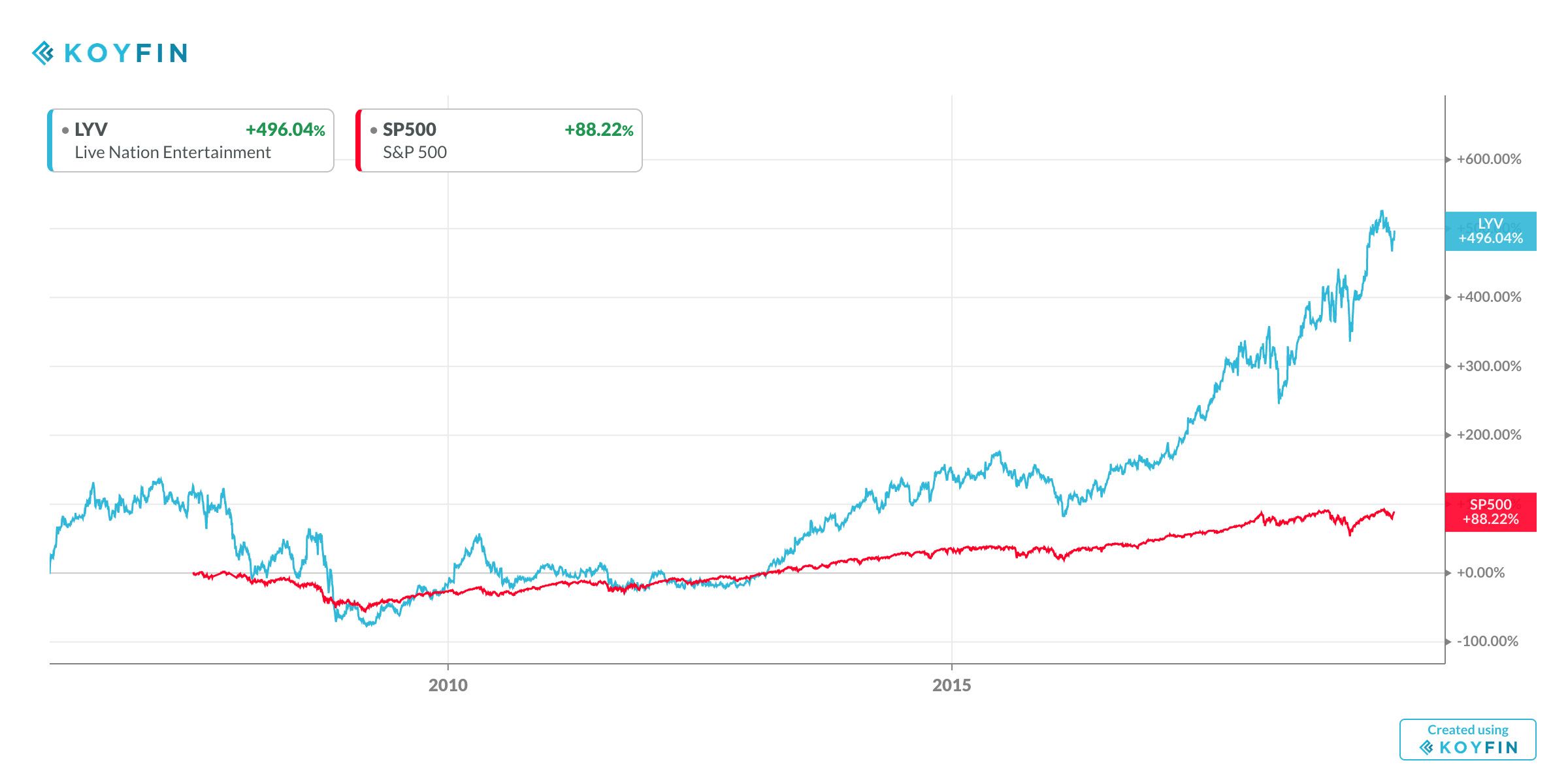

If you have made it this far 🙂 it’s pretty clear that the vertical integration and scale of LiveNation is the source of its competitive advantage. Owning the venue or getting exclusive rights to the venue was a smart move. In classic network effect terms, the venue was the supply and the artists/fans were the demand side of the equation. By owning the supply side and having a strong distribution avenue to the fans via the ticketing franchise, LiveNation has built a nice moat around its business. The merger with Ticketmaster was a good bet and the company has been rewarded for it. It’s stock performance relative to the S&P 500 has been stellar!

What about the competition? Can Livenation be disrupted?

That’s this post 🙂

What do you guys think? Anything that I missed? Respond in the comments!

* Venues that LiveNation outright owns or has an interest in