Affirm filed for an IPO last week. I’ve wanted to do a deep dive into the BNPL segment and Affirm’s filing is the inspiration that I’ve been waiting for!

Let us start at the very beginning. Once humans came together in groups, the concept of lending aka credit has been willed into existence. The very earliest example of lending dates back to over 4,000 years ago in Mesopotamia, 2,000 BCE, where farmers bought seeds on credit and repaid the debt after the harvest. Pre-industrial revolution most economies were rural. Lending was like having a tab at your corner store. All underwriting was social and very few folks wanted to risk being cut off from the local economy by defaulting on their debt. All credit was local.

As the industrial revolution kicked into high gear, there was mass migration into cities. The economy switched from a local rural non-connected economy to a connected industrial economy dominated by cities. Industrial goods companies needed to encourage usage of their products by providing some sort of credit to their consumers. The secured installment credit product was born. The consumer purchases a durable good from a retailer with a fixed down payment paid up front. The remaining amount is paid in fixed installments plus fees. This installment loan is a secured loan with the durable good as the collateral. The consumer relationship is with the retailer and each retailer manages the credit origination and servicing process, i.e the retailer managed the books on who owes what. They collected and managed customer repayments. This product expanded the number of consumers with access to credit but was still restricted to a local area, in this case, a large city.

Then came the great depression. Bank runs were everywhere and business’s just collapsed. Installment credit shrunk considerably. This led to the next innovation of the “layaway”. Layaway flips the script. Instead of the consumer getting the good upfront and paying back over time, the consumer down-payment is used to reserve the item. The consumer has to continue to pay the monthly installments plus fees and gets the item only after he has paid off the entire purchase price. There is zero credit risk involved in this arrangement, which was a fit for depression times. As the depression eased installment credit came back and layaway existed as a product along-with installment credit.

This setup continued till the 1960s till the arrival of the next innovation, revolving credit in the form of a credit card. In the installment setup, each retailer was still restricted to operating in a local city as the operational elements were still highly localized. With the advent of the telegraph and national banking, you had the operational technology to expand to the entire united states. To service, this use case the credit card product was born. Instead of being provided a loan for a particular product (say a sewing machine) a consumer could now apply for a credit card and gain the ability to spend up to a limit. The consumer relationship now switched from being a secured loan relationship with a retailer (an installment loan) to an unsecured loan relationship with a bank (the credit card issuer). This was great for the merchant. They no longer had to keep track of outstanding balances for their customers. When customers used credit cards, they got paid upfront for the full price of the good (minus the fee – the credit card interchange fee). This was a huge improvement – merchants loved this model, zero hassle, and get paid in days rather than months! The customer could if they chose to revolve their balance at the end of the month for an interest rate. Revolving consumer credit card credit became a huge driver of bank profits. As this business grew, retailers got back into the game and started offering their consumer credit offerings or partnered with other providers to provide revolving credit.

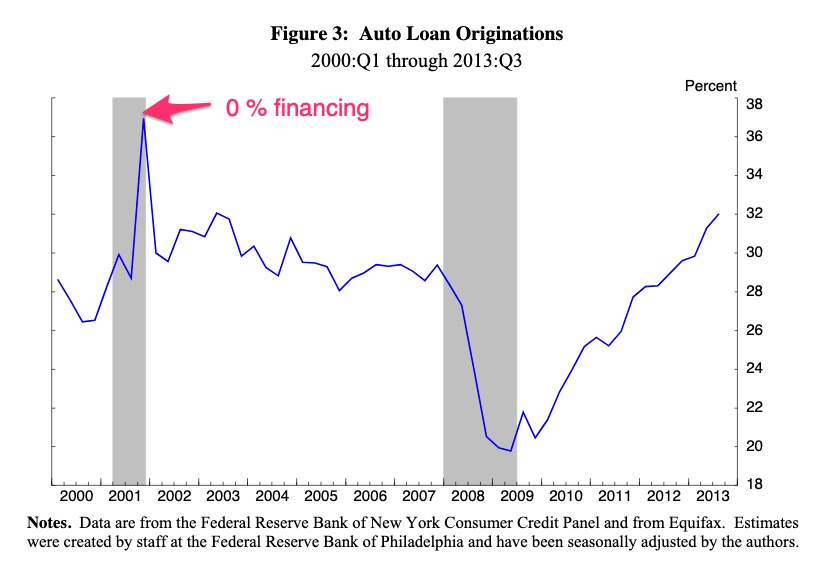

As a side note, a small digression into 0% financing that will be important later. In any financial product, the price is the dominant factor in consumer’s minds. Nothing increases conversion than not charging a price :). 0% financing is such a tool, some might say mind trick :). There are always fees associated with 0% financing, but its a valuable tool to shift units. Right after 9/11, car sales still kept growing even when the economy was in a recession. This was purely due to auto manufactures providing 0% financing. Consumers love 0% financing, whats not to love – paying the same amount over a while is better than paying the full amount up front!

Back to credit cards, its rise eventually reduced the need for installment loans and layaway for everyday durable goods, except for large ticket items like autos, etc. Why provide installment credit for small dollar items when consumers could just use a credit card?

Then came 2008. The great financial crisis.

As with any recession, the first thing to contract is credit. The GFC was a broad-based crisis – consumer credit, business credit, bank credit – all forms of credit contracted. Lenders withdrew from the market and underwriting standards tightened overnight. A whole generation (millennials) entered adulthood with bleak prospects. I have written before about how crisis’s shape your spending habits and the same theory holds with the millennials. They were saddled with student loans and as a collective group has had worse job prospects and income than previous generations. These factors led them to be extremely suspicious and averse to taking on more debt. They do not like to take out credit cards like their parents!

We’ve also had the rise of the internet and e-commerce. E commerce is a growing sector and the majority of new businesses are starting online rather than going the brick and mortar route. The internet also made traditional brick and mortar retailers think about adapting their business and offer online offerings – multichannel is the name of the game and the internet is now the dominant channel for sales.

There is a business opportunity here,

* Offering credit shifts units for merchants (increases conversion)

* Installment loans are a hassle for merchants to do by themselves

* Consumers aren’t taking/utilizing credit via the usual credit card route

* The internet is a big channel and we want an internet native solution

These dynamics led to the birth and growth of the Buy Now Pay Later (BNPL) as we know today.

At its very core, BNPL is installment loans for merchants for the internet age. Its consumer credit for the internet age. The song remains the same, except its now internet native.

The BNPL value proposition for the consumer is simple. In real time, within the checkout flow, we will offer you financing options with instant approval. You don’t have to use your credit card. It is super simple and easy. A few of them don’t even check your credit score. A lot of the providers lead in with 0% financing, which is a huge draw. You get to use the item instantly and make payments to us over time, just like a loan. Its instant gratification at its finest! The BNPL value proposition to merchants is that they get to offer financing options to their customers right in the checkout flow. The merchant gets paid upfront from the BNPL provider the price for the good, minus fees. The merchant is not taking any of the credit risks nor are they taking any of the hassles of running a loan program. The merchant is now able to, with an integrated experience offer financing to its customers to increase conversion and is willing to pay fees for it!

In the next few posts, I will go deeper into the three main BNPL players in the US – Affirm, Klarna, and Afterpay. They have similar business models with a few different tweaks. I will be exploring a few areas. What are the competitive advantages/ disadvantages of the players? Where are they taking market share from? Who are the competitive threats and who are they threatening to unseat? In a lending business eventually, it comes down to risk management – can we glean anything from the public filings?

Stay tuned! Part 2 is here

5 Comments